Stifel Financial Corp grew its position in FMC Co. (NYSE:FMC - Free Report) by 11.5% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 94,508 shares of the basic materials company's stock after buying an additional 9,772 shares during the quarter. Stifel Financial Corp owned 0.08% of FMC worth $6,232,000 as of its most recent SEC filing.

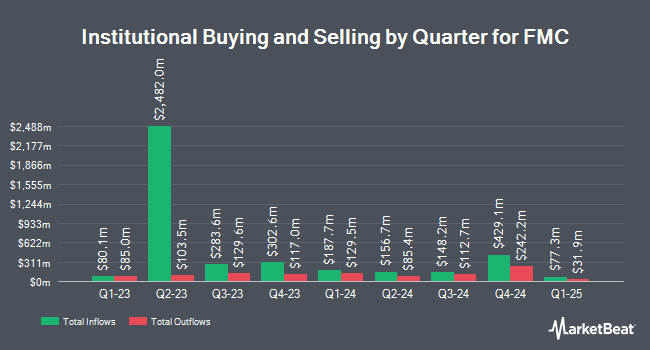

A number of other institutional investors and hedge funds also recently made changes to their positions in the company. Quantinno Capital Management LP boosted its stake in FMC by 43.3% in the third quarter. Quantinno Capital Management LP now owns 8,114 shares of the basic materials company's stock valued at $535,000 after buying an additional 2,450 shares in the last quarter. Quarry LP lifted its holdings in shares of FMC by 1,334.2% in the third quarter. Quarry LP now owns 1,133 shares of the basic materials company's stock worth $75,000 after acquiring an additional 1,054 shares during the last quarter. Point72 DIFC Ltd acquired a new stake in shares of FMC in the 3rd quarter valued at approximately $427,000. Point72 Asset Management L.P. bought a new stake in shares of FMC during the 3rd quarter valued at approximately $5,623,000. Finally, Polar Asset Management Partners Inc. acquired a new position in FMC during the 3rd quarter worth approximately $3,996,000. Institutional investors own 91.86% of the company's stock.

Insiders Place Their Bets

In other news, VP Jacqueline Scanlan sold 4,529 shares of the company's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $59.67, for a total transaction of $270,245.43. Following the transaction, the vice president now owns 28,649 shares in the company, valued at approximately $1,709,485.83. This represents a 13.65 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.85% of the company's stock.

FMC Trading Down 1.8 %

Shares of NYSE:FMC traded down $1.00 during trading on Friday, reaching $53.50. The stock had a trading volume of 2,057,970 shares, compared to its average volume of 1,648,530. FMC Co. has a 52 week low of $50.03 and a 52 week high of $68.72. The company has a debt-to-equity ratio of 0.65, a quick ratio of 1.09 and a current ratio of 1.48. The firm's fifty day moving average is $59.83 and its 200 day moving average is $60.19. The stock has a market cap of $6.68 billion, a price-to-earnings ratio of 4.60, a P/E/G ratio of 1.48 and a beta of 0.80.

FMC (NYSE:FMC - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The basic materials company reported $0.69 EPS for the quarter, beating analysts' consensus estimates of $0.49 by $0.20. The business had revenue of $1.07 billion for the quarter, compared to analysts' expectations of $1.04 billion. FMC had a net margin of 34.93% and a return on equity of 7.68%. The business's quarterly revenue was up 8.5% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.44 earnings per share. As a group, equities analysts forecast that FMC Co. will post 3.35 EPS for the current fiscal year.

FMC Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 16th. Shareholders of record on Tuesday, December 31st will be paid a $0.58 dividend. This represents a $2.32 annualized dividend and a yield of 4.34%. FMC's dividend payout ratio (DPR) is presently 19.97%.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on the stock. Citigroup initiated coverage on shares of FMC in a research report on Wednesday, October 23rd. They issued a "neutral" rating and a $67.00 target price on the stock. Mizuho raised their price objective on FMC from $64.00 to $70.00 and gave the company a "neutral" rating in a report on Friday, November 1st. Finally, Royal Bank of Canada upped their target price on FMC from $78.00 to $81.00 and gave the stock an "outperform" rating in a report on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $68.00.

View Our Latest Stock Report on FMC

FMC Profile

(

Free Report)

FMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control.

Further Reading

Before you consider FMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FMC wasn't on the list.

While FMC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.