Stifel Financial Corp lessened its holdings in T. Rowe Price Group, Inc. (NASDAQ:TROW - Free Report) by 12.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,237,904 shares of the asset manager's stock after selling 170,173 shares during the quarter. Stifel Financial Corp owned approximately 0.56% of T. Rowe Price Group worth $134,849,000 at the end of the most recent reporting period.

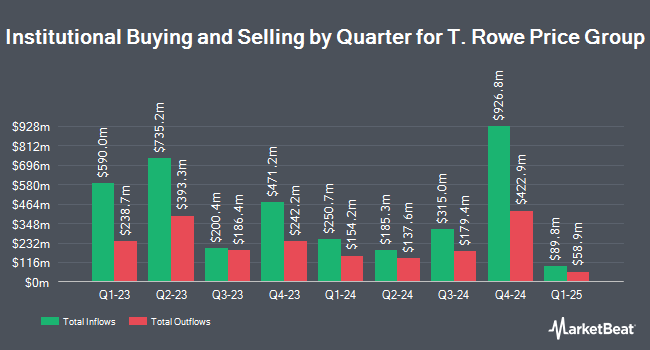

A number of other large investors have also added to or reduced their stakes in the business. Cetera Investment Advisers raised its holdings in T. Rowe Price Group by 175.6% during the 1st quarter. Cetera Investment Advisers now owns 43,261 shares of the asset manager's stock worth $5,274,000 after purchasing an additional 27,565 shares during the last quarter. Valeo Financial Advisors LLC raised its holdings in T. Rowe Price Group by 8.6% during the 2nd quarter. Valeo Financial Advisors LLC now owns 2,887 shares of the asset manager's stock worth $333,000 after purchasing an additional 228 shares during the last quarter. Simplicity Wealth LLC raised its holdings in T. Rowe Price Group by 7.7% during the 2nd quarter. Simplicity Wealth LLC now owns 2,967 shares of the asset manager's stock worth $342,000 after purchasing an additional 212 shares during the last quarter. OLD National Bancorp IN raised its holdings in T. Rowe Price Group by 3.7% during the 2nd quarter. OLD National Bancorp IN now owns 64,512 shares of the asset manager's stock worth $7,439,000 after purchasing an additional 2,298 shares during the last quarter. Finally, QRG Capital Management Inc. raised its holdings in T. Rowe Price Group by 2.8% during the 2nd quarter. QRG Capital Management Inc. now owns 5,199 shares of the asset manager's stock worth $599,000 after purchasing an additional 140 shares during the last quarter. Institutional investors own 73.39% of the company's stock.

T. Rowe Price Group Trading Down 0.7 %

NASDAQ TROW traded down $0.86 during mid-day trading on Friday, hitting $123.83. The company's stock had a trading volume of 1,092,898 shares, compared to its average volume of 1,268,557. The company's 50 day simple moving average is $114.97 and its 200 day simple moving average is $113.08. T. Rowe Price Group, Inc. has a twelve month low of $97.50 and a twelve month high of $125.81. The firm has a market capitalization of $27.51 billion, a price-to-earnings ratio of 13.55, a PEG ratio of 1.74 and a beta of 1.42.

T. Rowe Price Group (NASDAQ:TROW - Get Free Report) last posted its earnings results on Friday, November 1st. The asset manager reported $2.57 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.36 by $0.21. T. Rowe Price Group had a net margin of 30.35% and a return on equity of 20.35%. The firm had revenue of $1.79 billion during the quarter, compared to analyst estimates of $1.84 billion. During the same quarter in the prior year, the business posted $2.17 EPS. The business's revenue was up 6.9% compared to the same quarter last year. As a group, research analysts forecast that T. Rowe Price Group, Inc. will post 9.39 EPS for the current year.

T. Rowe Price Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, December 13th will be paid a $1.24 dividend. The ex-dividend date is Friday, December 13th. This represents a $4.96 annualized dividend and a dividend yield of 4.01%. T. Rowe Price Group's payout ratio is 54.27%.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on TROW shares. Barclays raised their price objective on shares of T. Rowe Price Group from $101.00 to $110.00 and gave the stock an "underweight" rating in a research report on Monday, November 4th. JPMorgan Chase & Co. reduced their price objective on shares of T. Rowe Price Group from $116.00 to $115.00 and set an "underweight" rating for the company in a research report on Monday, November 4th. Morgan Stanley raised their price objective on shares of T. Rowe Price Group from $127.00 to $129.00 and gave the stock an "equal weight" rating in a research report on Monday, November 4th. Wells Fargo & Company raised their price objective on shares of T. Rowe Price Group from $109.00 to $112.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 9th. Finally, Deutsche Bank Aktiengesellschaft raised their price objective on shares of T. Rowe Price Group from $115.00 to $120.00 and gave the stock a "hold" rating in a research report on Monday, November 11th. Four research analysts have rated the stock with a sell rating and eight have issued a hold rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $115.55.

Read Our Latest Stock Analysis on T. Rowe Price Group

Insider Transactions at T. Rowe Price Group

In related news, insider Jessica M. Hiebler sold 484 shares of the business's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $104.73, for a total value of $50,689.32. Following the transaction, the insider now directly owns 13,939 shares of the company's stock, valued at approximately $1,459,831.47. The trade was a 3.36 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Company insiders own 2.00% of the company's stock.

T. Rowe Price Group Profile

(

Free Report)

T. Rowe Price Group, Inc is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe.

Featured Stories

Before you consider T. Rowe Price Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T. Rowe Price Group wasn't on the list.

While T. Rowe Price Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.