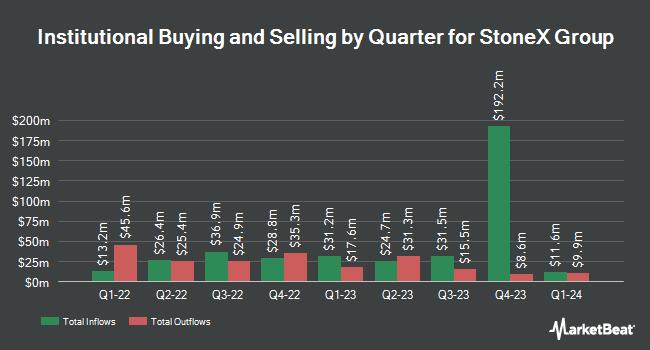

Charles Schwab Investment Management Inc. lowered its position in StoneX Group Inc. (NASDAQ:SNEX - Free Report) by 8.1% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 270,054 shares of the company's stock after selling 23,826 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.85% of StoneX Group worth $22,112,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other large investors have also added to or reduced their stakes in the business. Foundry Partners LLC bought a new stake in shares of StoneX Group in the 3rd quarter valued at about $5,348,000. Intech Investment Management LLC lifted its position in shares of StoneX Group by 53.9% in the 3rd quarter. Intech Investment Management LLC now owns 9,061 shares of the company's stock worth $742,000 after purchasing an additional 3,173 shares during the period. Connor Clark & Lunn Investment Management Ltd. increased its position in shares of StoneX Group by 299.1% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 21,894 shares of the company's stock worth $1,793,000 after buying an additional 16,408 shares during the period. Quest Partners LLC raised its stake in StoneX Group by 1,187.7% during the third quarter. Quest Partners LLC now owns 7,134 shares of the company's stock worth $584,000 after buying an additional 6,580 shares during the last quarter. Finally, Sawgrass Asset Management LLC lifted its holdings in StoneX Group by 13.3% in the third quarter. Sawgrass Asset Management LLC now owns 3,180 shares of the company's stock valued at $260,000 after buying an additional 373 shares during the period. Institutional investors own 75.93% of the company's stock.

Insider Buying and Selling

In related news, Director John Moore Fowler sold 1,800 shares of the stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $100.14, for a total transaction of $180,252.00. Following the transaction, the director now directly owns 81,375 shares of the company's stock, valued at $8,148,892.50. This represents a 2.16 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Sean Michael Oconnor sold 37,500 shares of StoneX Group stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $98.42, for a total transaction of $3,690,750.00. Following the completion of the sale, the chief executive officer now directly owns 506,994 shares of the company's stock, valued at approximately $49,898,349.48. This trade represents a 6.89 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 16.24% of the stock is currently owned by insiders.

StoneX Group Trading Down 0.5 %

StoneX Group stock traded down $0.56 during trading hours on Friday, reaching $103.36. 54,225 shares of the company's stock were exchanged, compared to its average volume of 134,039. The firm's 50 day simple moving average is $92.74 and its 200 day simple moving average is $82.82. StoneX Group Inc. has a twelve month low of $61.68 and a twelve month high of $106.77. The company has a quick ratio of 1.30, a current ratio of 1.81 and a debt-to-equity ratio of 1.26. The firm has a market capitalization of $3.30 billion, a PE ratio of 12.97 and a beta of 0.78.

StoneX Group Profile

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

See Also

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.