SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) was upgraded by equities research analysts at StockNews.com to a "sell" rating in a report released on Friday.

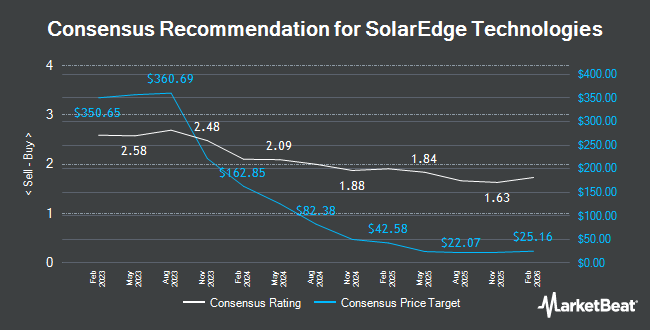

Several other analysts have also recently commented on the stock. Glj Research cut shares of SolarEdge Technologies from a "strong-buy" rating to a "strong sell" rating in a research note on Tuesday, October 8th. Piper Sandler lowered SolarEdge Technologies from a "neutral" rating to an "underweight" rating and dropped their target price for the company from $17.00 to $9.00 in a research note on Thursday. Guggenheim downgraded SolarEdge Technologies from a "neutral" rating to a "sell" rating and set a $10.00 target price on the stock. in a research report on Thursday, October 17th. DZ Bank cut SolarEdge Technologies from a "hold" rating to a "sell" rating and set a $24.00 price target for the company. in a report on Wednesday, July 17th. Finally, UBS Group dropped their price objective on shares of SolarEdge Technologies from $26.00 to $18.00 and set a "neutral" rating for the company in a research note on Friday. Nine analysts have rated the stock with a sell rating, nineteen have given a hold rating and two have assigned a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $23.79.

Get Our Latest Stock Analysis on SolarEdge Technologies

SolarEdge Technologies Price Performance

SolarEdge Technologies stock traded down $1.35 during mid-day trading on Friday, hitting $13.53. 7,872,062 shares of the company were exchanged, compared to its average volume of 3,473,123. The company has a market capitalization of $775.27 million, a P/E ratio of -0.47 and a beta of 1.59. The business's 50 day simple moving average is $19.34 and its two-hundred day simple moving average is $31.18. SolarEdge Technologies has a 12-month low of $12.38 and a 12-month high of $103.15. The company has a debt-to-equity ratio of 0.32, a current ratio of 5.10 and a quick ratio of 2.45.

SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The semiconductor company reported ($1.79) EPS for the quarter, missing analysts' consensus estimates of ($1.60) by ($0.19). The firm had revenue of $265.41 million for the quarter, compared to analysts' expectations of $264.31 million. SolarEdge Technologies had a negative return on equity of 56.32% and a negative net margin of 158.19%. The business's quarterly revenue was down 73.2% compared to the same quarter last year. During the same quarter last year, the firm earned $2.06 earnings per share. Analysts forecast that SolarEdge Technologies will post -8.85 earnings per share for the current fiscal year.

Institutional Investors Weigh In On SolarEdge Technologies

A number of institutional investors have recently made changes to their positions in SEDG. Trillium Asset Management LLC lifted its holdings in shares of SolarEdge Technologies by 1.6% in the 1st quarter. Trillium Asset Management LLC now owns 27,604 shares of the semiconductor company's stock worth $1,960,000 after purchasing an additional 427 shares during the last quarter. Yelin Lapidot Holdings Management Ltd. increased its holdings in shares of SolarEdge Technologies by 5.1% during the second quarter. Yelin Lapidot Holdings Management Ltd. now owns 11,654 shares of the semiconductor company's stock valued at $294,000 after purchasing an additional 564 shares during the period. Texas Permanent School Fund Corp increased its holdings in shares of SolarEdge Technologies by 1.2% during the first quarter. Texas Permanent School Fund Corp now owns 49,655 shares of the semiconductor company's stock valued at $3,525,000 after purchasing an additional 585 shares during the period. Swiss National Bank lifted its holdings in SolarEdge Technologies by 0.5% in the first quarter. Swiss National Bank now owns 112,100 shares of the semiconductor company's stock worth $7,957,000 after purchasing an additional 600 shares during the period. Finally, Louisiana State Employees Retirement System lifted its holdings in SolarEdge Technologies by 2.5% in the second quarter. Louisiana State Employees Retirement System now owns 28,800 shares of the semiconductor company's stock worth $727,000 after purchasing an additional 700 shares during the period. 95.10% of the stock is currently owned by institutional investors.

About SolarEdge Technologies

(

Get Free Report)

SolarEdge Technologies, Inc, together with its subsidiaries, designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally. It operates in two segments, Solar and Energy Storage.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SolarEdge Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarEdge Technologies wasn't on the list.

While SolarEdge Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.