Sumitomo Mitsui Trust Group Inc. grew its holdings in DocuSign, Inc. (NASDAQ:DOCU - Free Report) by 10.4% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 475,113 shares of the company's stock after purchasing an additional 44,615 shares during the period. Sumitomo Mitsui Trust Group Inc. owned approximately 0.23% of DocuSign worth $29,500,000 as of its most recent SEC filing.

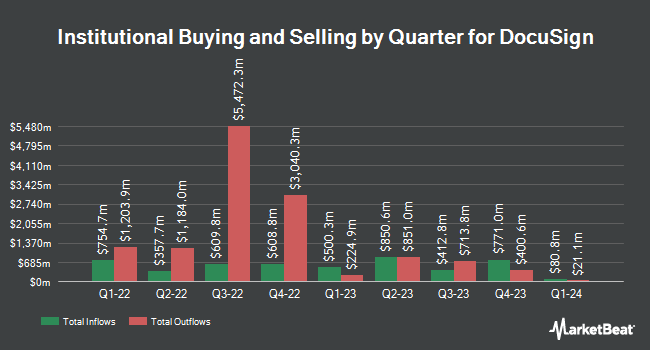

Several other hedge funds and other institutional investors have also modified their holdings of DOCU. Massmutual Trust Co. FSB ADV lifted its position in DocuSign by 5,000.0% in the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 510 shares of the company's stock worth $27,000 after buying an additional 500 shares in the last quarter. Mather Group LLC. raised its holdings in shares of DocuSign by 4,338.5% during the second quarter. Mather Group LLC. now owns 577 shares of the company's stock worth $31,000 after acquiring an additional 564 shares in the last quarter. Reston Wealth Management LLC acquired a new stake in DocuSign during the third quarter valued at $47,000. nVerses Capital LLC acquired a new stake in DocuSign during the second quarter valued at $48,000. Finally, Quarry LP purchased a new position in DocuSign in the second quarter valued at about $53,000. Institutional investors and hedge funds own 77.64% of the company's stock.

DocuSign Trading Down 1.6 %

NASDAQ:DOCU traded down $1.25 during mid-day trading on Friday, hitting $79.11. 2,165,420 shares of the company's stock traded hands, compared to its average volume of 2,406,698. The firm has a market capitalization of $16.06 billion, a price-to-earnings ratio of 16.69, a price-to-earnings-growth ratio of 8.37 and a beta of 0.90. The firm has a 50 day moving average of $67.05 and a two-hundred day moving average of $59.50. DocuSign, Inc. has a 12 month low of $42.12 and a 12 month high of $83.68.

DocuSign (NASDAQ:DOCU - Get Free Report) last announced its quarterly earnings data on Thursday, September 5th. The company reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.80 by $0.17. DocuSign had a net margin of 34.56% and a return on equity of 16.18%. The business had revenue of $736.03 million for the quarter, compared to the consensus estimate of $727.20 million. During the same quarter last year, the company posted $0.09 earnings per share. DocuSign's quarterly revenue was up 7.0% on a year-over-year basis. As a group, equities research analysts expect that DocuSign, Inc. will post 1.01 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have recently weighed in on DOCU. Bank of America raised their price target on DocuSign from $60.00 to $68.00 and gave the stock a "neutral" rating in a research note on Friday, September 6th. JMP Securities reiterated a "market outperform" rating and issued a $84.00 target price on shares of DocuSign in a research note on Thursday, September 5th. Citigroup increased their price target on shares of DocuSign from $86.00 to $87.00 and gave the stock a "buy" rating in a research note on Friday, September 6th. Needham & Company LLC reaffirmed a "hold" rating on shares of DocuSign in a research note on Friday, September 6th. Finally, Robert W. Baird increased their target price on shares of DocuSign from $55.00 to $59.00 and gave the stock a "neutral" rating in a research report on Friday, September 6th. Two equities research analysts have rated the stock with a sell rating, seven have assigned a hold rating and two have assigned a buy rating to the stock. According to MarketBeat.com, DocuSign has a consensus rating of "Hold" and an average target price of $63.40.

Read Our Latest Stock Analysis on DocuSign

Insider Activity at DocuSign

In other DocuSign news, CEO Allan C. Thygesen sold 7,725 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $59.09, for a total value of $456,470.25. Following the sale, the chief executive officer now owns 102,193 shares of the company's stock, valued at $6,038,584.37. The trade was a 7.03 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Teresa Briggs sold 534 shares of the firm's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $56.56, for a total transaction of $30,203.04. Following the transaction, the director now directly owns 7,202 shares of the company's stock, valued at $407,345.12. The trade was a 6.90 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 69,558 shares of company stock worth $4,272,768 over the last three months. Company insiders own 1.66% of the company's stock.

DocuSign Profile

(

Free Report)

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

Read More

Before you consider DocuSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DocuSign wasn't on the list.

While DocuSign currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.