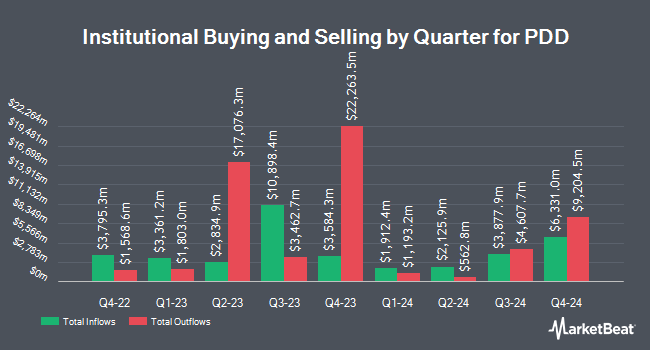

Sumitomo Mitsui Trust Group Inc. boosted its stake in PDD Holdings Inc. (NASDAQ:PDD - Free Report) by 16.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,680,380 shares of the company's stock after acquiring an additional 232,181 shares during the period. Sumitomo Mitsui Trust Group Inc. owned 0.12% of PDD worth $226,532,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Venturi Wealth Management LLC acquired a new position in shares of PDD in the 3rd quarter valued at about $29,000. Ashton Thomas Private Wealth LLC bought a new stake in PDD in the second quarter worth approximately $32,000. Richardson Financial Services Inc. lifted its stake in PDD by 3,883.3% in the second quarter. Richardson Financial Services Inc. now owns 239 shares of the company's stock valued at $32,000 after buying an additional 233 shares during the period. Future Financial Wealth Managment LLC bought a new position in shares of PDD during the 3rd quarter worth approximately $34,000. Finally, Strategic Financial Concepts LLC acquired a new stake in shares of PDD during the 2nd quarter worth approximately $40,000. Institutional investors and hedge funds own 29.07% of the company's stock.

Analysts Set New Price Targets

A number of research firms recently issued reports on PDD. Jefferies Financial Group dropped their target price on shares of PDD from $193.00 to $151.00 and set a "buy" rating on the stock in a research report on Monday, August 26th. Macquarie upgraded shares of PDD from a "neutral" rating to an "outperform" rating and upped their price objective for the company from $126.00 to $224.00 in a report on Monday, October 7th. Nomura Securities upgraded PDD to a "strong-buy" rating in a research note on Tuesday, August 27th. Benchmark dropped their price target on PDD from $230.00 to $185.00 and set a "buy" rating on the stock in a research note on Tuesday, August 27th. Finally, Daiwa America raised PDD to a "strong-buy" rating in a research note on Tuesday, August 27th. One research analyst has rated the stock with a hold rating, nine have assigned a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Buy" and a consensus price target of $182.40.

Get Our Latest Stock Analysis on PDD

PDD Stock Down 0.3 %

Shares of NASDAQ:PDD traded down $0.39 during mid-day trading on Wednesday, hitting $113.41. 4,582,762 shares of the company traded hands, compared to its average volume of 10,595,636. The stock has a 50-day moving average price of $120.37 and a two-hundred day moving average price of $130.87. PDD Holdings Inc. has a 12-month low of $88.01 and a 12-month high of $164.69. The stock has a market cap of $156.04 billion, a P/E ratio of 12.22, a P/E/G ratio of 0.27 and a beta of 0.71. The company has a current ratio of 2.11, a quick ratio of 2.11 and a debt-to-equity ratio of 0.02.

PDD (NASDAQ:PDD - Get Free Report) last posted its quarterly earnings data on Monday, August 26th. The company reported $23.24 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.66 by $20.58. The firm had revenue of $97.06 billion for the quarter, compared to the consensus estimate of $100.17 billion. PDD had a net margin of 28.92% and a return on equity of 48.14%. The business's revenue for the quarter was up 85.7% compared to the same quarter last year. During the same period in the previous year, the firm earned $1.27 EPS. On average, equities research analysts forecast that PDD Holdings Inc. will post 11.19 earnings per share for the current year.

About PDD

(

Free Report)

PDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

See Also

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.