Stifel Financial Corp increased its position in Copart, Inc. (NASDAQ:CPRT - Free Report) by 2.4% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 822,091 shares of the business services provider's stock after acquiring an additional 19,198 shares during the period. Stifel Financial Corp owned approximately 0.09% of Copart worth $43,078,000 at the end of the most recent reporting period.

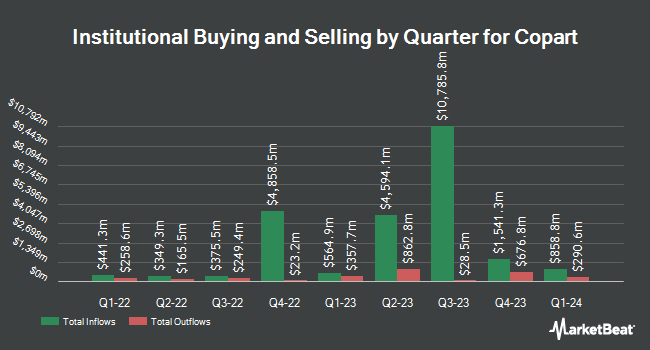

A number of other large investors have also modified their holdings of the company. Principal Financial Group Inc. grew its stake in shares of Copart by 2.5% in the third quarter. Principal Financial Group Inc. now owns 38,876,517 shares of the business services provider's stock worth $2,037,130,000 after purchasing an additional 941,858 shares in the last quarter. Edgewood Management LLC lifted its holdings in Copart by 0.6% in the third quarter. Edgewood Management LLC now owns 20,555,713 shares of the business services provider's stock worth $1,077,119,000 after purchasing an additional 125,220 shares during the period. Bank of New York Mellon Corp grew its position in Copart by 8.1% in the 2nd quarter. Bank of New York Mellon Corp now owns 16,008,444 shares of the business services provider's stock valued at $867,017,000 after buying an additional 1,199,781 shares in the last quarter. Massachusetts Financial Services Co. MA increased its stake in Copart by 0.4% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 7,898,956 shares of the business services provider's stock valued at $427,807,000 after buying an additional 30,454 shares during the period. Finally, Legal & General Group Plc raised its position in shares of Copart by 9.4% during the 2nd quarter. Legal & General Group Plc now owns 6,943,042 shares of the business services provider's stock worth $376,035,000 after buying an additional 598,566 shares in the last quarter. Institutional investors and hedge funds own 85.78% of the company's stock.

Copart Stock Performance

NASDAQ CPRT traded up $0.17 on Friday, reaching $62.08. The company's stock had a trading volume of 2,905,943 shares, compared to its average volume of 4,609,977. The firm's 50 day moving average is $56.07 and its two-hundred day moving average is $53.76. The stock has a market cap of $59.82 billion, a PE ratio of 43.72 and a beta of 1.31. Copart, Inc. has a twelve month low of $46.21 and a twelve month high of $64.38.

Copart (NASDAQ:CPRT - Get Free Report) last released its earnings results on Thursday, November 21st. The business services provider reported $0.37 EPS for the quarter, meeting the consensus estimate of $0.37. The business had revenue of $1.15 billion during the quarter, compared to analyst estimates of $1.10 billion. Copart had a net margin of 31.92% and a return on equity of 18.96%. The business's quarterly revenue was up 12.4% on a year-over-year basis. During the same period in the prior year, the business earned $0.34 earnings per share. Equities research analysts anticipate that Copart, Inc. will post 1.57 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on CPRT. JPMorgan Chase & Co. raised their price objective on shares of Copart from $55.00 to $60.00 and gave the company a "neutral" rating in a research note on Tuesday, November 19th. Robert W. Baird lowered their price target on Copart from $58.00 to $56.00 and set an "outperform" rating on the stock in a research report on Thursday, September 5th.

View Our Latest Report on Copart

Insider Activity

In other news, Chairman A Jayson Adair sold 251,423 shares of the business's stock in a transaction on Tuesday, November 26th. The stock was sold at an average price of $63.79, for a total transaction of $16,038,273.17. Following the sale, the chairman now directly owns 14,436,557 shares of the company's stock, valued at $920,907,971.03. The trade was a 1.71 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 9.68% of the company's stock.

Copart Company Profile

(

Free Report)

Copart, Inc provides online auctions and vehicle remarketing services. It offers a range of services for processing and selling vehicles over the Internet through its Virtual Bidding Third Generation Internet auction-style sales technology on behalf of vehicle sellers, insurance companies, banks and finance companies, charities, and fleet operators and dealers, as well as individual owners.

Further Reading

Before you consider Copart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Copart wasn't on the list.

While Copart currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.