StockNews.com initiated coverage on shares of América Móvil (NYSE:AMX - Free Report) in a research report report published on Friday. The brokerage issued a buy rating on the Wireless communications provider's stock.

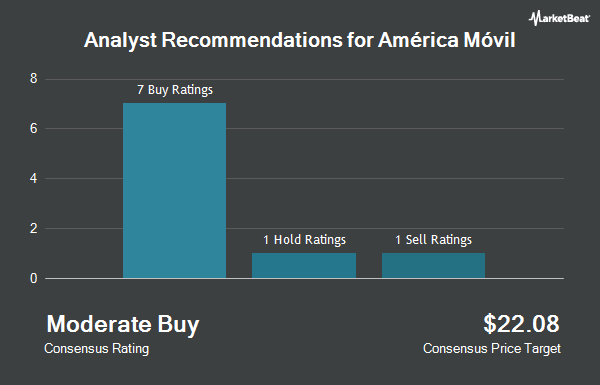

Other analysts also recently issued research reports about the stock. Scotiabank dropped their price target on shares of América Móvil from $17.80 to $17.30 and set a "sector perform" rating on the stock in a report on Wednesday, October 16th. The Goldman Sachs Group dropped their price target on shares of América Móvil from $20.80 to $17.80 and set a "buy" rating for the company in a research report on Friday, November 15th. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $19.48.

Get Our Latest Stock Analysis on AMX

América Móvil Trading Down 1.1 %

Shares of AMX traded down $0.16 during mid-day trading on Friday, reaching $15.02. The company's stock had a trading volume of 2,747,855 shares, compared to its average volume of 1,564,584. The company's fifty day moving average price is $16.12 and its two-hundred day moving average price is $17.07. The company has a current ratio of 0.72, a quick ratio of 0.67 and a debt-to-equity ratio of 0.90. América Móvil has a 52 week low of $14.87 and a 52 week high of $20.31. The stock has a market cap of $46.11 billion, a PE ratio of 22.42, a P/E/G ratio of 1.01 and a beta of 0.95.

América Móvil (NYSE:AMX - Get Free Report) last released its quarterly earnings results on Tuesday, October 15th. The Wireless communications provider reported $0.11 EPS for the quarter, missing analysts' consensus estimates of $0.41 by ($0.30). América Móvil had a net margin of 4.45% and a return on equity of 8.61%. The business had revenue of $11.82 billion for the quarter, compared to the consensus estimate of $11.97 billion. On average, analysts predict that América Móvil will post 1.25 earnings per share for the current fiscal year.

América Móvil Increases Dividend

The firm also recently declared a semi-annual dividend, which was paid on Monday, November 18th. Shareholders of record on Friday, November 8th were issued a $0.245 dividend. This represents a yield of 2%. This is a positive change from América Móvil's previous semi-annual dividend of $0.18. The ex-dividend date was Friday, November 8th. América Móvil's dividend payout ratio is presently 34.33%.

Institutional Trading of América Móvil

A number of institutional investors and hedge funds have recently modified their holdings of AMX. Mirae Asset Global Investments Co. Ltd. grew its stake in América Móvil by 5.9% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 10,839 shares of the Wireless communications provider's stock worth $178,000 after purchasing an additional 608 shares in the last quarter. Profund Advisors LLC grew its holdings in América Móvil by 1.7% during the second quarter. Profund Advisors LLC now owns 37,515 shares of the Wireless communications provider's stock worth $638,000 after acquiring an additional 630 shares during the period. Oppenheimer Asset Management Inc. increased its holdings in shares of América Móvil by 6.5% in the 2nd quarter. Oppenheimer Asset Management Inc. now owns 16,707 shares of the Wireless communications provider's stock valued at $284,000 after purchasing an additional 1,025 shares in the last quarter. Allworth Financial LP grew its holdings in shares of América Móvil by 46.1% in the 3rd quarter. Allworth Financial LP now owns 4,964 shares of the Wireless communications provider's stock worth $81,000 after acquiring an additional 1,567 shares during the period. Finally, Wealthspire Advisors LLC grew its stake in América Móvil by 16.0% in the 2nd quarter. Wealthspire Advisors LLC now owns 13,656 shares of the Wireless communications provider's stock valued at $232,000 after acquiring an additional 1,880 shares during the last quarter. Hedge funds and other institutional investors own 6.30% of the company's stock.

América Móvil Company Profile

(

Get Free Report)

América Móvil, SAB. de C.V. provides telecommunications services in Latin America and internationally. The company offers wireless and fixed voice services, including airtime, local, domestic, and international long-distance services; and network interconnection services. It provides data services, such as data centers, data administration, and hosting services to residential and corporate clients; value-added services, including Internet access, messaging and other wireless entertainment, and corporate services; data transmission, email services, instant messaging, content streaming, and interactive applications; and wireless security services, mobile payment solutions, machine-to-machine services, mobile banking, virtual private network services, and video calls and personal communications services.

Read More

Before you consider América Móvil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and América Móvil wasn't on the list.

While América Móvil currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.