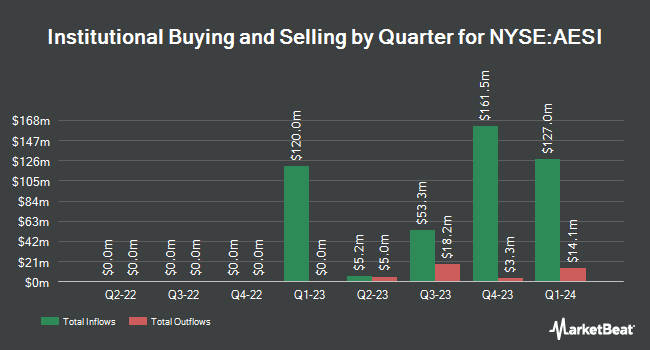

Stifel Financial Corp grew its position in Atlas Energy Solutions Inc. (NYSE:AESI - Free Report) by 28.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 126,667 shares of the company's stock after purchasing an additional 28,158 shares during the period. Stifel Financial Corp owned approximately 0.11% of Atlas Energy Solutions worth $2,761,000 as of its most recent SEC filing.

A number of other institutional investors have also modified their holdings of AESI. Barrow Hanley Mewhinney & Strauss LLC raised its position in Atlas Energy Solutions by 1.1% in the second quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 2,696,418 shares of the company's stock valued at $53,740,000 after purchasing an additional 30,082 shares during the period. Meridian Wealth Advisors LLC lifted its position in Atlas Energy Solutions by 25.8% during the 2nd quarter. Meridian Wealth Advisors LLC now owns 2,677,490 shares of the company's stock worth $53,362,000 after acquiring an additional 548,620 shares in the last quarter. Copeland Capital Management LLC boosted its holdings in Atlas Energy Solutions by 19.8% in the 3rd quarter. Copeland Capital Management LLC now owns 1,884,032 shares of the company's stock worth $41,072,000 after acquiring an additional 311,228 shares during the period. Cooke & Bieler LP grew its position in Atlas Energy Solutions by 775.7% in the second quarter. Cooke & Bieler LP now owns 1,699,013 shares of the company's stock valued at $33,861,000 after acquiring an additional 1,504,988 shares in the last quarter. Finally, Victory Capital Management Inc. raised its stake in shares of Atlas Energy Solutions by 13.9% during the second quarter. Victory Capital Management Inc. now owns 1,622,241 shares of the company's stock valued at $32,331,000 after purchasing an additional 197,783 shares during the period. Hedge funds and other institutional investors own 34.59% of the company's stock.

Atlas Energy Solutions Stock Down 0.5 %

NYSE AESI traded down $0.10 on Thursday, hitting $21.33. 1,121,465 shares of the stock traded hands, compared to its average volume of 964,041. The company has a current ratio of 1.23, a quick ratio of 1.08 and a debt-to-equity ratio of 0.42. The stock has a 50-day moving average of $21.44 and a 200 day moving average of $20.98. Atlas Energy Solutions Inc. has a twelve month low of $15.55 and a twelve month high of $24.93. The company has a market capitalization of $2.35 billion, a P/E ratio of 27.00, a price-to-earnings-growth ratio of 11.53 and a beta of 0.96.

Atlas Energy Solutions (NYSE:AESI - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The company reported $0.04 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.29 by ($0.25). Atlas Energy Solutions had a net margin of 8.78% and a return on equity of 11.01%. The firm had revenue of $304.40 million for the quarter, compared to analyst estimates of $307.93 million. During the same period in the prior year, the company posted $0.51 earnings per share. The business's revenue was up 93.1% on a year-over-year basis. As a group, analysts expect that Atlas Energy Solutions Inc. will post 0.88 earnings per share for the current fiscal year.

Atlas Energy Solutions Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, November 14th. Shareholders of record on Thursday, November 7th were issued a dividend of $0.24 per share. This represents a $0.96 dividend on an annualized basis and a dividend yield of 4.50%. This is a boost from Atlas Energy Solutions's previous quarterly dividend of $0.23. The ex-dividend date of this dividend was Thursday, November 7th. Atlas Energy Solutions's dividend payout ratio is 121.52%.

Insider Transactions at Atlas Energy Solutions

In related news, major shareholder Brian Anthony Leveille sold 5,000 shares of the firm's stock in a transaction that occurred on Monday, December 16th. The stock was sold at an average price of $23.17, for a total value of $115,850.00. Following the sale, the insider now owns 409,510 shares of the company's stock, valued at approximately $9,488,346.70. This trade represents a 1.21 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, major shareholder Stacy Hock sold 8,571 shares of the business's stock in a transaction that occurred on Thursday, October 3rd. The shares were sold at an average price of $21.49, for a total value of $184,190.79. Following the transaction, the insider now owns 934,746 shares of the company's stock, valued at $20,087,691.54. This represents a 0.91 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have acquired 60,869 shares of company stock worth $1,187,983 and have sold 124,642 shares worth $2,766,035. Insiders own 24.34% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on AESI. Pickering Energy Partners downgraded shares of Atlas Energy Solutions from an "outperform" rating to a "neutral" rating in a research note on Wednesday, October 30th. The Goldman Sachs Group assumed coverage on shares of Atlas Energy Solutions in a research report on Friday, December 13th. They issued a "neutral" rating and a $23.00 price objective for the company. Royal Bank of Canada reaffirmed an "outperform" rating and set a $25.00 target price on shares of Atlas Energy Solutions in a research report on Wednesday, October 30th. Citigroup cut Atlas Energy Solutions from a "buy" rating to a "neutral" rating and cut their price target for the stock from $23.00 to $22.00 in a research note on Thursday, November 14th. Finally, Barclays lowered Atlas Energy Solutions from an "overweight" rating to an "equal weight" rating and lowered their price objective for the company from $23.00 to $19.00 in a research note on Tuesday, November 12th. Four investment analysts have rated the stock with a hold rating, six have issued a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $24.67.

Read Our Latest Report on Atlas Energy Solutions

Atlas Energy Solutions Company Profile

(

Free Report)

Atlas Energy Solutions Inc engages in the production, processing, and sale of mesh and sand that are used as a proppant during the well completion process in the Permian Basin of Texas and New Mexico. The company provides transportation and logistics, storage solutions, and contract labor services. It sells its products and services to oil and natural gas exploration and production companies, and oilfield services companies.

Further Reading

Before you consider Atlas Energy Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlas Energy Solutions wasn't on the list.

While Atlas Energy Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report