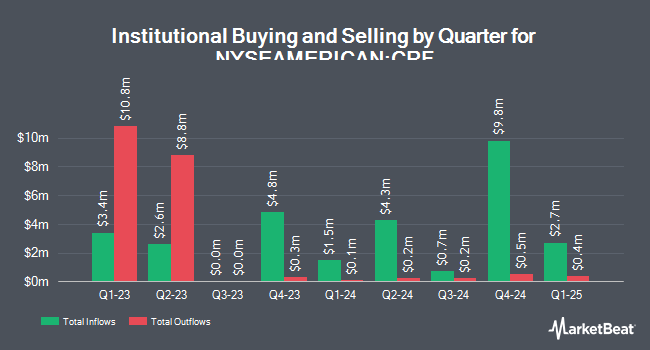

StoneX Group Inc. increased its position in Cornerstone Total Return Fund, Inc. (NYSEAMERICAN:CRF - Free Report) by 74.5% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 138,840 shares of the investment management company's stock after buying an additional 59,272 shares during the period. StoneX Group Inc. owned 0.13% of Cornerstone Total Return Fund worth $1,207,000 at the end of the most recent reporting period.

A number of other hedge funds have also recently added to or reduced their stakes in the company. Rockefeller Capital Management L.P. raised its holdings in Cornerstone Total Return Fund by 21.8% during the third quarter. Rockefeller Capital Management L.P. now owns 44,295 shares of the investment management company's stock valued at $358,000 after buying an additional 7,935 shares in the last quarter. Quarry LP acquired a new position in shares of Cornerstone Total Return Fund during the 3rd quarter valued at about $42,000. Virtu Financial LLC raised its stake in shares of Cornerstone Total Return Fund by 70.3% in the 3rd quarter. Virtu Financial LLC now owns 18,637 shares of the investment management company's stock valued at $151,000 after acquiring an additional 7,696 shares in the last quarter. Grimes & Company Inc. lifted its holdings in Cornerstone Total Return Fund by 4.9% in the 4th quarter. Grimes & Company Inc. now owns 25,556 shares of the investment management company's stock worth $222,000 after purchasing an additional 1,193 shares during the last quarter. Finally, Chicago Partners Investment Group LLC boosted its position in Cornerstone Total Return Fund by 4.2% during the fourth quarter. Chicago Partners Investment Group LLC now owns 77,104 shares of the investment management company's stock worth $687,000 after purchasing an additional 3,097 shares during the period. Institutional investors and hedge funds own 10.41% of the company's stock.

Cornerstone Total Return Fund Stock Down 5.2 %

Cornerstone Total Return Fund stock traded down $0.36 on Friday, reaching $6.62. 2,192,397 shares of the stock were exchanged, compared to its average volume of 867,920. Cornerstone Total Return Fund, Inc. has a twelve month low of $6.44 and a twelve month high of $9.75. The firm has a fifty day moving average price of $8.09 and a two-hundred day moving average price of $8.16.

Cornerstone Total Return Fund Dividend Announcement

The firm also recently announced a monthly dividend, which will be paid on Wednesday, April 30th. Investors of record on Tuesday, April 15th will be paid a dividend of $0.1168 per share. The ex-dividend date of this dividend is Tuesday, April 15th. This represents a $1.40 annualized dividend and a yield of 21.17%.

Cornerstone Total Return Fund Profile

(

Free Report)

Cornerstone Total Return Fund, Inc is a closed-ended equity mutual fund launched and managed by Cornerstone Advisors, LLC. It invests in the public equity markets of the United States. The fund seeks to invest in stocks of companies operating across diversified sectors. It primarily invests in value and growth stocks of companies across all market capitalizations.

See Also

Before you consider Cornerstone Total Return Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cornerstone Total Return Fund wasn't on the list.

While Cornerstone Total Return Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.