Strategy Asset Managers LLC bought a new stake in shares of Ciena Co. (NYSE:CIEN - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor bought 16,295 shares of the communications equipment provider's stock, valued at approximately $1,382,000.

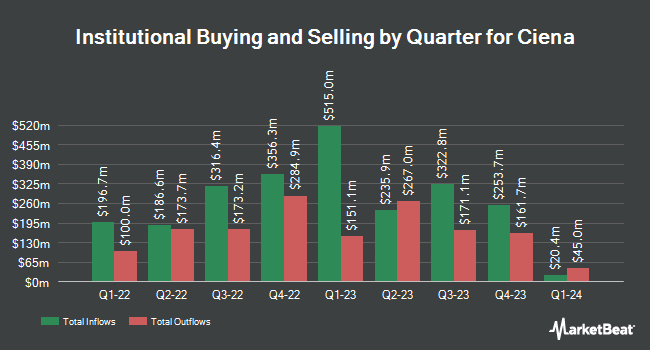

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Geode Capital Management LLC lifted its holdings in Ciena by 1.4% during the 3rd quarter. Geode Capital Management LLC now owns 2,408,014 shares of the communications equipment provider's stock valued at $148,348,000 after buying an additional 33,074 shares in the last quarter. Ritholtz Wealth Management bought a new stake in shares of Ciena during the fourth quarter valued at approximately $245,000. US Bancorp DE raised its stake in shares of Ciena by 1.5% during the fourth quarter. US Bancorp DE now owns 10,459 shares of the communications equipment provider's stock valued at $887,000 after acquiring an additional 152 shares in the last quarter. Merit Financial Group LLC purchased a new stake in shares of Ciena in the fourth quarter valued at approximately $421,000. Finally, Paloma Partners Management Co increased its holdings in Ciena by 283.7% during the 3rd quarter. Paloma Partners Management Co now owns 50,000 shares of the communications equipment provider's stock worth $3,080,000 after purchasing an additional 36,970 shares during the period. 91.99% of the stock is currently owned by hedge funds and other institutional investors.

Ciena Stock Up 6.8 %

Shares of CIEN stock traded up $4.19 during trading hours on Wednesday, reaching $65.73. 2,002,667 shares of the company's stock were exchanged, compared to its average volume of 2,596,680. Ciena Co. has a fifty-two week low of $43.30 and a fifty-two week high of $101.44. The stock's 50 day moving average is $77.71 and its 200-day moving average is $74.29. The company has a current ratio of 3.55, a quick ratio of 2.72 and a debt-to-equity ratio of 0.54. The company has a market cap of $9.34 billion, a price-to-earnings ratio of 115.32, a P/E/G ratio of 1.54 and a beta of 0.91.

Analysts Set New Price Targets

Several equities research analysts have weighed in on the company. B. Riley reiterated a "buy" rating and issued a $89.00 target price (down from $97.00) on shares of Ciena in a report on Wednesday, March 12th. Rosenblatt Securities lowered their price objective on shares of Ciena from $94.00 to $79.00 and set a "neutral" rating for the company in a research note on Friday, March 7th. Barclays set a $100.00 target price on shares of Ciena and gave the stock an "overweight" rating in a report on Wednesday, March 12th. Northland Securities upgraded shares of Ciena from a "market perform" rating to an "outperform" rating and boosted their price target for the company from $60.00 to $75.00 in a report on Wednesday, March 12th. Finally, JPMorgan Chase & Co. upgraded shares of Ciena from a "neutral" rating to an "overweight" rating and increased their price objective for the company from $84.00 to $88.00 in a research note on Tuesday, January 28th. Four analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $81.38.

Check Out Our Latest Analysis on CIEN

Insider Activity at Ciena

In other Ciena news, CEO Gary B. Smith sold 6,800 shares of the business's stock in a transaction that occurred on Monday, March 17th. The shares were sold at an average price of $65.18, for a total transaction of $443,224.00. Following the sale, the chief executive officer now owns 391,749 shares of the company's stock, valued at approximately $25,534,199.82. The trade was a 1.71 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, SVP Jason Phipps sold 5,648 shares of the company's stock in a transaction that occurred on Thursday, January 2nd. The shares were sold at an average price of $84.64, for a total transaction of $478,046.72. Following the transaction, the senior vice president now owns 109,878 shares in the company, valued at $9,300,073.92. The trade was a 4.89 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 66,560 shares of company stock valued at $5,406,323 in the last ninety days. Corporate insiders own 0.93% of the company's stock.

About Ciena

(

Free Report)

Ciena Corporation provides hardware and software services for delivery of video, data, and voice traffic metro, aggregation, and access communications network worldwide. The company's Networking Platforms segment offers convergence of coherent optical transport, open optical networking, optical transport network switching, IP routing, and switching services.

Featured Articles

Before you consider Ciena, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ciena wasn't on the list.

While Ciena currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.