Sumitomo Mitsui Trust Group Inc. grew its position in shares of Essex Property Trust, Inc. (NYSE:ESS - Free Report) by 4.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 237,217 shares of the real estate investment trust's stock after acquiring an additional 9,743 shares during the quarter. Sumitomo Mitsui Trust Group Inc. owned about 0.37% of Essex Property Trust worth $70,079,000 as of its most recent filing with the Securities & Exchange Commission.

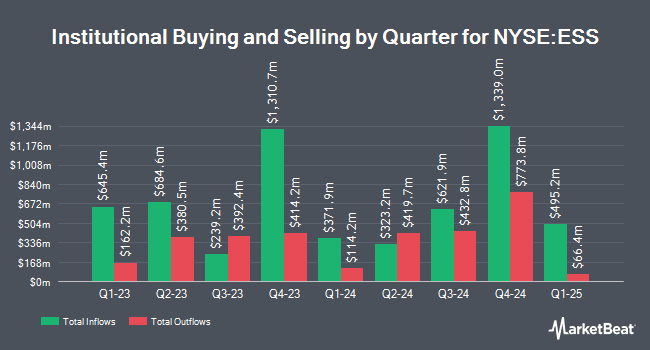

Several other institutional investors have also recently bought and sold shares of ESS. Price T Rowe Associates Inc. MD lifted its position in shares of Essex Property Trust by 8.7% during the first quarter. Price T Rowe Associates Inc. MD now owns 1,832,845 shares of the real estate investment trust's stock valued at $448,701,000 after purchasing an additional 147,130 shares in the last quarter. Massachusetts Financial Services Co. MA boosted its stake in Essex Property Trust by 2.5% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,145,569 shares of the real estate investment trust's stock worth $311,824,000 after purchasing an additional 27,570 shares during the period. Daiwa Securities Group Inc. grew its stake in Essex Property Trust by 0.4% during the second quarter. Daiwa Securities Group Inc. now owns 1,001,769 shares of the real estate investment trust's stock valued at $272,682,000 after acquiring an additional 3,977 shares in the last quarter. Dimensional Fund Advisors LP increased its holdings in shares of Essex Property Trust by 1.4% in the second quarter. Dimensional Fund Advisors LP now owns 941,501 shares of the real estate investment trust's stock worth $256,280,000 after purchasing an additional 12,822 shares during the period. Finally, Boston Partners raised its holdings in shares of Essex Property Trust by 3.3% in the 1st quarter. Boston Partners now owns 744,175 shares of the real estate investment trust's stock valued at $182,185,000 after acquiring an additional 23,673 shares in the last quarter. Institutional investors and hedge funds own 96.51% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have commented on ESS. Stifel Nicolaus increased their price target on shares of Essex Property Trust from $267.00 to $268.00 and gave the company a "hold" rating in a research report on Wednesday, July 31st. The Goldman Sachs Group initiated coverage on Essex Property Trust in a research note on Wednesday, September 4th. They issued a "neutral" rating and a $318.00 target price for the company. Deutsche Bank Aktiengesellschaft boosted their price target on Essex Property Trust from $240.00 to $308.00 and gave the stock a "hold" rating in a research report on Tuesday, September 10th. Bank of America lowered shares of Essex Property Trust from a "buy" rating to a "neutral" rating and raised their price objective for the company from $307.00 to $321.00 in a research note on Tuesday, September 24th. Finally, Royal Bank of Canada increased their price objective on Essex Property Trust from $284.00 to $288.00 and gave the company an "outperform" rating in a research report on Thursday, August 1st. One research analyst has rated the stock with a sell rating, thirteen have issued a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $297.00.

View Our Latest Stock Report on Essex Property Trust

Essex Property Trust Price Performance

ESS stock traded down $0.98 during trading on Friday, reaching $301.76. The company's stock had a trading volume of 316,714 shares, compared to its average volume of 379,049. Essex Property Trust, Inc. has a 1 year low of $209.17 and a 1 year high of $317.73. The company has a quick ratio of 1.14, a current ratio of 1.14 and a debt-to-equity ratio of 1.13. The company has a market capitalization of $19.39 billion, a P/E ratio of 35.21, a price-to-earnings-growth ratio of 6.05 and a beta of 0.88. The company's fifty day moving average is $297.61 and its 200-day moving average is $282.93.

Essex Property Trust (NYSE:ESS - Get Free Report) last issued its earnings results on Tuesday, October 29th. The real estate investment trust reported $1.84 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.88 by ($2.04). Essex Property Trust had a return on equity of 9.72% and a net margin of 31.55%. The firm had revenue of $450.70 million during the quarter, compared to the consensus estimate of $445.88 million. During the same period last year, the firm posted $3.78 earnings per share. On average, research analysts expect that Essex Property Trust, Inc. will post 15.56 earnings per share for the current fiscal year.

Essex Property Trust Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, October 11th. Investors of record on Monday, September 30th were issued a dividend of $2.45 per share. The ex-dividend date was Monday, September 30th. This represents a $9.80 annualized dividend and a yield of 3.25%. Essex Property Trust's payout ratio is presently 114.49%.

Insider Transactions at Essex Property Trust

In other Essex Property Trust news, Director Amal M. Johnson sold 7,298 shares of the firm's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $316.31, for a total transaction of $2,308,430.38. Following the transaction, the director now directly owns 2,585 shares in the company, valued at $817,661.35. This trade represents a 73.84 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CEO Angela L. Kleiman sold 8,080 shares of the company's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $315.10, for a total value of $2,546,008.00. Following the completion of the sale, the chief executive officer now owns 9,494 shares of the company's stock, valued at $2,991,559.40. This represents a 45.98 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 20,402 shares of company stock worth $6,399,663. 3.80% of the stock is currently owned by insiders.

About Essex Property Trust

(

Free Report)

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

See Also

Before you consider Essex Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essex Property Trust wasn't on the list.

While Essex Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report