Sumitomo Mitsui Trust Group Inc. boosted its holdings in Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 2.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 400,273 shares of the technology infrastructure company's stock after buying an additional 8,402 shares during the period. Sumitomo Mitsui Trust Group Inc. owned approximately 0.26% of Akamai Technologies worth $40,408,000 as of its most recent filing with the Securities and Exchange Commission.

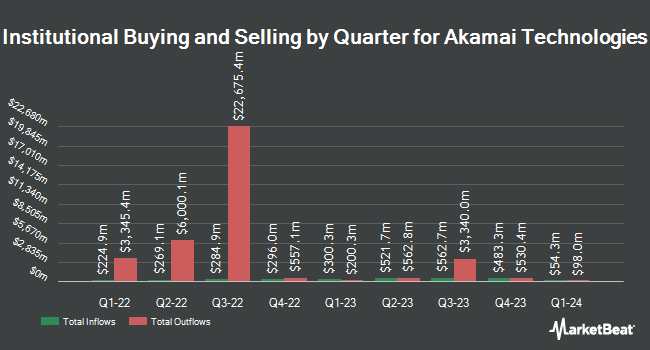

A number of other hedge funds and other institutional investors have also bought and sold shares of AKAM. Janus Henderson Group PLC raised its stake in shares of Akamai Technologies by 19.6% during the 1st quarter. Janus Henderson Group PLC now owns 41,034 shares of the technology infrastructure company's stock valued at $4,462,000 after purchasing an additional 6,724 shares during the period. Principal Financial Group Inc. lifted its holdings in shares of Akamai Technologies by 3.5% in the third quarter. Principal Financial Group Inc. now owns 200,458 shares of the technology infrastructure company's stock worth $20,236,000 after buying an additional 6,785 shares in the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. boosted its position in shares of Akamai Technologies by 17.4% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 185,101 shares of the technology infrastructure company's stock valued at $20,132,000 after acquiring an additional 27,484 shares during the period. EP Wealth Advisors LLC purchased a new position in Akamai Technologies during the first quarter valued at approximately $1,093,000. Finally, Quadrature Capital Ltd bought a new stake in Akamai Technologies during the 1st quarter worth approximately $2,610,000. Institutional investors own 94.28% of the company's stock.

Insider Transactions at Akamai Technologies

In other Akamai Technologies news, EVP Paul C. Joseph sold 4,000 shares of the company's stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $88.63, for a total value of $354,520.00. Following the sale, the executive vice president now owns 26,703 shares in the company, valued at approximately $2,366,686.89. This represents a 13.03 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director William Raymond Wagner sold 1,000 shares of Akamai Technologies stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $100.73, for a total transaction of $100,730.00. Following the transaction, the director now owns 16,719 shares of the company's stock, valued at $1,684,104.87. The trade was a 5.64 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 11,500 shares of company stock valued at $1,065,975. Company insiders own 1.80% of the company's stock.

Akamai Technologies Trading Down 1.0 %

AKAM traded down $0.92 during trading on Friday, hitting $87.43. 2,616,717 shares of the stock traded hands, compared to its average volume of 1,664,409. The firm has a market capitalization of $13.13 billion, a P/E ratio of 25.87, a price-to-earnings-growth ratio of 3.36 and a beta of 0.68. Akamai Technologies, Inc. has a 12-month low of $86.78 and a 12-month high of $129.17. The company has a debt-to-equity ratio of 0.50, a current ratio of 1.33 and a quick ratio of 1.32. The firm has a 50-day moving average of $99.84 and a 200 day moving average of $96.78.

Wall Street Analyst Weigh In

AKAM has been the subject of a number of recent analyst reports. Royal Bank of Canada restated a "sector perform" rating and set a $100.00 price target on shares of Akamai Technologies in a research report on Thursday, August 15th. Craig Hallum upgraded Akamai Technologies from a "hold" rating to a "buy" rating and upped their target price for the stock from $110.00 to $125.00 in a research note on Friday, August 9th. Needham & Company LLC reiterated a "hold" rating on shares of Akamai Technologies in a research report on Friday, August 9th. Robert W. Baird cut their price objective on Akamai Technologies from $120.00 to $115.00 and set an "outperform" rating for the company in a report on Monday, November 11th. Finally, Tigress Financial reaffirmed a "strong-buy" rating and issued a $140.00 target price on shares of Akamai Technologies in a research note on Thursday, August 29th. One research analyst has rated the stock with a sell rating, five have issued a hold rating, twelve have given a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Akamai Technologies presently has a consensus rating of "Moderate Buy" and a consensus price target of $117.47.

View Our Latest Research Report on Akamai Technologies

Akamai Technologies Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Featured Stories

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.