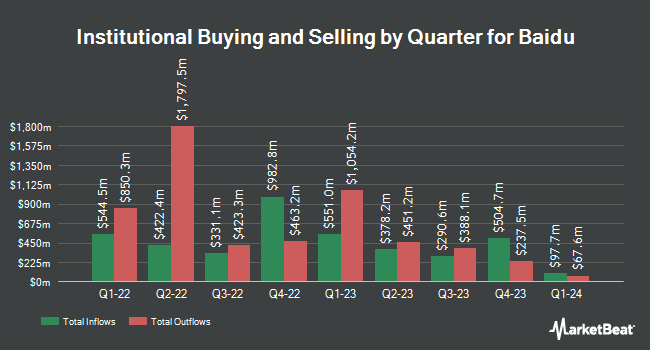

Stifel Financial Corp raised its stake in shares of Baidu, Inc. (NASDAQ:BIDU - Free Report) by 82.5% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 75,546 shares of the information services provider's stock after purchasing an additional 34,145 shares during the period. Stifel Financial Corp's holdings in Baidu were worth $7,954,000 at the end of the most recent reporting period.

A number of other large investors also recently bought and sold shares of BIDU. Grove Bank & Trust increased its position in Baidu by 21.6% during the 3rd quarter. Grove Bank & Trust now owns 731 shares of the information services provider's stock worth $77,000 after purchasing an additional 130 shares in the last quarter. Advisors Asset Management Inc. lifted its stake in shares of Baidu by 5.2% during the third quarter. Advisors Asset Management Inc. now owns 2,818 shares of the information services provider's stock worth $297,000 after purchasing an additional 140 shares in the last quarter. Blue Trust Inc. boosted its position in shares of Baidu by 9.0% in the second quarter. Blue Trust Inc. now owns 2,078 shares of the information services provider's stock worth $180,000 after buying an additional 171 shares during the period. Intellectus Partners LLC raised its holdings in shares of Baidu by 1.5% during the 3rd quarter. Intellectus Partners LLC now owns 16,538 shares of the information services provider's stock valued at $1,741,000 after buying an additional 250 shares during the period. Finally, Ridgewood Investments LLC lifted its position in Baidu by 5.3% during the 2nd quarter. Ridgewood Investments LLC now owns 6,900 shares of the information services provider's stock worth $597,000 after acquiring an additional 349 shares in the last quarter.

Baidu Stock Performance

Shares of Baidu stock traded up $0.50 during trading hours on Friday, reaching $90.82. The company's stock had a trading volume of 2,418,146 shares, compared to its average volume of 3,601,490. The company has a debt-to-equity ratio of 0.18, a quick ratio of 2.19 and a current ratio of 2.19. Baidu, Inc. has a one year low of $78.95 and a one year high of $120.25. The company's 50 day simple moving average is $90.90 and its 200 day simple moving average is $90.57. The stock has a market cap of $31.85 billion, a P/E ratio of 11.12, a price-to-earnings-growth ratio of 1.19 and a beta of 0.46.

Analyst Ratings Changes

A number of analysts have recently issued reports on the stock. JPMorgan Chase & Co. lowered shares of Baidu from an "overweight" rating to a "neutral" rating in a research note on Wednesday, November 27th. Sanford C. Bernstein cut shares of Baidu from an "outperform" rating to a "market perform" rating and decreased their price objective for the company from $130.00 to $97.00 in a research report on Friday, August 23rd. Dbs Bank cut Baidu from a "strong-buy" rating to a "hold" rating in a research note on Thursday, October 3rd. Jefferies Financial Group lowered their price objective on Baidu from $174.00 to $139.00 and set a "buy" rating for the company in a research note on Thursday, August 22nd. Finally, Citigroup cut their target price on Baidu from $142.00 to $141.00 and set a "buy" rating on the stock in a research report on Friday, November 29th. Eleven analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $113.75.

Get Our Latest Analysis on BIDU

About Baidu

(

Free Report)

Baidu, Inc engages in the provision of internet search services in China. It operates through two segments: Baidu Core and iQIYI. The company offers Baidu App to access search, feed, and other services using mobile devices; Baidu Search to access its search and other services; Baidu Feed that provides users with personalized timeline based on their demographics and interests; Baidu Health that helps users to find the doctor and hospital for healthcare needs; and Haokan, a short video app.

Recommended Stories

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.