Equities research analysts at StockNews.com initiated coverage on shares of Envestnet (NYSE:ENV - Get Free Report) in a note issued to investors on Wednesday. The brokerage set a "sell" rating on the business services provider's stock.

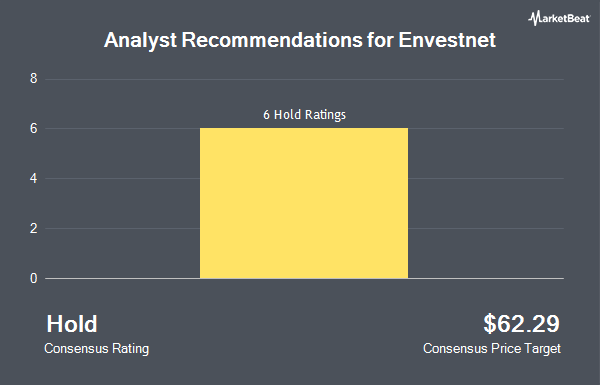

Separately, DA Davidson reaffirmed a "neutral" rating and set a $63.00 price objective on shares of Envestnet in a research note on Wednesday, September 18th. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating and one has issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $61.88.

Get Our Latest Stock Report on Envestnet

Envestnet Price Performance

ENV stock remained flat at $63.09 during midday trading on Wednesday. 1,663,944 shares of the company's stock were exchanged, compared to its average volume of 692,457. The company has a market cap of $3.49 billion, a P/E ratio of -13.23 and a beta of 1.25. The company has a quick ratio of 0.59, a current ratio of 0.59 and a debt-to-equity ratio of 1.07. Envestnet has a fifty-two week low of $36.43 and a fifty-two week high of $73.04. The company's 50-day moving average is $62.74 and its 200-day moving average is $63.11.

Institutional Investors Weigh In On Envestnet

A number of large investors have recently modified their holdings of the stock. Arizona State Retirement System boosted its position in Envestnet by 2.5% during the 2nd quarter. Arizona State Retirement System now owns 11,552 shares of the business services provider's stock valued at $723,000 after acquiring an additional 286 shares in the last quarter. Farther Finance Advisors LLC lifted its position in Envestnet by 8.2% during the 3rd quarter. Farther Finance Advisors LLC now owns 5,803 shares of the business services provider's stock valued at $363,000 after acquiring an additional 439 shares during the period. Natixis boosted its stake in Envestnet by 12.9% during the first quarter. Natixis now owns 4,767 shares of the business services provider's stock worth $276,000 after acquiring an additional 544 shares in the last quarter. Louisiana State Employees Retirement System grew its holdings in Envestnet by 2.4% in the second quarter. Louisiana State Employees Retirement System now owns 25,200 shares of the business services provider's stock worth $1,577,000 after purchasing an additional 600 shares during the period. Finally, Benjamin Edwards Inc. increased its stake in shares of Envestnet by 9.2% during the second quarter. Benjamin Edwards Inc. now owns 7,781 shares of the business services provider's stock valued at $487,000 after purchasing an additional 658 shares in the last quarter.

About Envestnet

(

Get Free Report)

Envestnet, Inc, through its subsidiaries, provides wealth management software and services in the United States and internationally. It operates through two segments: Envestnet Wealth Solutions and Envestnet Data & Analytics. The Envestnet Wealth Solutions segment offers Envestnet | Enterprise, an end-to-end open architecture wealth management platform, as well as offers data aggregation and reporting, data analytics, and digital advice capabilities; Envestnet | Wealth Analytics that transforms data into actionable intelligence; Envestnet | Tamarac which provides trading, rebalancing, portfolio accounting, performance reporting, and client relationship management software; and Envestnet | MoneyGuide that provides goals-based financial planning solutions to the financial services industry.

Featured Articles

Before you consider Envestnet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Envestnet wasn't on the list.

While Envestnet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.