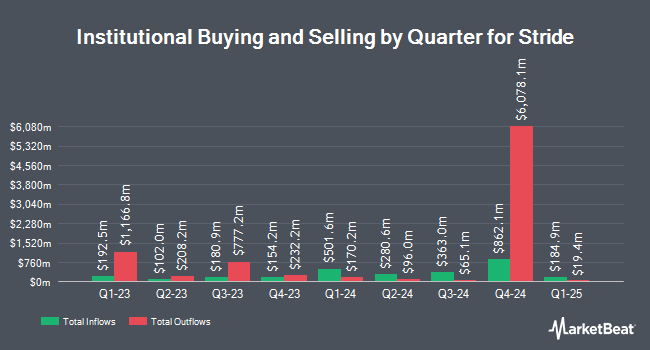

Erste Asset Management GmbH boosted its position in shares of Stride, Inc. (NYSE:LRN - Free Report) by 12.3% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 84,749 shares of the company's stock after purchasing an additional 9,263 shares during the period. Erste Asset Management GmbH owned approximately 0.19% of Stride worth $8,918,000 at the end of the most recent reporting period.

A number of other large investors have also added to or reduced their stakes in the company. Principal Financial Group Inc. lifted its stake in shares of Stride by 293.1% in the fourth quarter. Principal Financial Group Inc. now owns 866,182 shares of the company's stock worth $90,024,000 after acquiring an additional 645,835 shares in the last quarter. Victory Capital Management Inc. increased its holdings in Stride by 72.4% during the 3rd quarter. Victory Capital Management Inc. now owns 827,505 shares of the company's stock worth $70,594,000 after purchasing an additional 347,564 shares during the last quarter. Vaughan Nelson Investment Management L.P. raised its position in shares of Stride by 51.1% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 929,855 shares of the company's stock valued at $79,326,000 after purchasing an additional 314,435 shares in the last quarter. Loomis Sayles & Co. L P purchased a new position in shares of Stride during the 3rd quarter valued at approximately $21,044,000. Finally, Wellington Management Group LLP boosted its stake in shares of Stride by 416.7% during the 3rd quarter. Wellington Management Group LLP now owns 275,483 shares of the company's stock valued at $23,501,000 after buying an additional 222,165 shares during the last quarter. 98.24% of the stock is owned by institutional investors and hedge funds.

Stride Price Performance

Shares of NYSE:LRN opened at $118.16 on Friday. The company has a market cap of $5.15 billion, a PE ratio of 19.73, a P/E/G ratio of 1.04 and a beta of 0.46. Stride, Inc. has a fifty-two week low of $56.17 and a fifty-two week high of $145.00. The firm has a 50-day simple moving average of $126.80 and a 200 day simple moving average of $104.05. The company has a quick ratio of 5.93, a current ratio of 6.02 and a debt-to-equity ratio of 0.35.

Stride (NYSE:LRN - Get Free Report) last issued its earnings results on Tuesday, January 28th. The company reported $2.03 EPS for the quarter, beating analysts' consensus estimates of $1.92 by $0.11. Stride had a return on equity of 22.42% and a net margin of 12.30%. On average, sell-side analysts anticipate that Stride, Inc. will post 6.67 EPS for the current year.

Wall Street Analyst Weigh In

Several analysts recently issued reports on LRN shares. Canaccord Genuity Group upped their price target on shares of Stride from $135.00 to $145.00 and gave the company a "buy" rating in a report on Tuesday. Barrington Research upped their target price on shares of Stride from $130.00 to $140.00 and gave the company an "outperform" rating in a research note on Wednesday, January 29th. Morgan Stanley lifted their price target on Stride from $94.00 to $109.00 and gave the stock an "equal weight" rating in a research note on Thursday, December 12th. Finally, BMO Capital Markets boosted their price objective on Stride from $122.00 to $134.00 and gave the company an "outperform" rating in a report on Thursday, January 30th. Three investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, Stride currently has a consensus rating of "Moderate Buy" and an average price target of $119.33.

View Our Latest Stock Report on LRN

Stride Profile

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.