CrowdStrike (NASDAQ:CRWD - Get Free Report) had its target price upped by research analysts at Stifel Nicolaus from $300.00 to $375.00 in a report released on Wednesday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Stifel Nicolaus' price target would indicate a potential upside of 7.10% from the company's current price.

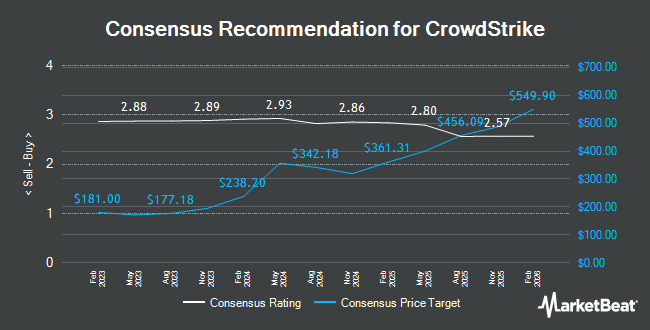

Other research analysts have also issued reports about the stock. UBS Group reduced their price target on shares of CrowdStrike from $330.00 to $310.00 and set a "buy" rating for the company in a research report on Thursday, August 29th. Hsbc Global Res upgraded shares of CrowdStrike from a "hold" rating to a "strong-buy" rating in a research report on Friday, August 30th. KeyCorp raised their price objective on shares of CrowdStrike from $300.00 to $345.00 and gave the company an "overweight" rating in a research report on Monday, September 23rd. The Goldman Sachs Group lowered their price target on CrowdStrike from $400.00 to $295.00 and set a "buy" rating on the stock in a research report on Thursday, August 15th. Finally, Evercore ISI decreased their price objective on CrowdStrike from $350.00 to $325.00 and set an "outperform" rating on the stock in a report on Tuesday, July 30th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating, thirty-one have issued a buy rating and three have given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $333.82.

Read Our Latest Analysis on CrowdStrike

CrowdStrike Stock Down 0.9 %

CrowdStrike stock traded down $3.14 during midday trading on Wednesday, hitting $350.15. 2,493,843 shares of the stock were exchanged, compared to its average volume of 4,992,874. CrowdStrike has a 52-week low of $200.81 and a 52-week high of $398.33. The company has a quick ratio of 1.90, a current ratio of 1.90 and a debt-to-equity ratio of 0.26. The business's 50-day moving average price is $301.83 and its 200-day moving average price is $310.94. The stock has a market capitalization of $85.83 billion, a price-to-earnings ratio of 502.17, a price-to-earnings-growth ratio of 22.77 and a beta of 1.10.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last released its earnings results on Wednesday, August 28th. The company reported $1.04 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.97 by $0.07. CrowdStrike had a return on equity of 8.44% and a net margin of 4.84%. The business had revenue of $963.87 million during the quarter, compared to the consensus estimate of $958.27 million. During the same period last year, the business posted $0.06 earnings per share. The business's revenue for the quarter was up 31.7% on a year-over-year basis. On average, research analysts expect that CrowdStrike will post 0.52 EPS for the current fiscal year.

Insider Activity at CrowdStrike

In other CrowdStrike news, insider Shawn Henry sold 4,500 shares of the stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $260.73, for a total transaction of $1,173,285.00. Following the completion of the transaction, the insider now owns 174,591 shares of the company's stock, valued at $45,521,111.43. This represents a 2.51 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Anurag Saha sold 1,683 shares of CrowdStrike stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $297.28, for a total value of $500,322.24. Following the completion of the sale, the chief accounting officer now directly owns 38,962 shares in the company, valued at $11,582,623.36. This trade represents a 4.14 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 108,248 shares of company stock worth $32,465,110. 4.34% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. Beacon Financial Advisory LLC purchased a new stake in shares of CrowdStrike in the 3rd quarter worth $955,000. Sumitomo Mitsui Trust Group Inc. grew its stake in CrowdStrike by 10.2% in the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 846,189 shares of the company's stock valued at $237,331,000 after purchasing an additional 78,305 shares during the last quarter. Burney Co. purchased a new stake in shares of CrowdStrike during the first quarter valued at about $1,342,000. Doliver Advisors LP boosted its stake in CrowdStrike by 223.2% in the third quarter. Doliver Advisors LP now owns 6,754 shares of the company's stock valued at $1,894,000 after acquiring an additional 4,664 shares in the last quarter. Finally, DekaBank Deutsche Girozentrale grew its stake in CrowdStrike by 0.7% during the 3rd quarter. DekaBank Deutsche Girozentrale now owns 439,865 shares of the company's stock worth $124,644,000 after buying an additional 2,863 shares during the last quarter. 71.16% of the stock is owned by hedge funds and other institutional investors.

CrowdStrike Company Profile

(

Get Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

See Also

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.