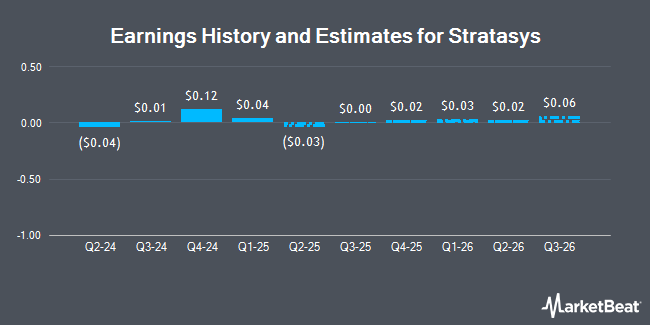

Stratasys Ltd. (NASDAQ:SSYS - Free Report) - Research analysts at Zacks Research lifted their FY2024 earnings estimates for Stratasys in a note issued to investors on Wednesday, December 4th. Zacks Research analyst R. Department now expects that the technology company will post earnings per share of ($0.36) for the year, up from their previous estimate of ($0.43). The consensus estimate for Stratasys' current full-year earnings is ($0.40) per share. Zacks Research also issued estimates for Stratasys' Q4 2024 earnings at $0.01 EPS, Q1 2025 earnings at ($0.03) EPS, Q2 2025 earnings at ($0.01) EPS, Q3 2025 earnings at $0.01 EPS, FY2025 earnings at ($0.07) EPS, Q1 2026 earnings at $0.23 EPS, Q2 2026 earnings at $0.28 EPS, Q3 2026 earnings at $0.43 EPS and FY2026 earnings at $1.55 EPS.

A number of other equities analysts have also recently commented on the stock. StockNews.com cut shares of Stratasys from a "buy" rating to a "hold" rating in a research note on Thursday. Loop Capital dropped their price objective on shares of Stratasys from $9.00 to $7.00 and set a "hold" rating for the company in a research note on Thursday, September 5th. Craig Hallum lifted their price objective on shares of Stratasys from $12.00 to $15.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. Lake Street Capital dropped their price objective on shares of Stratasys from $15.00 to $11.00 and set a "buy" rating for the company in a research note on Friday, August 30th. Finally, Needham & Company LLC lifted their price objective on shares of Stratasys from $10.00 to $12.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. Two equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Stratasys has an average rating of "Moderate Buy" and a consensus target price of $11.40.

Check Out Our Latest Analysis on SSYS

Stratasys Trading Up 6.5 %

SSYS traded up $0.62 during trading on Monday, hitting $10.22. 873,302 shares of the company traded hands, compared to its average volume of 515,708. The company has a market cap of $729.50 million, a PE ratio of -7.74 and a beta of 1.31. The stock's 50-day simple moving average is $8.31 and its two-hundred day simple moving average is $8.18. Stratasys has a 1 year low of $6.05 and a 1 year high of $14.93.

Stratasys (NASDAQ:SSYS - Get Free Report) last posted its earnings results on Wednesday, November 13th. The technology company reported $0.01 earnings per share for the quarter, beating the consensus estimate of ($0.04) by $0.05. The company had revenue of $140.00 million during the quarter, compared to analysts' expectations of $139.49 million. Stratasys had a negative net margin of 16.13% and a negative return on equity of 3.75%. Stratasys's quarterly revenue was down 13.6% on a year-over-year basis. During the same period last year, the company posted ($0.05) earnings per share.

Hedge Funds Weigh In On Stratasys

A number of large investors have recently made changes to their positions in SSYS. State Street Corp lifted its holdings in Stratasys by 1.4% during the 3rd quarter. State Street Corp now owns 105,578 shares of the technology company's stock valued at $877,000 after buying an additional 1,500 shares in the last quarter. Barclays PLC lifted its holdings in Stratasys by 1.9% during the 3rd quarter. Barclays PLC now owns 80,454 shares of the technology company's stock valued at $669,000 after buying an additional 1,525 shares in the last quarter. Tidal Investments LLC lifted its holdings in Stratasys by 4.6% during the 3rd quarter. Tidal Investments LLC now owns 56,176 shares of the technology company's stock valued at $467,000 after buying an additional 2,483 shares in the last quarter. Pinnacle Associates Ltd. lifted its holdings in Stratasys by 0.4% during the 3rd quarter. Pinnacle Associates Ltd. now owns 1,050,639 shares of the technology company's stock valued at $8,731,000 after buying an additional 3,791 shares in the last quarter. Finally, ARK Investment Management LLC lifted its holdings in Stratasys by 0.7% during the 3rd quarter. ARK Investment Management LLC now owns 647,221 shares of the technology company's stock valued at $5,378,000 after buying an additional 4,589 shares in the last quarter. 75.77% of the stock is owned by hedge funds and other institutional investors.

Stratasys Company Profile

(

Get Free Report)

Stratasys Ltd. provides connected polymer-based 3D printing solutions. It offers range of 3D printing systems, which includes polyjet printer, Fused Deposition Modeling (FDM) printers, stereolithography printing systems, origin P3 printers, and selective absorption fusion printer for additive manufacturing, and tooling and rapid prototyping for various vertical markets, such as automotive, aerospace, consumer products and healthcare.

Read More

Before you consider Stratasys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stratasys wasn't on the list.

While Stratasys currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.