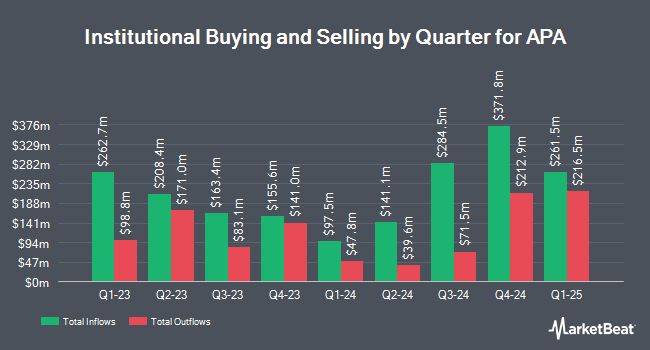

Stifel Financial Corp decreased its stake in shares of APA Co. (NASDAQ:APA - Free Report) by 12.7% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 582,247 shares of the company's stock after selling 84,345 shares during the period. Stifel Financial Corp owned 0.16% of APA worth $14,242,000 at the end of the most recent reporting period.

Several other large investors have also recently added to or reduced their stakes in the business. Harris Associates L P lifted its position in shares of APA by 20.8% during the third quarter. Harris Associates L P now owns 24,914,700 shares of the company's stock worth $609,414,000 after purchasing an additional 4,293,932 shares in the last quarter. Hotchkis & Wiley Capital Management LLC raised its stake in shares of APA by 12.6% in the 3rd quarter. Hotchkis & Wiley Capital Management LLC now owns 30,471,834 shares of the company's stock worth $745,341,000 after buying an additional 3,411,270 shares in the last quarter. Dimensional Fund Advisors LP lifted its holdings in shares of APA by 131.7% during the second quarter. Dimensional Fund Advisors LP now owns 4,813,655 shares of the company's stock valued at $141,704,000 after purchasing an additional 2,736,041 shares during the last quarter. Mizuho Securities USA LLC boosted its position in APA by 3,450.8% during the 3rd quarter. Mizuho Securities USA LLC now owns 985,907 shares of the company's stock worth $24,115,000 after acquiring an additional 958,141 shares during the period. Finally, AQR Capital Management LLC raised its holdings in APA by 112.6% during the second quarter. AQR Capital Management LLC now owns 1,448,935 shares of the company's stock valued at $42,092,000 after buying an additional 767,557 shares in the last quarter. 83.01% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts have recently issued reports on APA shares. Susquehanna dropped their price objective on shares of APA from $52.00 to $48.00 and set a "positive" rating on the stock in a report on Friday, October 18th. Piper Sandler reduced their price objective on APA from $28.00 to $26.00 and set a "neutral" rating on the stock in a report on Monday, November 18th. Barclays cut their price target on shares of APA from $30.00 to $27.00 and set an "equal weight" rating on the stock in a research report on Friday, November 8th. JPMorgan Chase & Co. decreased their price objective on APA from $29.00 to $25.00 and set a "neutral" rating for the company in a research report on Wednesday, November 13th. Finally, Evercore ISI cut their target price on APA from $39.00 to $33.00 and set an "in-line" rating on the stock in a research note on Monday, September 30th. Four analysts have rated the stock with a sell rating, eleven have assigned a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $32.52.

Read Our Latest Report on APA

APA Price Performance

Shares of APA stock traded up $0.12 on Wednesday, reaching $22.38. 4,537,253 shares of the stock were exchanged, compared to its average volume of 6,269,727. The firm's 50 day moving average is $23.73 and its 200-day moving average is $26.70. The firm has a market cap of $8.28 billion, a PE ratio of 3.14 and a beta of 3.19. The company has a debt-to-equity ratio of 1.03, a quick ratio of 1.24 and a current ratio of 1.24. APA Co. has a one year low of $20.95 and a one year high of $37.82.

APA Profile

(

Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Read More

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.