Sumitomo Mitsui Trust Group Inc. purchased a new position in shares of PagSeguro Digital Ltd. (NYSE:PAGS - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund purchased 377,030 shares of the company's stock, valued at approximately $3,246,000. Sumitomo Mitsui Trust Group Inc. owned about 0.11% of PagSeguro Digital as of its most recent SEC filing.

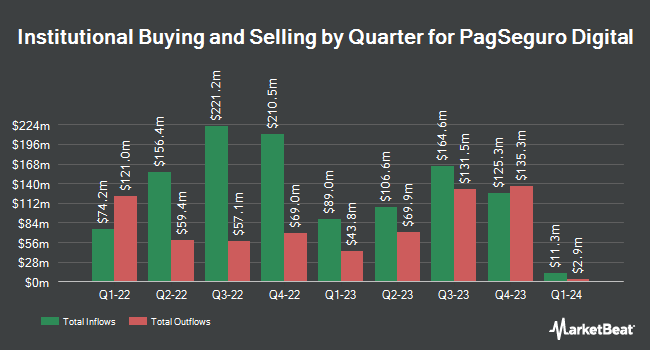

A number of other institutional investors and hedge funds also recently made changes to their positions in the stock. Marshall Wace LLP raised its stake in PagSeguro Digital by 55.5% in the 2nd quarter. Marshall Wace LLP now owns 6,994,870 shares of the company's stock valued at $81,770,000 after acquiring an additional 2,497,968 shares during the period. Millennium Management LLC lifted its stake in shares of PagSeguro Digital by 115.1% during the 2nd quarter. Millennium Management LLC now owns 3,813,901 shares of the company's stock worth $44,585,000 after buying an additional 2,040,704 shares during the last quarter. Robeco Institutional Asset Management B.V. boosted its holdings in shares of PagSeguro Digital by 26.4% during the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 5,478,310 shares of the company's stock worth $47,168,000 after buying an additional 1,144,590 shares during the period. American Century Companies Inc. grew its stake in PagSeguro Digital by 251.4% in the 2nd quarter. American Century Companies Inc. now owns 1,320,420 shares of the company's stock valued at $15,436,000 after buying an additional 944,660 shares during the last quarter. Finally, Acadian Asset Management LLC raised its holdings in PagSeguro Digital by 35.7% in the 2nd quarter. Acadian Asset Management LLC now owns 2,454,259 shares of the company's stock valued at $28,670,000 after acquiring an additional 645,562 shares during the period. Institutional investors own 45.88% of the company's stock.

Analysts Set New Price Targets

PAGS has been the topic of several research reports. KeyCorp raised PagSeguro Digital to a "hold" rating in a research report on Friday. Morgan Stanley reissued an "underweight" rating and set a $6.50 target price (down previously from $14.00) on shares of PagSeguro Digital in a report on Thursday, September 5th. Barclays decreased their price target on shares of PagSeguro Digital from $16.00 to $13.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 15th. Susquehanna cut their price objective on shares of PagSeguro Digital from $19.00 to $16.00 and set a "positive" rating for the company in a report on Monday. Finally, The Goldman Sachs Group dropped their price target on shares of PagSeguro Digital from $14.00 to $12.00 and set a "buy" rating for the company in a research report on Friday. One research analyst has rated the stock with a sell rating, three have issued a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $14.36.

Get Our Latest Report on PAGS

PagSeguro Digital Stock Down 0.4 %

Shares of PAGS stock traded down $0.03 on Tuesday, reaching $7.56. The company had a trading volume of 4,975,533 shares, compared to its average volume of 3,977,630. The business's 50-day moving average is $8.47 and its 200 day moving average is $10.88. PagSeguro Digital Ltd. has a one year low of $7.35 and a one year high of $14.98. The stock has a market capitalization of $2.49 billion, a PE ratio of 6.27, a price-to-earnings-growth ratio of 0.39 and a beta of 1.95.

PagSeguro Digital (NYSE:PAGS - Get Free Report) last announced its quarterly earnings results on Tuesday, August 20th. The company reported $0.32 EPS for the quarter, beating analysts' consensus estimates of $0.31 by $0.01. The firm had revenue of $874.38 million for the quarter, compared to analyst estimates of $816.34 million. PagSeguro Digital had a return on equity of 15.49% and a net margin of 11.12%. During the same period last year, the firm posted $0.26 earnings per share. On average, sell-side analysts forecast that PagSeguro Digital Ltd. will post 1.19 earnings per share for the current fiscal year.

PagSeguro Digital Profile

(

Free Report)

PagSeguro Digital Ltd., together with its subsidiaries, provides financial technology solutions and services for consumers, individual entrepreneurs, micro-merchants, and small and medium-sized companies in Brazil and internationally. The company's products and services include PagSeguro Ecosystem, a digital ecosystem that operates as a closed loop where its clients are able to address their primary day to day financial needs, including receiving and spending funds, and managing and growing their businesses; PagBank digital account, which offers payment and banking services through the PagBank mobile app, as well as centralizes various cash-in options, functionalities, services, and cash-out options in a single ecosystem; and PlugPag, a tool for medium-sized and larger merchants that enables them to connect their point of sale (POS) device directly to their enterprise resource planning software or sales automation system through Bluetooth.

Recommended Stories

Before you consider PagSeguro Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PagSeguro Digital wasn't on the list.

While PagSeguro Digital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.