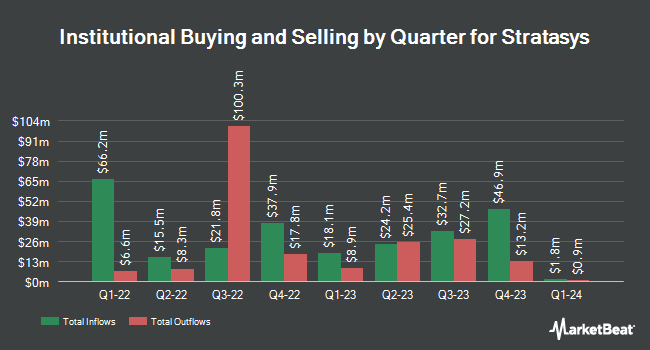

Charles Schwab Investment Management Inc. reduced its position in Stratasys Ltd. (NASDAQ:SSYS - Free Report) by 32.6% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 145,224 shares of the technology company's stock after selling 70,375 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 0.20% of Stratasys worth $1,207,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Connor Clark & Lunn Investment Management Ltd. raised its stake in shares of Stratasys by 510.6% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 67,803 shares of the technology company's stock valued at $563,000 after acquiring an additional 56,699 shares in the last quarter. Trium Capital LLP increased its holdings in Stratasys by 5.6% during the 2nd quarter. Trium Capital LLP now owns 150,948 shares of the technology company's stock worth $1,266,000 after purchasing an additional 8,052 shares during the period. Gabelli Funds LLC raised its position in Stratasys by 9.0% in the 2nd quarter. Gabelli Funds LLC now owns 193,037 shares of the technology company's stock valued at $1,620,000 after purchasing an additional 16,000 shares in the last quarter. RPG Investment Advisory LLC boosted its stake in shares of Stratasys by 6.1% in the 2nd quarter. RPG Investment Advisory LLC now owns 509,105 shares of the technology company's stock valued at $4,271,000 after buying an additional 29,177 shares during the period. Finally, ARK Investment Management LLC grew its position in shares of Stratasys by 0.7% during the third quarter. ARK Investment Management LLC now owns 647,221 shares of the technology company's stock worth $5,378,000 after buying an additional 4,589 shares in the last quarter. 75.77% of the stock is currently owned by hedge funds and other institutional investors.

Stratasys Stock Down 3.3 %

NASDAQ:SSYS traded down $0.33 during mid-day trading on Wednesday, reaching $9.66. 650,615 shares of the stock were exchanged, compared to its average volume of 522,813. The stock has a market capitalization of $689.51 million, a P/E ratio of -7.32 and a beta of 1.31. Stratasys Ltd. has a 1 year low of $6.05 and a 1 year high of $14.93. The company has a 50 day simple moving average of $8.62 and a 200-day simple moving average of $8.23.

Stratasys (NASDAQ:SSYS - Get Free Report) last posted its quarterly earnings data on Wednesday, November 13th. The technology company reported $0.01 earnings per share for the quarter, beating the consensus estimate of ($0.04) by $0.05. The business had revenue of $140.00 million during the quarter, compared to the consensus estimate of $139.49 million. Stratasys had a negative return on equity of 3.75% and a negative net margin of 16.13%. The company's revenue was down 13.6% compared to the same quarter last year. During the same period in the prior year, the company earned ($0.05) earnings per share. As a group, research analysts predict that Stratasys Ltd. will post -0.4 EPS for the current year.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on the stock. Lake Street Capital reduced their target price on shares of Stratasys from $15.00 to $11.00 and set a "buy" rating on the stock in a report on Friday, August 30th. Craig Hallum increased their price objective on shares of Stratasys from $12.00 to $15.00 and gave the company a "buy" rating in a research report on Thursday, November 14th. Cantor Fitzgerald decreased their price objective on shares of Stratasys from $23.00 to $12.00 and set an "overweight" rating for the company in a research report on Friday, August 30th. Needham & Company LLC boosted their target price on shares of Stratasys from $10.00 to $12.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. Finally, Loop Capital dropped their price target on shares of Stratasys from $9.00 to $7.00 and set a "hold" rating on the stock in a research note on Thursday, September 5th. Two investment analysts have rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat.com, Stratasys has a consensus rating of "Moderate Buy" and an average target price of $11.40.

Read Our Latest Analysis on SSYS

About Stratasys

(

Free Report)

Stratasys Ltd. provides connected polymer-based 3D printing solutions. It offers range of 3D printing systems, which includes polyjet printer, Fused Deposition Modeling (FDM) printers, stereolithography printing systems, origin P3 printers, and selective absorption fusion printer for additive manufacturing, and tooling and rapid prototyping for various vertical markets, such as automotive, aerospace, consumer products and healthcare.

Recommended Stories

Before you consider Stratasys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stratasys wasn't on the list.

While Stratasys currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.