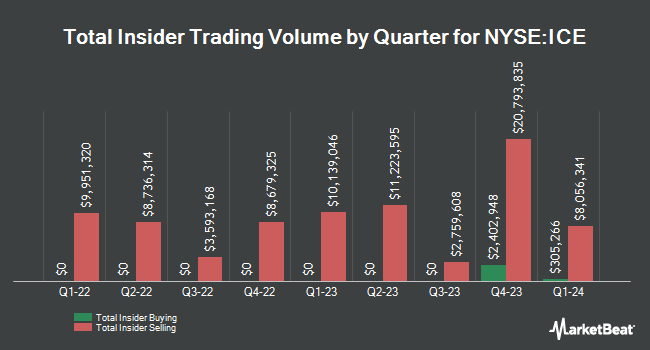

Intercontinental Exchange, Inc. (NYSE:ICE - Get Free Report) COO Stuart Glen Williams sold 750 shares of the firm's stock in a transaction that occurred on Wednesday, December 18th. The shares were sold at an average price of $152.99, for a total transaction of $114,742.50. Following the completion of the sale, the chief operating officer now directly owns 12,780 shares of the company's stock, valued at approximately $1,955,212.20. This represents a 5.54 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website.

Intercontinental Exchange Stock Up 1.4 %

ICE traded up $2.02 during trading on Friday, hitting $150.31. The company had a trading volume of 6,272,922 shares, compared to its average volume of 2,636,590. The company has a market capitalization of $86.30 billion, a PE ratio of 35.62, a PEG ratio of 2.61 and a beta of 1.08. Intercontinental Exchange, Inc. has a one year low of $122.65 and a one year high of $167.99. The firm's 50-day moving average price is $159.12 and its 200 day moving average price is $153.74. The company has a quick ratio of 1.00, a current ratio of 1.00 and a debt-to-equity ratio of 0.68.

Intercontinental Exchange (NYSE:ICE - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The financial services provider reported $1.55 EPS for the quarter, meeting the consensus estimate of $1.55. The business had revenue of $2.35 billion for the quarter, compared to analysts' expectations of $2.35 billion. Intercontinental Exchange had a net margin of 21.31% and a return on equity of 12.75%. The firm's revenue was up 17.3% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.46 EPS. As a group, equities analysts expect that Intercontinental Exchange, Inc. will post 6.07 earnings per share for the current year.

Institutional Investors Weigh In On Intercontinental Exchange

Institutional investors have recently added to or reduced their stakes in the stock. Principal Financial Group Inc. lifted its position in Intercontinental Exchange by 3.7% during the 3rd quarter. Principal Financial Group Inc. now owns 656,874 shares of the financial services provider's stock worth $105,520,000 after buying an additional 23,638 shares in the last quarter. Copley Financial Group Inc. bought a new stake in Intercontinental Exchange during the 3rd quarter worth about $478,000. Oddo BHF Asset Management Sas bought a new stake in Intercontinental Exchange during the 3rd quarter worth about $14,880,000. Inspire Trust Co. N.A. lifted its position in Intercontinental Exchange by 2.4% during the 3rd quarter. Inspire Trust Co. N.A. now owns 12,000 shares of the financial services provider's stock worth $1,928,000 after buying an additional 283 shares in the last quarter. Finally, Franklin Resources Inc. lifted its position in Intercontinental Exchange by 8.0% during the 3rd quarter. Franklin Resources Inc. now owns 5,265,020 shares of the financial services provider's stock worth $865,455,000 after buying an additional 390,332 shares in the last quarter. 89.30% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of analysts have commented on ICE shares. StockNews.com raised shares of Intercontinental Exchange from a "sell" rating to a "hold" rating in a report on Thursday, December 5th. The Goldman Sachs Group lifted their target price on shares of Intercontinental Exchange from $171.00 to $185.00 and gave the stock a "buy" rating in a report on Thursday, October 3rd. TD Cowen started coverage on shares of Intercontinental Exchange in a report on Thursday, September 26th. They set a "buy" rating and a $182.00 target price for the company. Morgan Stanley lifted their target price on shares of Intercontinental Exchange from $160.00 to $174.00 and gave the stock an "equal weight" rating in a report on Thursday, October 17th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and set a $200.00 target price on shares of Intercontinental Exchange in a report on Friday, November 1st. Three investment analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. According to data from MarketBeat, Intercontinental Exchange presently has an average rating of "Moderate Buy" and an average price target of $175.07.

View Our Latest Stock Report on Intercontinental Exchange

About Intercontinental Exchange

(

Get Free Report)

Intercontinental Exchange, Inc, together with its subsidiaries, engages in the provision of market infrastructure, data services, and technology solutions for financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, Singapore, India, Abu Dhabi, Israel, and Canada.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Intercontinental Exchange, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intercontinental Exchange wasn't on the list.

While Intercontinental Exchange currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.