Fourth Sail Capital LP lessened its holdings in shares of StoneCo Ltd. (NASDAQ:STNE - Free Report) by 54.1% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 816,333 shares of the company's stock after selling 962,067 shares during the period. StoneCo comprises 2.3% of Fourth Sail Capital LP's holdings, making the stock its 18th largest holding. Fourth Sail Capital LP owned 0.26% of StoneCo worth $9,192,000 as of its most recent SEC filing.

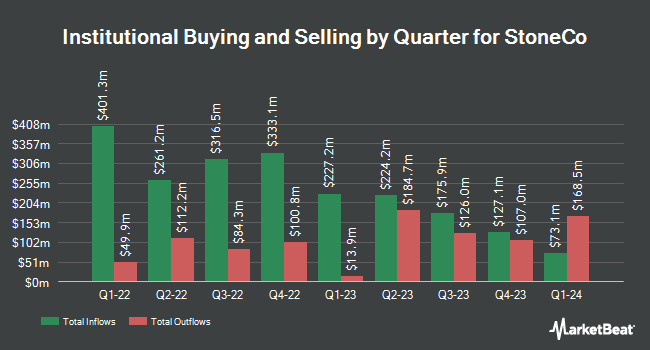

Other large investors have also recently bought and sold shares of the company. Point72 Asset Management L.P. lifted its holdings in StoneCo by 10.2% in the second quarter. Point72 Asset Management L.P. now owns 8,386,945 shares of the company's stock valued at $100,559,000 after buying an additional 779,445 shares during the period. Vanguard Group Inc. grew its holdings in StoneCo by 3.5% during the 1st quarter. Vanguard Group Inc. now owns 2,636,619 shares of the company's stock valued at $43,794,000 after buying an additional 88,256 shares in the last quarter. Creative Planning increased its position in shares of StoneCo by 224.9% in the third quarter. Creative Planning now owns 65,321 shares of the company's stock worth $736,000 after purchasing an additional 45,218 shares during the last quarter. GSA Capital Partners LLP purchased a new stake in StoneCo in the third quarter worth approximately $716,000. Finally, Coronation Fund Managers Ltd. increased its stake in StoneCo by 4.6% in the 2nd quarter. Coronation Fund Managers Ltd. now owns 2,562,394 shares of the company's stock worth $30,723,000 after purchasing an additional 113,656 shares during the period. 73.19% of the stock is currently owned by institutional investors and hedge funds.

StoneCo Stock Performance

Shares of StoneCo stock traded down $0.09 during trading on Monday, hitting $9.67. 4,124,018 shares of the stock were exchanged, compared to its average volume of 5,133,637. StoneCo Ltd. has a 1-year low of $9.61 and a 1-year high of $19.46. The stock has a market capitalization of $2.99 billion, a price-to-earnings ratio of 7.55, a price-to-earnings-growth ratio of 0.34 and a beta of 2.29. The company has a fifty day moving average price of $11.24 and a 200-day moving average price of $12.66. The company has a current ratio of 1.42, a quick ratio of 1.36 and a debt-to-equity ratio of 0.47.

Analyst Ratings Changes

STNE has been the subject of a number of analyst reports. Cantor Fitzgerald raised StoneCo to a "strong-buy" rating in a research report on Thursday, October 3rd. UBS Group upped their price target on shares of StoneCo from $17.00 to $18.00 and gave the company a "buy" rating in a report on Thursday, August 29th. Barclays cut their price target on StoneCo from $13.00 to $12.00 and set an "equal weight" rating on the stock in a report on Monday. Susquehanna dropped their target price on shares of StoneCo from $22.00 to $19.00 and set a "positive" rating on the stock in a research report on Wednesday, November 13th. Finally, Morgan Stanley reissued an "underweight" rating and set a $7.00 price target (down from $16.50) on shares of StoneCo in a report on Thursday, September 5th. One investment analyst has rated the stock with a sell rating, one has given a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $16.89.

Get Our Latest Stock Report on STNE

StoneCo Profile

(

Free Report)

StoneCo Ltd. provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. It distributes its solutions, principally through proprietary Stone Hubs, which offer hyper-local sales and services; and sells solutions to brick-and-mortar and digital merchants through sales team.

Featured Stories

Before you consider StoneCo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneCo wasn't on the list.

While StoneCo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.