Strengthening Families & Communities LLC cut its stake in shares of Watsco, Inc. (NYSE:WSO - Free Report) by 95.5% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 331 shares of the construction company's stock after selling 6,988 shares during the quarter. Strengthening Families & Communities LLC's holdings in Watsco were worth $163,000 at the end of the most recent reporting period.

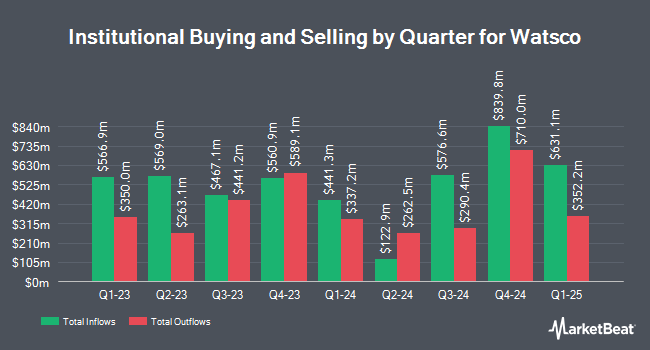

A number of other large investors have also recently made changes to their positions in the company. Quarry LP acquired a new stake in Watsco in the second quarter valued at $26,000. EntryPoint Capital LLC raised its position in shares of Watsco by 100.0% during the 1st quarter. EntryPoint Capital LLC now owns 58 shares of the construction company's stock worth $25,000 after acquiring an additional 29 shares in the last quarter. Tortoise Investment Management LLC lifted its stake in Watsco by 76.2% during the second quarter. Tortoise Investment Management LLC now owns 74 shares of the construction company's stock worth $34,000 after purchasing an additional 32 shares during the last quarter. Ashton Thomas Securities LLC acquired a new position in Watsco in the third quarter valued at approximately $43,000. Finally, Massmutual Trust Co. FSB ADV raised its holdings in Watsco by 30.6% during the third quarter. Massmutual Trust Co. FSB ADV now owns 94 shares of the construction company's stock worth $46,000 after purchasing an additional 22 shares in the last quarter. 89.71% of the stock is currently owned by hedge funds and other institutional investors.

Watsco Trading Up 1.2 %

Shares of WSO traded up $6.22 during mid-day trading on Tuesday, hitting $533.39. 188,101 shares of the company's stock were exchanged, compared to its average volume of 283,130. The firm has a market capitalization of $21.54 billion, a P/E ratio of 40.19 and a beta of 0.88. Watsco, Inc. has a fifty-two week low of $373.33 and a fifty-two week high of $545.49. The business's 50 day moving average is $493.90 and its two-hundred day moving average is $483.20.

Watsco (NYSE:WSO - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The construction company reported $4.22 earnings per share for the quarter, missing the consensus estimate of $4.73 by ($0.51). Watsco had a net margin of 6.99% and a return on equity of 17.77%. The company had revenue of $2.16 billion during the quarter, compared to analysts' expectations of $2.24 billion. During the same quarter last year, the business posted $4.35 earnings per share. The company's revenue for the quarter was up 1.6% compared to the same quarter last year. On average, equities research analysts forecast that Watsco, Inc. will post 13.06 earnings per share for the current year.

Watsco Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Wednesday, October 16th were paid a $2.70 dividend. This represents a $10.80 annualized dividend and a dividend yield of 2.02%. The ex-dividend date of this dividend was Wednesday, October 16th. Watsco's dividend payout ratio (DPR) is presently 83.46%.

Analyst Ratings Changes

A number of research analysts recently commented on the stock. Robert W. Baird dropped their target price on shares of Watsco from $550.00 to $540.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. JPMorgan Chase & Co. raised their price target on Watsco from $420.00 to $425.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 31st.

View Our Latest Stock Analysis on WSO

Watsco Company Profile

(

Free Report)

Watsco, Inc, together with its subsidiaries, engages in the distribution of air conditioning, heating, refrigeration equipment, and related parts and supplies in the United States and internationally. The company distributes equipment, including residential ducted and ductless air conditioners, such as gas, electric, and oil furnaces; commercial air conditioning and heating equipment systems; and other specialized equipment.

Further Reading

Before you consider Watsco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Watsco wasn't on the list.

While Watsco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.