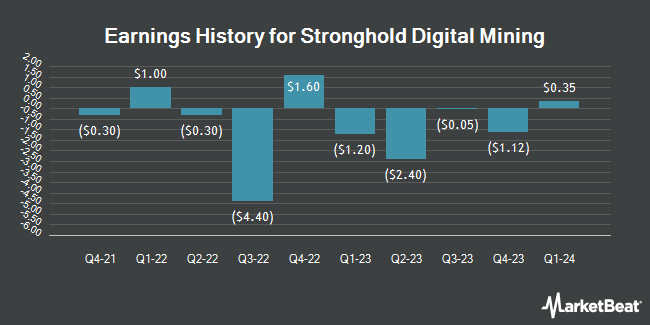

Stronghold Digital Mining (NASDAQ:SDIG - Get Free Report) will post its quarterly earnings results before the market opens on Wednesday, November 13th. Analysts expect Stronghold Digital Mining to post earnings of ($0.62) per share for the quarter. Individual that wish to listen to the company's earnings conference call can do so using this link.

Stronghold Digital Mining (NASDAQ:SDIG - Get Free Report) last issued its quarterly earnings results on Wednesday, August 14th. The company reported ($0.74) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.41) by ($0.33). Stronghold Digital Mining had a negative net margin of 7.61% and a positive return on equity of 40.15%. The firm had revenue of $19.10 million for the quarter, compared to the consensus estimate of $20.15 million. On average, analysts expect Stronghold Digital Mining to post $-2 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Stronghold Digital Mining Stock Performance

SDIG traded up $0.75 on Wednesday, hitting $5.09. 833,458 shares of the stock traded hands, compared to its average volume of 937,335. Stronghold Digital Mining has a 52 week low of $1.65 and a 52 week high of $11.56. The company has a current ratio of 0.34, a quick ratio of 0.24 and a debt-to-equity ratio of 0.92. The firm has a market capitalization of $85.97 million, a PE ratio of -1.10 and a beta of 2.90. The business has a fifty day moving average price of $4.60 and a two-hundred day moving average price of $3.88.

Analyst Ratings Changes

Several equities analysts recently issued reports on the company. B. Riley boosted their price target on Stronghold Digital Mining from $5.00 to $6.00 and gave the company a "neutral" rating in a research note on Monday, August 26th. HC Wainwright restated a "neutral" rating on shares of Stronghold Digital Mining in a research note on Thursday, August 22nd.

View Our Latest Analysis on SDIG

Insider Activity

In other news, CEO Gregory A. Beard sold 44,261 shares of the company's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $4.44, for a total value of $196,518.84. Following the sale, the chief executive officer now directly owns 379,324 shares in the company, valued at approximately $1,684,198.56. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. In other news, CFO Matthew J. Smith sold 9,170 shares of the company's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $4.45, for a total value of $40,806.50. Following the sale, the chief financial officer now directly owns 159,598 shares in the company, valued at approximately $710,211.10. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, CEO Gregory A. Beard sold 44,261 shares of the company's stock in a transaction that occurred on Wednesday, September 18th. The shares were sold at an average price of $4.44, for a total value of $196,518.84. Following the completion of the sale, the chief executive officer now owns 379,324 shares in the company, valued at approximately $1,684,198.56. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 72,585 shares of company stock worth $316,757. Company insiders own 21.14% of the company's stock.

Stronghold Digital Mining Company Profile

(

Get Free Report)

Stronghold Digital Mining, Inc, a crypto asset mining company, focuses on Bitcoin mining in the United States. It operates in two segments, Energy Operations and Cryptocurrency Operations. It also owns and operates coal refuse power generation facilities; and provides environmental remediation and reclamation services.

Read More

Before you consider Stronghold Digital Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stronghold Digital Mining wasn't on the list.

While Stronghold Digital Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.