Stifel Financial Corp increased its holdings in DraftKings Inc. (NASDAQ:DKNG - Free Report) by 27.7% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 195,628 shares of the company's stock after buying an additional 42,431 shares during the period. Stifel Financial Corp's holdings in DraftKings were worth $7,669,000 as of its most recent SEC filing.

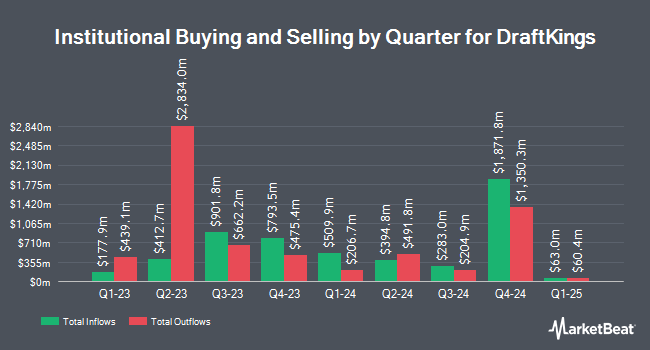

Other institutional investors and hedge funds also recently made changes to their positions in the company. Wealth Enhancement Advisory Services LLC boosted its position in shares of DraftKings by 24.2% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 32,975 shares of the company's stock valued at $1,259,000 after acquiring an additional 6,425 shares during the last quarter. Envestnet Portfolio Solutions Inc. grew its stake in DraftKings by 440.9% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 91,854 shares of the company's stock worth $3,506,000 after buying an additional 74,872 shares in the last quarter. Miracle Mile Advisors LLC increased its holdings in shares of DraftKings by 10.2% in the 2nd quarter. Miracle Mile Advisors LLC now owns 8,284 shares of the company's stock worth $316,000 after buying an additional 770 shares during the last quarter. Blue Trust Inc. raised its position in shares of DraftKings by 2,465.0% during the 2nd quarter. Blue Trust Inc. now owns 5,207 shares of the company's stock valued at $199,000 after buying an additional 5,004 shares in the last quarter. Finally, Nisa Investment Advisors LLC lifted its holdings in shares of DraftKings by 1.6% during the 2nd quarter. Nisa Investment Advisors LLC now owns 71,906 shares of the company's stock worth $2,745,000 after acquiring an additional 1,100 shares during the last quarter. Hedge funds and other institutional investors own 37.70% of the company's stock.

Insider Transactions at DraftKings

In other news, insider Jason Robins sold 3,151 shares of the firm's stock in a transaction dated Thursday, November 21st. The shares were sold at an average price of $43.71, for a total transaction of $137,730.21. Following the sale, the insider now owns 2,631,033 shares of the company's stock, valued at $115,002,452.43. This trade represents a 0.12 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Paul Liberman sold 88,441 shares of DraftKings stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $36.41, for a total transaction of $3,220,136.81. Following the completion of the sale, the insider now owns 1,923,483 shares of the company's stock, valued at $70,034,016.03. This represents a 4.40 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 963,742 shares of company stock worth $39,668,077. Corporate insiders own 51.19% of the company's stock.

DraftKings Stock Down 3.8 %

DKNG stock traded down $1.59 on Friday, reaching $39.88. 10,972,171 shares of the company traded hands, compared to its average volume of 10,147,942. The company has a debt-to-equity ratio of 1.17, a current ratio of 1.00 and a quick ratio of 1.00. The firm has a fifty day simple moving average of $40.07 and a 200-day simple moving average of $37.94. DraftKings Inc. has a one year low of $28.69 and a one year high of $49.57. The company has a market cap of $35.12 billion, a P/E ratio of -45.32 and a beta of 1.87.

DraftKings (NASDAQ:DKNG - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported ($0.60) earnings per share for the quarter, missing the consensus estimate of ($0.42) by ($0.18). The company had revenue of $1.10 billion for the quarter, compared to the consensus estimate of $1.12 billion. DraftKings had a negative net margin of 9.06% and a negative return on equity of 41.23%. Research analysts anticipate that DraftKings Inc. will post -0.79 earnings per share for the current year.

Analysts Set New Price Targets

DKNG has been the topic of a number of research analyst reports. Wells Fargo & Company increased their target price on DraftKings from $47.00 to $52.00 and gave the company an "overweight" rating in a research note on Thursday, October 17th. Needham & Company LLC reiterated a "buy" rating and set a $60.00 price objective on shares of DraftKings in a research report on Friday, November 8th. BNP Paribas raised DraftKings from an "underperform" rating to a "neutral" rating and set a $35.00 price objective on the stock in a report on Tuesday, September 10th. Macquarie upped their target price on DraftKings from $50.00 to $51.00 and gave the stock an "outperform" rating in a research note on Monday, November 11th. Finally, JPMorgan Chase & Co. increased their price target on shares of DraftKings from $47.00 to $53.00 and gave the company an "overweight" rating in a research report on Friday. Three investment analysts have rated the stock with a hold rating and twenty-three have issued a buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $51.00.

Get Our Latest Report on DraftKings

About DraftKings

(

Free Report)

DraftKings Inc operates as a digital sports entertainment and gaming company in the United States and internationally. It provides online sports betting and casino, daily fantasy sports, media, and other consumer products, as well as retails sportsbooks. The company also engages in the design and development of sports betting and casino gaming software for online and retail sportsbooks, and iGaming operators.

Read More

Before you consider DraftKings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DraftKings wasn't on the list.

While DraftKings currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.