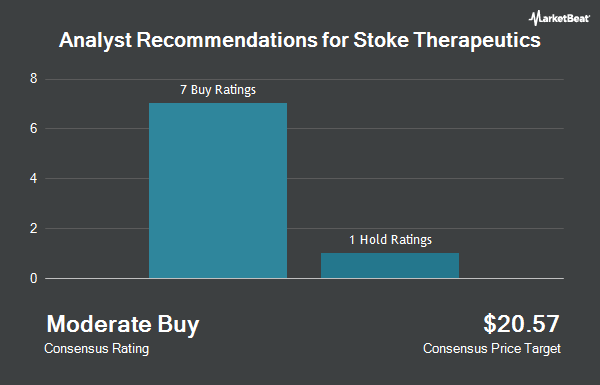

Shares of Stoke Therapeutics, Inc. (NASDAQ:STOK - Get Free Report) have been assigned a consensus rating of "Buy" from the nine analysts that are covering the stock, Marketbeat.com reports. One research analyst has rated the stock with a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company. The average 1 year price objective among brokers that have issued a report on the stock in the last year is $20.83.

Several equities analysts recently commented on the stock. HC Wainwright reiterated a "buy" rating and set a $35.00 target price on shares of Stoke Therapeutics in a research note on Wednesday, November 6th. Needham & Company LLC reissued a "buy" rating and issued a $22.00 target price on shares of Stoke Therapeutics in a report on Wednesday, November 6th. Leerink Partners began coverage on shares of Stoke Therapeutics in a research note on Monday, October 14th. They set an "outperform" rating and a $18.00 price target on the stock. Finally, Leerink Partnrs upgraded shares of Stoke Therapeutics to a "strong-buy" rating in a research report on Friday, October 11th.

View Our Latest Analysis on STOK

Insider Buying and Selling

In related news, major shareholder Skorpios Trust sold 1,937,500 shares of Stoke Therapeutics stock in a transaction that occurred on Thursday, September 19th. The stock was sold at an average price of $14.05, for a total value of $27,221,875.00. Following the sale, the insider now owns 8,906,181 shares of the company's stock, valued at approximately $125,131,843.05. This trade represents a 17.87 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 11.30% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Stoke Therapeutics

A number of large investors have recently modified their holdings of the business. Geode Capital Management LLC lifted its stake in Stoke Therapeutics by 9.7% in the 3rd quarter. Geode Capital Management LLC now owns 870,831 shares of the company's stock valued at $10,705,000 after purchasing an additional 76,661 shares during the last quarter. Barclays PLC lifted its position in shares of Stoke Therapeutics by 145.3% in the third quarter. Barclays PLC now owns 79,740 shares of the company's stock valued at $980,000 after buying an additional 47,239 shares during the last quarter. Jane Street Group LLC boosted its stake in shares of Stoke Therapeutics by 338.2% during the 3rd quarter. Jane Street Group LLC now owns 330,442 shares of the company's stock worth $4,061,000 after acquiring an additional 255,028 shares during the period. State Street Corp increased its holdings in shares of Stoke Therapeutics by 8.6% during the 3rd quarter. State Street Corp now owns 1,728,888 shares of the company's stock worth $21,248,000 after acquiring an additional 137,145 shares during the last quarter. Finally, RTW Investments LP raised its stake in Stoke Therapeutics by 10.1% in the 3rd quarter. RTW Investments LP now owns 4,652,285 shares of the company's stock valued at $57,177,000 after acquiring an additional 427,447 shares during the period.

Stoke Therapeutics Trading Down 13.6 %

Stoke Therapeutics stock traded down $1.89 during midday trading on Friday, reaching $12.03. The stock had a trading volume of 813,819 shares, compared to its average volume of 374,363. Stoke Therapeutics has a twelve month low of $3.77 and a twelve month high of $17.58. The firm's fifty day simple moving average is $13.06 and its two-hundred day simple moving average is $13.80.

Stoke Therapeutics (NASDAQ:STOK - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The company reported ($0.47) EPS for the quarter, topping the consensus estimate of ($0.52) by $0.05. Stoke Therapeutics had a negative net margin of 629.90% and a negative return on equity of 54.45%. The company had revenue of $4.89 million for the quarter, compared to analyst estimates of $3.46 million. Research analysts forecast that Stoke Therapeutics will post -2.03 EPS for the current year.

Stoke Therapeutics Company Profile

(

Get Free ReportStoke Therapeutics, Inc, an early-stage biopharmaceutical company, develops medicines to treat the underlying causes of severe genetic diseases in the United States. The company utilizes its proprietary targeted augmentation of nuclear gene output to develop antisense oligonucleotides to selectively restore protein levels.

Featured Stories

Before you consider Stoke Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stoke Therapeutics wasn't on the list.

While Stoke Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.