Sumitomo Mitsui Trust Group Inc. grew its position in shares of Revvity, Inc. (NYSE:RVTY - Free Report) by 3.3% during the third quarter, according to its most recent filing with the SEC. The firm owned 299,723 shares of the company's stock after acquiring an additional 9,473 shares during the period. Sumitomo Mitsui Trust Group Inc. owned about 0.24% of Revvity worth $38,290,000 at the end of the most recent quarter.

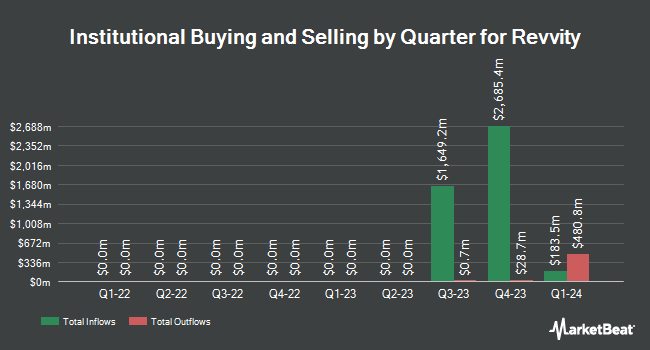

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. UniSuper Management Pty Ltd lifted its position in Revvity by 505.2% during the 1st quarter. UniSuper Management Pty Ltd now owns 9,864 shares of the company's stock valued at $1,036,000 after acquiring an additional 8,234 shares during the period. Jane Street Group LLC boosted its position in shares of Revvity by 516.4% in the 1st quarter. Jane Street Group LLC now owns 453,343 shares of the company's stock worth $47,601,000 after purchasing an additional 379,802 shares in the last quarter. Quadrature Capital Ltd purchased a new stake in shares of Revvity in the 1st quarter worth approximately $1,267,000. Assenagon Asset Management S.A. raised its stake in Revvity by 3,171.3% during the second quarter. Assenagon Asset Management S.A. now owns 87,180 shares of the company's stock valued at $9,142,000 after buying an additional 84,515 shares during the last quarter. Finally, DekaBank Deutsche Girozentrale boosted its holdings in Revvity by 27.8% in the first quarter. DekaBank Deutsche Girozentrale now owns 84,383 shares of the company's stock worth $8,790,000 after acquiring an additional 18,367 shares in the last quarter. Hedge funds and other institutional investors own 86.65% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on RVTY shares. Jefferies Financial Group lifted their price target on Revvity from $115.00 to $125.00 and gave the stock a "hold" rating in a research report on Monday, July 29th. Leerink Partners upped their target price on shares of Revvity from $130.00 to $135.00 and gave the stock an "outperform" rating in a research note on Thursday, October 17th. Citigroup raised their price target on shares of Revvity from $135.00 to $145.00 and gave the company a "buy" rating in a research report on Tuesday, July 30th. Sanford C. Bernstein lowered their price objective on Revvity from $150.00 to $145.00 and set an "outperform" rating on the stock in a research report on Tuesday, November 5th. Finally, Wells Fargo & Company began coverage on Revvity in a report on Tuesday, August 27th. They issued an "equal weight" rating and a $130.00 target price for the company. Seven investment analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $132.07.

Check Out Our Latest Report on RVTY

Revvity Stock Performance

Shares of RVTY traded down $6.53 on Friday, reaching $109.52. The company's stock had a trading volume of 1,817,426 shares, compared to its average volume of 961,648. The stock's 50 day simple moving average is $121.52 and its two-hundred day simple moving average is $115.35. The company has a debt-to-equity ratio of 0.40, a current ratio of 3.56 and a quick ratio of 2.97. The stock has a market capitalization of $13.33 billion, a P/E ratio of 52.91, a PEG ratio of 2.73 and a beta of 1.05. Revvity, Inc. has a 12-month low of $86.30 and a 12-month high of $129.50.

Revvity (NYSE:RVTY - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The company reported $1.28 earnings per share for the quarter, topping the consensus estimate of $1.13 by $0.15. The business had revenue of $684.10 million for the quarter, compared to analysts' expectations of $679.66 million. Revvity had a net margin of 9.34% and a return on equity of 7.42%. The company's revenue was up 2.1% compared to the same quarter last year. During the same quarter last year, the company posted $1.18 EPS. Research analysts forecast that Revvity, Inc. will post 4.85 earnings per share for the current fiscal year.

Revvity Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, February 7th. Investors of record on Friday, January 17th will be paid a dividend of $0.07 per share. The ex-dividend date is Friday, January 17th. This represents a $0.28 dividend on an annualized basis and a dividend yield of 0.26%. Revvity's dividend payout ratio (DPR) is presently 13.53%.

Revvity announced that its Board of Directors has initiated a share repurchase plan on Monday, November 4th that authorizes the company to buyback $1.00 billion in shares. This buyback authorization authorizes the company to repurchase up to 6.5% of its shares through open market purchases. Shares buyback plans are generally an indication that the company's board of directors believes its stock is undervalued.

Insiders Place Their Bets

In other news, insider Tajinder S. Vohra sold 2,154 shares of the company's stock in a transaction dated Wednesday, October 9th. The stock was sold at an average price of $121.73, for a total value of $262,206.42. Following the completion of the transaction, the insider now owns 19,652 shares of the company's stock, valued at $2,392,237.96. This represents a 9.88 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. 0.60% of the stock is owned by company insiders.

About Revvity

(

Free Report)

Revvity, Inc provides health sciences solutions, technologies, and services in the Americas, Europe, and Asia, and internationally. The Life Sciences segment provides instruments, reagents, informatics, software, subscriptions, detection, imaging technologies, warranties, training, and services. Its Diagnostics segment provides instruments, reagents, assay platforms, and software products for the early detection of genetic disorders, such as pregnancy and early childhood, as well as infectious disease testing in the diagnostics market.

See Also

Before you consider Revvity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revvity wasn't on the list.

While Revvity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report