SM Energy (NYSE:SM - Get Free Report) was upgraded by research analysts at StockNews.com from a "hold" rating to a "buy" rating in a report released on Thursday.

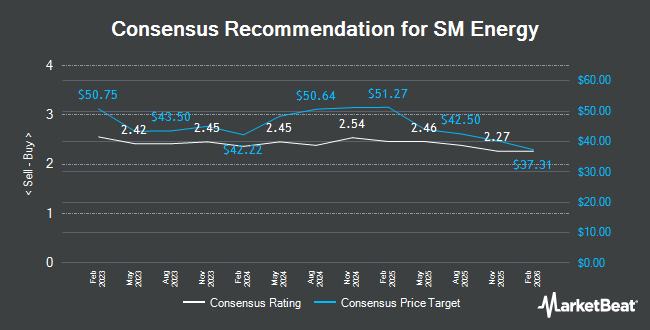

Other research analysts also recently issued reports about the stock. Mizuho decreased their price target on shares of SM Energy from $57.00 to $55.00 and set an "outperform" rating on the stock in a research note on Monday, December 16th. Wells Fargo & Company decreased their target price on shares of SM Energy from $47.00 to $45.00 and set an "equal weight" rating on the stock in a research report on Tuesday, December 17th. Truist Financial upped their price target on shares of SM Energy from $42.00 to $45.00 and gave the company a "hold" rating in a research report on Monday, January 13th. Susquehanna decreased their price objective on SM Energy from $48.00 to $46.00 and set a "neutral" rating on the stock in a report on Tuesday, November 5th. Finally, JPMorgan Chase & Co. reissued a "neutral" rating and issued a $53.00 target price (up previously from $51.00) on shares of SM Energy in a research note on Wednesday, December 4th. Six analysts have rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $51.90.

View Our Latest Research Report on SM Energy

SM Energy Price Performance

Shares of NYSE SM traded down $1.70 during mid-day trading on Thursday, reaching $37.13. 4,571,080 shares of the company were exchanged, compared to its average volume of 1,594,351. The stock has a market capitalization of $4.25 billion, a PE ratio of 5.19 and a beta of 4.11. The company has a quick ratio of 3.52, a current ratio of 3.52 and a debt-to-equity ratio of 0.67. SM Energy has a 52 week low of $36.13 and a 52 week high of $53.26. The company's 50 day moving average price is $39.76 and its 200 day moving average price is $41.80.

SM Energy (NYSE:SM - Get Free Report) last issued its quarterly earnings results on Wednesday, February 19th. The energy company reported $1.91 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.00 by ($0.09). The firm had revenue of $852.22 million for the quarter, compared to the consensus estimate of $849.44 million. SM Energy had a return on equity of 19.62% and a net margin of 33.89%. Sell-side analysts forecast that SM Energy will post 6.78 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of the company. State Street Corp raised its holdings in SM Energy by 1.9% during the third quarter. State Street Corp now owns 6,287,815 shares of the energy company's stock valued at $251,324,000 after acquiring an additional 114,664 shares during the period. JPMorgan Chase & Co. lifted its holdings in SM Energy by 22.0% in the 4th quarter. JPMorgan Chase & Co. now owns 4,632,255 shares of the energy company's stock worth $179,546,000 after purchasing an additional 835,929 shares in the last quarter. Pacer Advisors Inc. lifted its holdings in shares of SM Energy by 2,515.6% in the third quarter. Pacer Advisors Inc. now owns 4,463,443 shares of the energy company's stock worth $178,404,000 after buying an additional 4,292,793 shares in the last quarter. American Century Companies Inc. boosted its position in shares of SM Energy by 8.8% during the fourth quarter. American Century Companies Inc. now owns 3,682,093 shares of the energy company's stock worth $142,718,000 after acquiring an additional 296,601 shares during the last quarter. Finally, Geode Capital Management LLC boosted its position in shares of SM Energy by 1.1% during the third quarter. Geode Capital Management LLC now owns 2,693,372 shares of the energy company's stock worth $107,675,000 after acquiring an additional 29,911 shares during the last quarter. Hedge funds and other institutional investors own 94.56% of the company's stock.

About SM Energy

(

Get Free Report)

SM Energy Company, an independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas. It has working interests in oil and gas producing wells in the Midland Basin and South Texas. The company was formerly known as St.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SM Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SM Energy wasn't on the list.

While SM Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.