Stratasys (NASDAQ:SSYS - Get Free Report) had its price target lifted by investment analysts at Needham & Company LLC from $10.00 to $12.00 in a research report issued on Thursday,Benzinga reports. The firm currently has a "buy" rating on the technology company's stock. Needham & Company LLC's price objective indicates a potential upside of 24.87% from the company's current price.

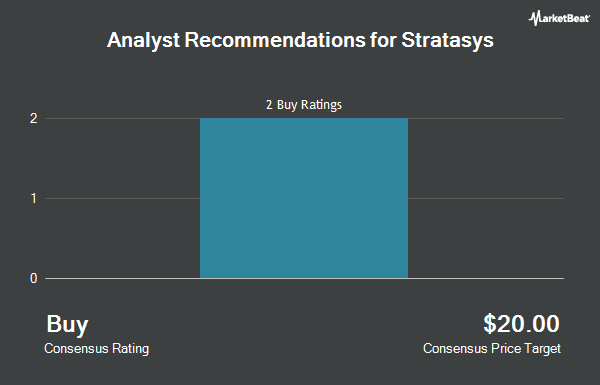

A number of other analysts also recently issued reports on SSYS. Lake Street Capital reduced their price target on shares of Stratasys from $15.00 to $11.00 and set a "buy" rating on the stock in a report on Friday, August 30th. StockNews.com initiated coverage on Stratasys in a research report on Monday, September 2nd. They issued a "hold" rating on the stock. Cantor Fitzgerald cut their price target on Stratasys from $23.00 to $12.00 and set an "overweight" rating for the company in a report on Friday, August 30th. Finally, Loop Capital lowered their target price on Stratasys from $9.00 to $7.00 and set a "hold" rating for the company in a research report on Thursday, September 5th. Two equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat, Stratasys currently has a consensus rating of "Moderate Buy" and a consensus price target of $11.40.

View Our Latest Analysis on Stratasys

Stratasys Trading Down 4.9 %

Stratasys stock traded down $0.50 during mid-day trading on Thursday, hitting $9.61. The stock had a trading volume of 1,317,751 shares, compared to its average volume of 504,858. The firm's 50 day moving average is $7.49 and its 200 day moving average is $8.20. The firm has a market capitalization of $685.96 million, a P/E ratio of -6.00 and a beta of 1.21. Stratasys has a one year low of $6.05 and a one year high of $14.93.

Stratasys (NASDAQ:SSYS - Get Free Report) last issued its earnings results on Thursday, August 29th. The technology company reported ($0.04) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.05) by $0.01. Stratasys had a negative return on equity of 3.29% and a negative net margin of 18.98%. The company had revenue of $138.00 million for the quarter, compared to the consensus estimate of $146.38 million. During the same quarter last year, the company earned ($0.08) EPS. The firm's quarterly revenue was down 13.6% on a year-over-year basis. As a group, equities research analysts forecast that Stratasys will post -0.44 earnings per share for the current year.

Institutional Investors Weigh In On Stratasys

Several institutional investors have recently modified their holdings of the stock. Rubric Capital Management LP lifted its position in Stratasys by 3.7% in the third quarter. Rubric Capital Management LP now owns 6,191,000 shares of the technology company's stock worth $51,447,000 after buying an additional 222,297 shares during the last quarter. Clearline Capital LP bought a new position in Stratasys during the 2nd quarter valued at about $9,301,000. Pinnacle Associates Ltd. raised its position in Stratasys by 0.4% in the 3rd quarter. Pinnacle Associates Ltd. now owns 1,050,639 shares of the technology company's stock worth $8,731,000 after purchasing an additional 3,791 shares during the period. State of Michigan Retirement System lifted its stake in Stratasys by 17.2% in the second quarter. State of Michigan Retirement System now owns 817,503 shares of the technology company's stock worth $6,859,000 after purchasing an additional 120,000 shares during the last quarter. Finally, RPG Investment Advisory LLC grew its stake in shares of Stratasys by 29.6% during the third quarter. RPG Investment Advisory LLC now owns 659,996 shares of the technology company's stock valued at $5,485,000 after buying an additional 150,891 shares during the last quarter. 75.77% of the stock is owned by institutional investors.

Stratasys Company Profile

(

Get Free Report)

Stratasys Ltd. provides connected polymer-based 3D printing solutions. It offers range of 3D printing systems, which includes polyjet printer, Fused Deposition Modeling (FDM) printers, stereolithography printing systems, origin P3 printers, and selective absorption fusion printer for additive manufacturing, and tooling and rapid prototyping for various vertical markets, such as automotive, aerospace, consumer products and healthcare.

See Also

Before you consider Stratasys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stratasys wasn't on the list.

While Stratasys currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.