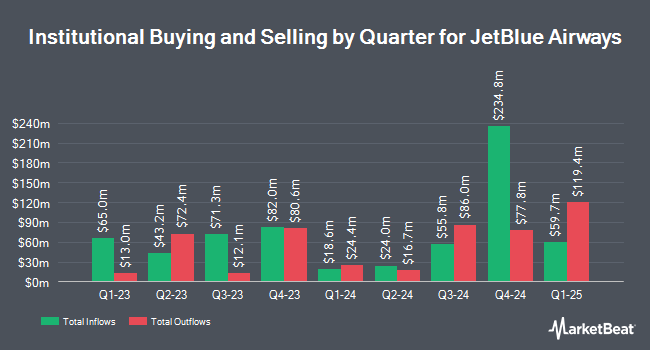

Stifel Financial Corp raised its stake in JetBlue Airways Co. (NASDAQ:JBLU - Free Report) by 21.4% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 525,024 shares of the transportation company's stock after purchasing an additional 92,468 shares during the quarter. Stifel Financial Corp owned 0.15% of JetBlue Airways worth $3,444,000 as of its most recent filing with the Securities & Exchange Commission.

Other large investors also recently modified their holdings of the company. Bogart Wealth LLC boosted its holdings in JetBlue Airways by 1,951.2% during the third quarter. Bogart Wealth LLC now owns 4,205 shares of the transportation company's stock worth $28,000 after purchasing an additional 4,000 shares during the last quarter. Harvest Fund Management Co. Ltd bought a new position in shares of JetBlue Airways during the 3rd quarter worth approximately $28,000. Strategic Investment Solutions Inc. IL purchased a new position in shares of JetBlue Airways in the 2nd quarter worth approximately $34,000. Point72 DIFC Ltd bought a new position in shares of JetBlue Airways in the second quarter valued at approximately $48,000. Finally, Glenmede Trust Co. NA purchased a new stake in shares of JetBlue Airways during the third quarter valued at approximately $66,000. Institutional investors own 83.71% of the company's stock.

Analysts Set New Price Targets

JBLU has been the topic of several research analyst reports. UBS Group reissued a "sell" rating and issued a $5.00 price objective on shares of JetBlue Airways in a research report on Tuesday, November 26th. Morgan Stanley reiterated an "equal weight" rating and set a $8.00 target price on shares of JetBlue Airways in a research note on Wednesday, December 11th. Barclays increased their price target on shares of JetBlue Airways from $5.00 to $7.00 and gave the company an "underweight" rating in a research report on Thursday, November 14th. StockNews.com raised shares of JetBlue Airways to a "sell" rating in a research report on Thursday, November 7th. Finally, Evercore ISI increased their target price on shares of JetBlue Airways from $4.00 to $5.00 and gave the company an "in-line" rating in a research report on Thursday, October 3rd. Four research analysts have rated the stock with a sell rating, seven have given a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $6.57.

Check Out Our Latest Analysis on JBLU

JetBlue Airways Stock Performance

Shares of JetBlue Airways stock traded up $0.25 during trading hours on Tuesday, reaching $7.30. The company had a trading volume of 15,004,258 shares, compared to its average volume of 16,034,922. The company has a debt-to-equity ratio of 2.98, a current ratio of 1.21 and a quick ratio of 1.18. JetBlue Airways Co. has a one year low of $4.49 and a one year high of $8.07. The firm has a market cap of $2.53 billion, a PE ratio of -2.80 and a beta of 1.92. The business has a fifty day simple moving average of $6.59 and a 200 day simple moving average of $6.01.

JetBlue Airways (NASDAQ:JBLU - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The transportation company reported ($0.16) earnings per share for the quarter, beating the consensus estimate of ($0.26) by $0.10. The firm had revenue of $2.37 billion for the quarter, compared to analysts' expectations of $2.36 billion. JetBlue Airways had a negative return on equity of 8.35% and a negative net margin of 9.17%. The company's revenue was up .5% on a year-over-year basis. During the same period in the prior year, the business posted ($0.39) earnings per share. On average, analysts anticipate that JetBlue Airways Co. will post -0.89 earnings per share for the current fiscal year.

About JetBlue Airways

(

Free Report)

JetBlue Airways Corporation provides air transportation services. The company operates a fleet of Airbus A321, Airbus A220, Airbus A321neo, Airbus A320 Restyled, Airbus A320, Airbus A321 with Mint, Airbus A321neo with Mint, Airbus A321neoLR with Mint, and Embraer E190 aircraft. It also serves 100 destinations across the United States, the Caribbean and Latin America, Canada, and Europe.

Featured Stories

Before you consider JetBlue Airways, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JetBlue Airways wasn't on the list.

While JetBlue Airways currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.