Stifel Financial Corp lowered its stake in PAR Technology Co. (NYSE:PAR - Free Report) by 20.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 93,048 shares of the software maker's stock after selling 23,946 shares during the period. Stifel Financial Corp owned about 0.26% of PAR Technology worth $4,846,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

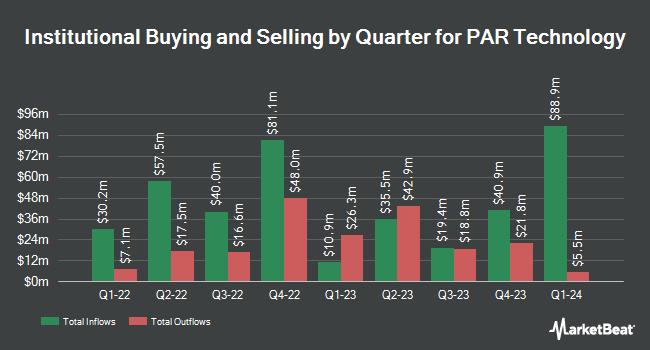

A number of other hedge funds also recently bought and sold shares of PAR. Arcadia Investment Management Corp MI purchased a new position in PAR Technology during the 2nd quarter worth approximately $32,000. Amalgamated Bank boosted its stake in shares of PAR Technology by 25.5% in the second quarter. Amalgamated Bank now owns 1,166 shares of the software maker's stock valued at $55,000 after buying an additional 237 shares in the last quarter. nVerses Capital LLC acquired a new position in PAR Technology during the third quarter worth $125,000. RiverPark Advisors LLC acquired a new position in PAR Technology during the second quarter worth $191,000. Finally, Principal Financial Group Inc. acquired a new position in shares of PAR Technology in the second quarter worth $211,000.

PAR Technology Price Performance

Shares of PAR stock traded up $2.32 during mid-day trading on Monday, hitting $77.95. 471,848 shares of the stock traded hands, compared to its average volume of 361,460. PAR Technology Co. has a twelve month low of $37.74 and a twelve month high of $82.24. The firm has a market cap of $2.83 billion, a price-to-earnings ratio of -311.91 and a beta of 2.20. The company's 50-day simple moving average is $68.52 and its 200-day simple moving average is $56.66. The company has a debt-to-equity ratio of 0.67, a quick ratio of 1.91 and a current ratio of 2.13.

PAR Technology (NYSE:PAR - Get Free Report) last issued its earnings results on Friday, November 8th. The software maker reported ($0.09) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.10) by $0.01. The business had revenue of $96.80 million for the quarter, compared to analysts' expectations of $91.01 million. PAR Technology had a negative return on equity of 8.99% and a negative net margin of 0.66%. The company's quarterly revenue was down 9.6% on a year-over-year basis. During the same period in the previous year, the firm posted ($0.35) EPS. As a group, equities research analysts expect that PAR Technology Co. will post -1.47 earnings per share for the current year.

Analysts Set New Price Targets

Several equities analysts recently weighed in on the company. Benchmark increased their target price on PAR Technology from $69.00 to $92.00 and gave the stock a "buy" rating in a research report on Tuesday, November 12th. Craig Hallum increased their target price on PAR Technology from $65.00 to $85.00 and gave the company a "buy" rating in a research note on Monday, November 11th. The Goldman Sachs Group raised their price objective on PAR Technology from $71.00 to $79.00 and gave the company a "neutral" rating in a research note on Monday, December 2nd. Stephens lifted their target price on PAR Technology from $83.00 to $90.00 and gave the stock an "overweight" rating in a research report on Tuesday, November 26th. Finally, Lake Street Capital lifted their target price on PAR Technology from $57.00 to $77.00 and gave the stock a "buy" rating in a research report on Monday, November 11th. One analyst has rated the stock with a sell rating, one has given a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $79.25.

Check Out Our Latest Stock Analysis on PAR

About PAR Technology

(

Free Report)

PAR Technology Corporation, together with its subsidiaries, provides omnichannel cloud-based hardware and software solutions to the restaurant and retail industries worldwide. The Restaurant/Retail segment offers PUNCHH, an enterprise-grade customer loyalty and engagement solution; MENU, an eCommerce platform for restaurant brands; BRINK POS, an open cloud, point-of-sale solution; PAR PAYMENT SERVICES, a merchant services business that enables electronic payment and processing services for businesses; and DATA CENTRAL, a back-office solution that leverages business intelligence and automation technologies.

Read More

Before you consider PAR Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PAR Technology wasn't on the list.

While PAR Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.