Russell Investments Group Ltd. lessened its stake in shares of Strategy Incorporated (NASDAQ:MSTR - Free Report) by 9.8% in the 4th quarter, according to its most recent disclosure with the SEC. The firm owned 26,769 shares of the software maker's stock after selling 2,914 shares during the period. Russell Investments Group Ltd.'s holdings in Strategy were worth $7,803,000 as of its most recent SEC filing.

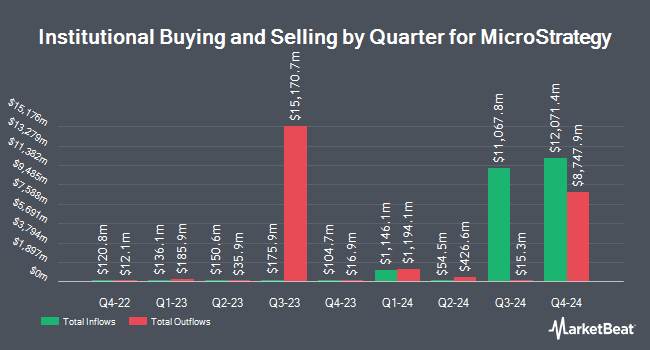

A number of other hedge funds and other institutional investors have also bought and sold shares of MSTR. Rahlfs Capital LLC bought a new position in shares of Strategy in the fourth quarter worth about $756,000. Wedbush Securities Inc. boosted its stake in Strategy by 12.0% in the 4th quarter. Wedbush Securities Inc. now owns 8,673 shares of the software maker's stock worth $2,512,000 after purchasing an additional 928 shares during the period. Aviva PLC grew its holdings in Strategy by 51.2% during the 4th quarter. Aviva PLC now owns 94,953 shares of the software maker's stock valued at $27,500,000 after buying an additional 32,171 shares in the last quarter. Hel Ved Capital Management Ltd purchased a new position in shares of Strategy in the fourth quarter worth $2,495,000. Finally, Resona Asset Management Co. Ltd. bought a new position in shares of Strategy during the fourth quarter worth $15,073,000. Hedge funds and other institutional investors own 59.84% of the company's stock.

Strategy Trading Up 3.8 %

Shares of MSTR stock traded up $11.47 on Monday, reaching $311.45. 15,586,656 shares of the company's stock were exchanged, compared to its average volume of 18,021,948. The company's fifty day simple moving average is $295.80 and its 200 day simple moving average is $306.65. Strategy Incorporated has a 52 week low of $101.00 and a 52 week high of $543.00. The company has a current ratio of 0.71, a quick ratio of 0.65 and a debt-to-equity ratio of 0.39. The stock has a market capitalization of $80.15 billion, a PE ratio of -55.29 and a beta of 3.46.

Strategy (NASDAQ:MSTR - Get Free Report) last issued its earnings results on Wednesday, February 5th. The software maker reported ($3.20) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.13) by ($3.07). Strategy had a negative net margin of 251.73% and a negative return on equity of 19.01%.

Insider Transactions at Strategy

In other news, Director Leslie J. Rechan sold 15,000 shares of the firm's stock in a transaction on Tuesday, March 25th. The stock was sold at an average price of $335.90, for a total transaction of $5,038,500.00. Following the transaction, the director now owns 4,970 shares in the company, valued at approximately $1,669,423. This trade represents a 75.11 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, EVP Wei-Ming Shao acquired 500 shares of the stock in a transaction that occurred on Thursday, March 20th. The stock was acquired at an average cost of $85.00 per share, with a total value of $42,500.00. Following the completion of the purchase, the executive vice president now owns 500 shares of the company's stock, valued at $42,500. This trade represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last three months, insiders have purchased 8,000 shares of company stock valued at $680,000 and have sold 22,998 shares valued at $7,671,926. Corporate insiders own 9.16% of the company's stock.

Wall Street Analysts Forecast Growth

MSTR has been the topic of several research analyst reports. Benchmark reiterated a "buy" rating and issued a $650.00 price target on shares of Strategy in a research note on Tuesday, January 14th. Cantor Fitzgerald boosted their target price on Strategy from $613.00 to $619.00 and gave the stock an "overweight" rating in a research report on Thursday, February 6th. Mizuho assumed coverage on Strategy in a report on Wednesday, January 29th. They set an "outperform" rating and a $515.00 price target for the company. Barclays decreased their price objective on Strategy from $515.00 to $421.00 and set an "overweight" rating on the stock in a report on Monday, February 10th. Finally, Compass Point raised shares of Strategy to a "strong-buy" rating in a research note on Wednesday, January 29th. One investment analyst has rated the stock with a sell rating, nine have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $508.09.

View Our Latest Report on MSTR

Strategy Company Profile

(

Free Report)

Strategy Incorporated, formerly known as MicroStrategy, provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers Strategy ONE, a platform that allows non-technical users to access novel and actionable insights for decision-making, and Strategy Cloud for Government, which provides always-on threat monitoring designed to meet the strict technical and regulatory standards of governments and financial institutions.

Further Reading

Before you consider Strategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Strategy wasn't on the list.

While Strategy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.