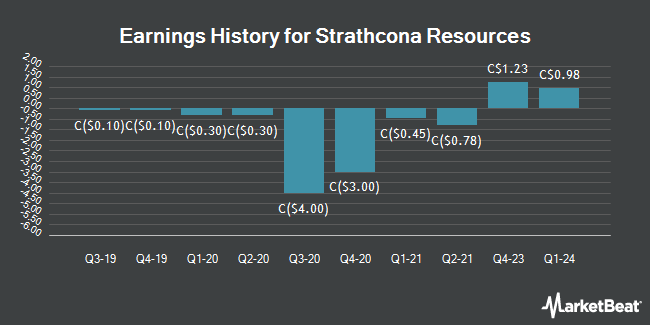

Strathcona Resources (TSE:SCR - Get Free Report) will release its earnings data after the market closes on Wednesday, November 13th. Analysts expect Strathcona Resources to post earnings of C$2.07 per share for the quarter.

Strathcona Resources (TSE:SCR - Get Free Report) last announced its quarterly earnings data on Tuesday, August 13th. The company reported C$1.43 earnings per share for the quarter. The business had revenue of C$992.90 million during the quarter, compared to the consensus estimate of C$978.00 million. Strathcona Resources had a return on equity of 12.32% and a net margin of 11.62%.

Strathcona Resources Trading Down 0.5 %

Shares of SCR stock traded down C$0.13 on Wednesday, hitting C$28.16. The company had a trading volume of 35,163 shares, compared to its average volume of 39,897. The stock's 50-day moving average is C$28.09 and its two-hundred day moving average is C$30.77. Strathcona Resources has a twelve month low of C$20.16 and a twelve month high of C$37.69. The firm has a market cap of C$6.03 billion and a P/E ratio of 6.55. The company has a debt-to-equity ratio of 50.29, a quick ratio of 11.09 and a current ratio of 0.53.

Strathcona Resources Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Friday, September 27th were given a $0.25 dividend. The ex-dividend date of this dividend was Monday, September 16th. This represents a $1.00 annualized dividend and a yield of 3.55%. Strathcona Resources's dividend payout ratio is currently 23.26%.

Analyst Ratings Changes

SCR has been the subject of a number of analyst reports. TD Securities reduced their price objective on Strathcona Resources from C$34.00 to C$30.00 in a research report on Tuesday, October 1st. Jefferies Financial Group reduced their price target on Strathcona Resources from C$35.00 to C$30.00 and set a "hold" rating on the stock in a research report on Monday, September 16th. Royal Bank of Canada lowered their price target on shares of Strathcona Resources from C$37.00 to C$34.00 in a report on Tuesday, September 17th. Finally, Standpoint Research increased their price objective on shares of Strathcona Resources from C$40.00 to C$42.00 in a report on Thursday, July 11th. Four equities research analysts have rated the stock with a hold rating, two have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, Strathcona Resources currently has an average rating of "Moderate Buy" and a consensus price target of C$34.25.

Check Out Our Latest Analysis on SCR

Insider Buying and Selling

In related news, Senior Officer Scott Seipert purchased 5,000 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were acquired at an average cost of C$30.50 per share, with a total value of C$152,500.00. In other news, Director Navjeet Dhillon purchased 3,455 shares of the stock in a transaction dated Monday, August 19th. The shares were acquired at an average cost of C$31.75 per share, for a total transaction of C$109,696.25. Also, Senior Officer Scott Seipert purchased 5,000 shares of the company's stock in a transaction that occurred on Tuesday, September 3rd. The stock was bought at an average cost of C$30.50 per share, for a total transaction of C$152,500.00. 91.34% of the stock is owned by company insiders.

Strathcona Resources Company Profile

(

Get Free Report)

Strathcona Resources Ltd. acquires, explores, develops, and produces petroleum and natural gas reserves in Canada. It operates through three segments: Cold Lake Thermal, Lloydminster Heavy Oil, and Montney. The Cold Lake Thermal segment includes three producing assets in the Cold Lake region of Northern Alberta; and Lindbergh, Orion, and Tucker.

Featured Articles

Before you consider Strathcona Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Strathcona Resources wasn't on the list.

While Strathcona Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.