StoneX Group Inc. acquired a new stake in shares of Carrier Global Co. (NYSE:CARR - Free Report) during the 4th quarter, according to its most recent disclosure with the SEC. The fund acquired 13,382 shares of the company's stock, valued at approximately $914,000.

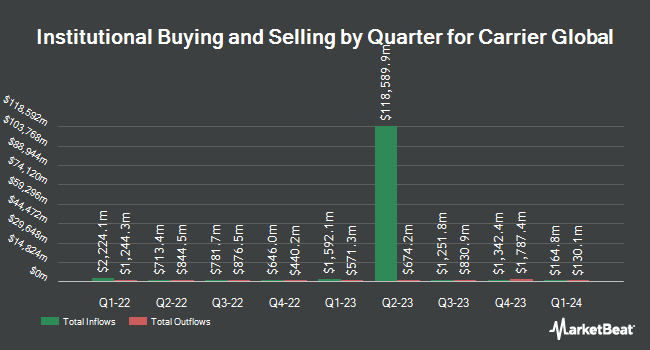

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. BOK Financial Private Wealth Inc. increased its position in Carrier Global by 80.0% during the 4th quarter. BOK Financial Private Wealth Inc. now owns 360 shares of the company's stock valued at $25,000 after buying an additional 160 shares in the last quarter. Bradley & Co. Private Wealth Management LLC bought a new position in Carrier Global in the 4th quarter worth about $31,000. Meeder Asset Management Inc. raised its holdings in Carrier Global by 236.1% in the fourth quarter. Meeder Asset Management Inc. now owns 484 shares of the company's stock worth $33,000 after buying an additional 340 shares during the last quarter. Roxbury Financial LLC bought a new position in shares of Carrier Global in the fourth quarter worth approximately $49,000. Finally, Centricity Wealth Management LLC purchased a new stake in shares of Carrier Global during the fourth quarter valued at approximately $49,000. Hedge funds and other institutional investors own 91.00% of the company's stock.

Carrier Global Stock Performance

NYSE:CARR traded down $3.66 during mid-day trading on Friday, hitting $57.06. 6,933,810 shares of the company traded hands, compared to its average volume of 4,442,539. The company has a quick ratio of 0.96, a current ratio of 1.25 and a debt-to-equity ratio of 0.77. The stock's fifty day moving average price is $65.27 and its 200-day moving average price is $71.31. The firm has a market cap of $49.30 billion, a price-to-earnings ratio of 9.09, a price-to-earnings-growth ratio of 2.01 and a beta of 1.33. Carrier Global Co. has a one year low of $53.33 and a one year high of $83.32.

Carrier Global (NYSE:CARR - Get Free Report) last released its earnings results on Tuesday, February 11th. The company reported $0.54 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.51 by $0.03. Carrier Global had a net margin of 23.83% and a return on equity of 18.82%. During the same period last year, the business posted $0.53 earnings per share. Research analysts anticipate that Carrier Global Co. will post 2.99 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms recently issued reports on CARR. Barclays lowered their price objective on Carrier Global from $87.00 to $83.00 and set an "overweight" rating on the stock in a research report on Wednesday, March 26th. Citigroup dropped their price objective on Carrier Global from $94.00 to $90.00 and set a "buy" rating on the stock in a research report on Monday, January 13th. Wells Fargo & Company decreased their target price on Carrier Global from $75.00 to $70.00 and set an "equal weight" rating for the company in a research report on Wednesday, February 12th. JPMorgan Chase & Co. upgraded shares of Carrier Global from a "neutral" rating to an "overweight" rating and lifted their price target for the stock from $77.00 to $78.00 in a research note on Wednesday, March 5th. Finally, Mizuho upgraded shares of Carrier Global from a "neutral" rating to an "outperform" rating and set a $78.00 price objective on the stock in a research report on Friday, February 14th. Five investment analysts have rated the stock with a hold rating, eleven have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $82.27.

Check Out Our Latest Report on Carrier Global

Carrier Global Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

See Also

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.