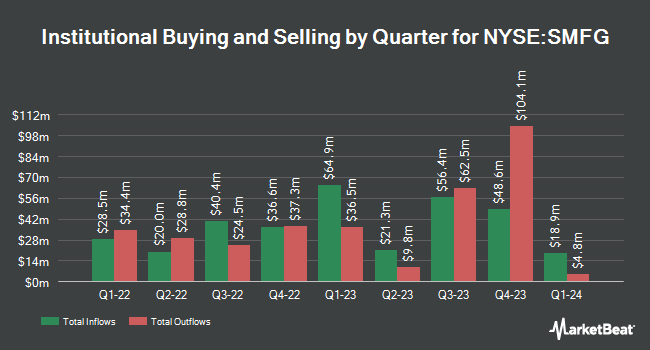

JPMorgan Chase & Co. decreased its holdings in Sumitomo Mitsui Financial Group, Inc. (NYSE:SMFG - Free Report) by 25.9% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,015,206 shares of the bank's stock after selling 354,744 shares during the period. JPMorgan Chase & Co.'s holdings in Sumitomo Mitsui Financial Group were worth $14,710,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors also recently modified their holdings of SMFG. LPL Financial LLC lifted its position in shares of Sumitomo Mitsui Financial Group by 264.9% during the fourth quarter. LPL Financial LLC now owns 324,992 shares of the bank's stock worth $4,709,000 after acquiring an additional 235,934 shares in the last quarter. American Century Companies Inc. grew its holdings in Sumitomo Mitsui Financial Group by 4.9% during the 4th quarter. American Century Companies Inc. now owns 1,515,323 shares of the bank's stock valued at $21,957,000 after buying an additional 70,774 shares in the last quarter. Summit Global Investments purchased a new stake in shares of Sumitomo Mitsui Financial Group in the fourth quarter worth about $560,000. Boston Partners grew its stake in Sumitomo Mitsui Financial Group by 134.4% during the fourth quarter. Boston Partners now owns 348,184 shares of the bank's stock valued at $5,046,000 after acquiring an additional 199,616 shares in the last quarter. Finally, Signaturefd LLC increased its holdings in Sumitomo Mitsui Financial Group by 3.7% during the 4th quarter. Signaturefd LLC now owns 221,164 shares of the bank's stock worth $3,205,000 after acquiring an additional 7,811 shares during the period. Institutional investors own 3.85% of the company's stock.

Sumitomo Mitsui Financial Group Price Performance

SMFG traded down $0.49 on Wednesday, reaching $13.10. The company had a trading volume of 1,120,211 shares, compared to its average volume of 1,299,436. Sumitomo Mitsui Financial Group, Inc. has a 52-week low of $10.74 and a 52-week high of $16.74. The company has a market cap of $84.81 billion, a price-to-earnings ratio of 12.72, a P/E/G ratio of 2.36 and a beta of 0.41. The company has a debt-to-equity ratio of 1.94, a quick ratio of 1.05 and a current ratio of 1.06. The business has a 50 day simple moving average of $14.91 and a 200 day simple moving average of $14.33.

Wall Street Analysts Forecast Growth

Separately, StockNews.com raised shares of Sumitomo Mitsui Financial Group from a "sell" rating to a "hold" rating in a report on Friday, March 21st.

View Our Latest Report on Sumitomo Mitsui Financial Group

Sumitomo Mitsui Financial Group Company Profile

(

Free Report)

Sumitomo Mitsui Financial Group, Inc, together with its subsidiaries, provides banking, leasing, securities, credit card, and consumer finance services in Japan, the Americas, Europe, the Middle East, Asia, and Oceania. It operates through Wholesale Business Unit, Retail Business Unit, Global Business Unit, and Global Markets Business Unit segments.

Featured Articles

Before you consider Sumitomo Mitsui Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sumitomo Mitsui Financial Group wasn't on the list.

While Sumitomo Mitsui Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.