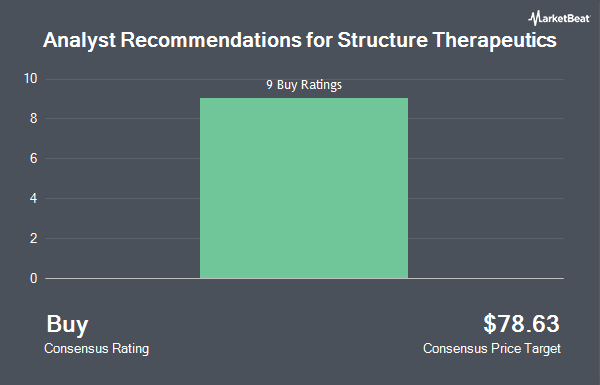

Shares of Structure Therapeutics Inc. (NASDAQ:GPCR - Get Free Report) have been assigned an average recommendation of "Buy" from the eight analysts that are presently covering the company, Marketbeat.com reports. Eight equities research analysts have rated the stock with a buy rating. The average 12 month price objective among brokerages that have issued ratings on the stock in the last year is $81.29.

Several equities research analysts have recently weighed in on the stock. HC Wainwright reiterated a "buy" rating and set a $80.00 target price on shares of Structure Therapeutics in a research note on Thursday, December 19th. William Blair initiated coverage on Structure Therapeutics in a research note on Friday. They issued an "outperform" rating on the stock. Stifel Nicolaus initiated coverage on Structure Therapeutics in a research note on Wednesday, January 8th. They set a "buy" rating and a $50.00 price target for the company. Finally, JMP Securities reiterated a "market outperform" rating and issued a $91.00 price objective on shares of Structure Therapeutics in a research report on Wednesday, December 18th.

Read Our Latest Stock Analysis on GPCR

Structure Therapeutics Trading Down 5.9 %

Structure Therapeutics stock traded down $1.41 during trading on Friday, hitting $22.34. The company had a trading volume of 1,382,446 shares, compared to its average volume of 829,368. Structure Therapeutics has a 1-year low of $19.61 and a 1-year high of $62.74. The company's 50 day simple moving average is $26.58 and its 200-day simple moving average is $33.57. The stock has a market cap of $1.28 billion, a price-to-earnings ratio of -30.19 and a beta of -2.75.

Structure Therapeutics (NASDAQ:GPCR - Get Free Report) last issued its earnings results on Thursday, February 27th. The company reported ($0.22) earnings per share for the quarter, beating the consensus estimate of ($0.23) by $0.01. As a group, analysts forecast that Structure Therapeutics will post -0.82 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Structure Therapeutics

Institutional investors and hedge funds have recently made changes to their positions in the business. Mirae Asset Global Investments Co. Ltd. increased its position in shares of Structure Therapeutics by 60.1% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 3,784 shares of the company's stock worth $158,000 after purchasing an additional 1,420 shares during the last quarter. abrdn plc increased its holdings in Structure Therapeutics by 132.7% in the third quarter. abrdn plc now owns 217,083 shares of the company's stock valued at $9,528,000 after buying an additional 123,789 shares during the last quarter. China Universal Asset Management Co. Ltd. raised its stake in Structure Therapeutics by 99.2% during the third quarter. China Universal Asset Management Co. Ltd. now owns 11,460 shares of the company's stock valued at $503,000 after buying an additional 5,707 shares in the last quarter. Janney Capital Management LLC bought a new position in Structure Therapeutics during the 3rd quarter worth approximately $290,000. Finally, Assetmark Inc. lifted its holdings in Structure Therapeutics by 120.0% during the 3rd quarter. Assetmark Inc. now owns 1,318 shares of the company's stock worth $58,000 after buying an additional 719 shares during the last quarter. 91.78% of the stock is currently owned by hedge funds and other institutional investors.

Structure Therapeutics Company Profile

(

Get Free ReportStructure Therapeutics Inc, a clinical stage global biopharmaceutical company, develops and delivers novel oral therapeutics to treat a range of chronic diseases with unmet medical needs. The company's lead product candidate is GSBR-1290, an oral and biased small molecule agonist of glucagon-like-peptide-1 receptor, a validated G-protein-coupled receptors (GPCRs) drug target for type-2 diabetes mellitus and obesity.

Recommended Stories

Before you consider Structure Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Structure Therapeutics wasn't on the list.

While Structure Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.