Strategic Financial Concepts LLC bought a new position in ING Groep (NYSE:ING - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 15,842 shares of the financial services provider's stock, valued at approximately $248,000.

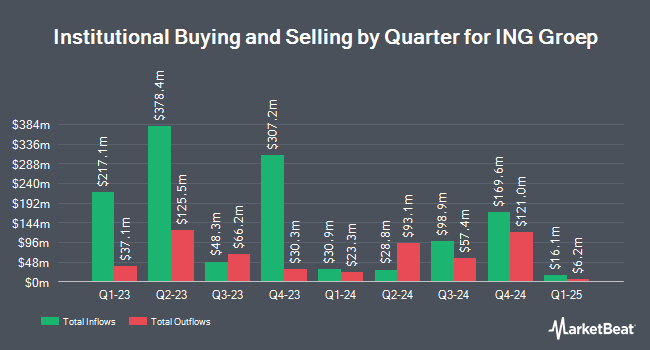

A number of other large investors have also bought and sold shares of the company. Fisher Asset Management LLC grew its position in shares of ING Groep by 0.6% in the third quarter. Fisher Asset Management LLC now owns 68,451,083 shares of the financial services provider's stock valued at $1,243,072,000 after purchasing an additional 429,562 shares in the last quarter. Natixis Advisors LLC grew its position in shares of ING Groep by 71.3% in the third quarter. Natixis Advisors LLC now owns 3,306,798 shares of the financial services provider's stock valued at $60,051,000 after purchasing an additional 1,376,713 shares in the last quarter. HighTower Advisors LLC grew its position in shares of ING Groep by 1.7% in the third quarter. HighTower Advisors LLC now owns 948,188 shares of the financial services provider's stock valued at $17,180,000 after purchasing an additional 15,964 shares in the last quarter. Raymond James & Associates grew its position in shares of ING Groep by 49.7% in the third quarter. Raymond James & Associates now owns 794,658 shares of the financial services provider's stock valued at $14,431,000 after purchasing an additional 263,904 shares in the last quarter. Finally, Public Employees Retirement System of Ohio purchased a new position in shares of ING Groep in the third quarter valued at $9,924,000. 4.49% of the stock is owned by hedge funds and other institutional investors.

ING Groep Price Performance

NYSE:ING traded up $0.29 during trading hours on Friday, hitting $17.11. 2,622,010 shares of the company's stock traded hands, compared to its average volume of 2,506,171. The firm has a market cap of $59.84 billion, a P/E ratio of 7.99, a P/E/G ratio of 6.14 and a beta of 1.46. ING Groep has a 52 week low of $13.24 and a 52 week high of $18.72. The business's fifty day simple moving average is $16.07 and its two-hundred day simple moving average is $16.72. The company has a quick ratio of 1.13, a current ratio of 1.13 and a debt-to-equity ratio of 2.89.

ING Groep (NYSE:ING - Get Free Report) last posted its quarterly earnings data on Thursday, February 6th. The financial services provider reported $0.39 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.41 by ($0.02). ING Groep had a net margin of 28.30% and a return on equity of 11.81%. On average, research analysts anticipate that ING Groep will post 2.14 earnings per share for the current fiscal year.

ING Groep Cuts Dividend

The company also recently declared a semi-annual dividend, which was paid on Thursday, January 23rd. Shareholders of record on Monday, January 13th were paid a dividend of $0.1667 per share. This represents a yield of 6.4%. The ex-dividend date was Monday, January 13th. ING Groep's dividend payout ratio (DPR) is currently 30.37%.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on ING. Barclays cut ING Groep from an "overweight" rating to an "equal weight" rating in a research report on Tuesday, October 22nd. Morgan Stanley lowered ING Groep from an "overweight" rating to an "equal weight" rating in a research note on Tuesday, November 26th.

View Our Latest Analysis on ING Groep

ING Groep Profile

(

Free Report)

ING Groep N.V. provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally. It operates through five segments: Retail Netherlands, Retail Belgium, Retail Germany, Retail Other, and Wholesale Banking. The company accepts current and savings accounts.

Featured Articles

Before you consider ING Groep, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ING Groep wasn't on the list.

While ING Groep currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.