Stifel Financial Corp cut its stake in shares of Campbell Soup (NASDAQ:CPB - Free Report) by 41.8% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 58,283 shares of the company's stock after selling 41,791 shares during the quarter. Stifel Financial Corp's holdings in Campbell Soup were worth $2,851,000 as of its most recent SEC filing.

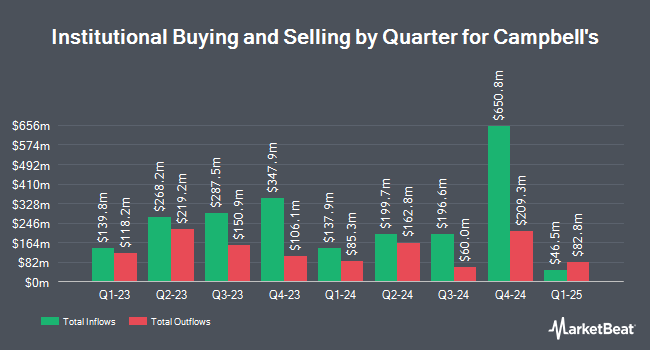

Other hedge funds have also recently modified their holdings of the company. Point72 Asia Singapore Pte. Ltd. acquired a new position in Campbell Soup during the 2nd quarter worth approximately $32,000. nVerses Capital LLC acquired a new position in Campbell Soup during the third quarter worth $34,000. Ashton Thomas Securities LLC purchased a new stake in shares of Campbell Soup during the 3rd quarter worth $39,000. Rothschild Investment LLC acquired a new position in Campbell Soup during the second quarter worth about $44,000. Finally, Sentry Investment Management LLC acquired a new stake in shares of Campbell Soup in the 2nd quarter worth approximately $44,000. 52.35% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities analysts have weighed in on CPB shares. Wells Fargo & Company dropped their target price on shares of Campbell Soup from $51.00 to $45.00 and set an "equal weight" rating for the company in a report on Thursday, December 5th. Citigroup dropped their price objective on shares of Campbell Soup from $44.00 to $41.00 and set a "sell" rating for the company in a research note on Thursday, December 5th. DA Davidson reiterated a "neutral" rating and issued a $51.00 target price on shares of Campbell Soup in a report on Wednesday, December 4th. Sanford C. Bernstein raised shares of Campbell Soup from a "market perform" rating to an "outperform" rating and increased their price objective for the stock from $55.00 to $58.00 in a research report on Monday, October 7th. Finally, StockNews.com upgraded Campbell Soup from a "sell" rating to a "hold" rating in a report on Thursday, September 26th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $50.92.

Get Our Latest Stock Analysis on Campbell Soup

Campbell Soup Price Performance

Shares of CPB stock opened at $43.05 on Wednesday. The company has a debt-to-equity ratio of 1.74, a current ratio of 0.91 and a quick ratio of 0.50. The firm has a market cap of $12.83 billion, a P/E ratio of 23.52, a P/E/G ratio of 2.96 and a beta of 0.18. Campbell Soup has a 1-year low of $40.26 and a 1-year high of $52.81. The firm has a fifty day moving average of $45.65 and a two-hundred day moving average of $46.89.

Campbell Soup Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, January 27th. Stockholders of record on Thursday, January 2nd will be given a $0.39 dividend. This is a positive change from Campbell Soup's previous quarterly dividend of $0.37. The ex-dividend date of this dividend is Thursday, January 2nd. This represents a $1.56 annualized dividend and a dividend yield of 3.62%. Campbell Soup's dividend payout ratio (DPR) is presently 85.25%.

Campbell Soup Profile

(

Free Report)

Campbell Soup Company, together with its subsidiaries, manufactures and markets food and beverage products in the United States and internationally. The company operates through Meals & Beverages and Snacks segments. The Meals & Beverages segment engages in the retail and foodservice businesses in the United States and Canada.

Read More

Before you consider Campbell Soup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Campbell Soup wasn't on the list.

While Campbell Soup currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.