StockNews.com started coverage on shares of H&E Equipment Services (NASDAQ:HEES - Free Report) in a report released on Monday. The brokerage issued a hold rating on the industrial products company's stock.

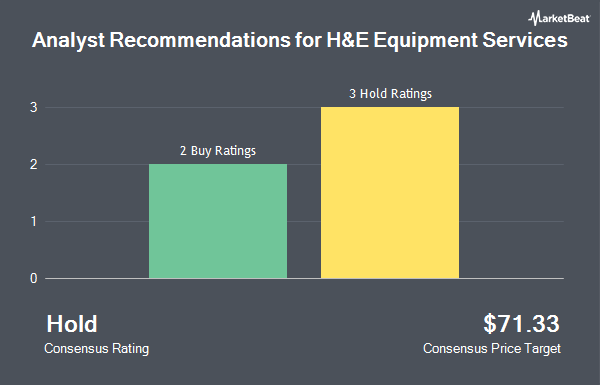

Separately, UBS Group reaffirmed a "neutral" rating and set a $92.00 target price (up previously from $60.00) on shares of H&E Equipment Services in a research note on Friday, January 17th. Four research analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, H&E Equipment Services has an average rating of "Hold" and a consensus target price of $71.33.

Check Out Our Latest Report on HEES

H&E Equipment Services Price Performance

Shares of HEES stock traded down $0.70 on Monday, reaching $90.96. The company's stock had a trading volume of 516,985 shares, compared to its average volume of 527,643. The company has a market capitalization of $3.34 billion, a P/E ratio of 23.09 and a beta of 1.74. The company has a quick ratio of 0.59, a current ratio of 0.64 and a debt-to-equity ratio of 2.09. The stock's 50 day simple moving average is $93.58 and its 200-day simple moving average is $71.67. H&E Equipment Services has a 12-month low of $40.93 and a 12-month high of $101.28.

H&E Equipment Services (NASDAQ:HEES - Get Free Report) last posted its quarterly earnings results on Friday, February 21st. The industrial products company reported $0.99 EPS for the quarter, topping the consensus estimate of $0.81 by $0.18. H&E Equipment Services had a net margin of 9.47% and a return on equity of 25.46%. The firm had revenue of $384.08 million for the quarter, compared to the consensus estimate of $372.50 million. As a group, equities analysts predict that H&E Equipment Services will post 3.25 earnings per share for the current fiscal year.

H&E Equipment Services Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, February 24th. Shareholders of record on Tuesday, February 18th were given a $0.275 dividend. This represents a $1.10 dividend on an annualized basis and a yield of 1.21%. The ex-dividend date of this dividend was Tuesday, February 18th. H&E Equipment Services's payout ratio is 32.64%.

Institutional Investors Weigh In On H&E Equipment Services

A number of institutional investors and hedge funds have recently added to or reduced their stakes in HEES. Farther Finance Advisors LLC lifted its holdings in H&E Equipment Services by 108.4% in the 1st quarter. Farther Finance Advisors LLC now owns 298 shares of the industrial products company's stock worth $28,000 after purchasing an additional 155 shares in the last quarter. Meeder Asset Management Inc. grew its position in H&E Equipment Services by 17.8% in the fourth quarter. Meeder Asset Management Inc. now owns 1,453 shares of the industrial products company's stock worth $71,000 after acquiring an additional 220 shares in the last quarter. CIBC Private Wealth Group LLC boosted its holdings in shares of H&E Equipment Services by 38.8% in the 4th quarter. CIBC Private Wealth Group LLC now owns 4,172 shares of the industrial products company's stock worth $190,000 after purchasing an additional 1,166 shares during the period. Wilmington Savings Fund Society FSB bought a new position in H&E Equipment Services during the third quarter valued at $288,000. Finally, Commonwealth Equity Services LLC raised its position in H&E Equipment Services by 15.0% in the 4th quarter. Commonwealth Equity Services LLC now owns 6,108 shares of the industrial products company's stock worth $299,000 after purchasing an additional 799 shares during the period. Institutional investors own 84.08% of the company's stock.

About H&E Equipment Services

(

Get Free Report)

H&E Equipment Services, Inc engages in the provision of equipment services, which focus on heavy construction and industrial equipment. It operates through the following segments: Equipment Rentals, New Equipment Sales, Used Equipment Sales, Parts Sales, and Services. The Equipment Rentals segment focuses on renting construction and industrial equipment.

Featured Articles

Before you consider H&E Equipment Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&E Equipment Services wasn't on the list.

While H&E Equipment Services currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn how options trading can help you navigate market volatility, manage risk, and maximize returns with MarketBeat's "Unlock the Potential in Options Trading." Click the link below to have this special report delivered to your inbox.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.