Sumitomo Mitsui Trust Group Inc. increased its position in shares of The Williams Companies, Inc. (NYSE:WMB - Free Report) by 1.4% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 2,873,473 shares of the pipeline company's stock after acquiring an additional 38,594 shares during the period. Sumitomo Mitsui Trust Group Inc. owned approximately 0.24% of Williams Companies worth $131,174,000 as of its most recent filing with the Securities and Exchange Commission.

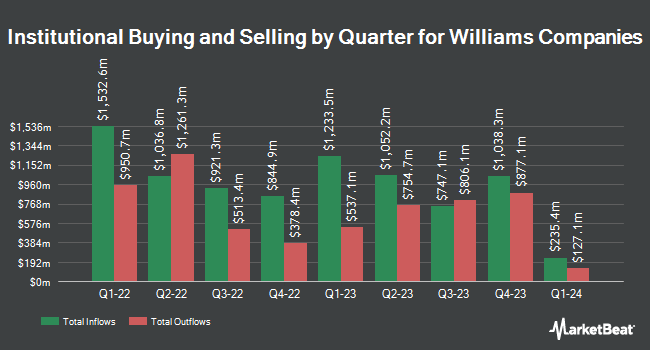

Other large investors have also recently bought and sold shares of the company. Blackstone Inc. raised its position in Williams Companies by 109.1% during the first quarter. Blackstone Inc. now owns 6,466,660 shares of the pipeline company's stock valued at $252,006,000 after purchasing an additional 3,373,800 shares in the last quarter. Castle Hook Partners LP purchased a new stake in Williams Companies in the first quarter worth approximately $57,220,000. Clearbridge Investments LLC grew its position in Williams Companies by 5.9% during the first quarter. Clearbridge Investments LLC now owns 20,983,727 shares of the pipeline company's stock valued at $817,736,000 after acquiring an additional 1,175,628 shares during the last quarter. American Century Companies Inc. raised its stake in shares of Williams Companies by 20.1% during the second quarter. American Century Companies Inc. now owns 6,117,298 shares of the pipeline company's stock worth $259,985,000 after acquiring an additional 1,024,158 shares in the last quarter. Finally, BROOKFIELD Corp ON lifted its holdings in shares of Williams Companies by 11.8% in the 1st quarter. BROOKFIELD Corp ON now owns 5,896,375 shares of the pipeline company's stock worth $229,782,000 after acquiring an additional 623,820 shares during the last quarter. 86.44% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of equities analysts recently commented on WMB shares. Scotiabank lifted their target price on shares of Williams Companies from $43.00 to $48.00 and gave the stock a "sector perform" rating in a research report on Thursday, August 8th. Barclays lifted their price target on Williams Companies from $42.00 to $46.00 and gave the stock an "equal weight" rating in a research note on Wednesday, October 2nd. StockNews.com cut shares of Williams Companies from a "buy" rating to a "hold" rating in a report on Tuesday, August 6th. CIBC upped their price target on shares of Williams Companies from $45.00 to $54.00 and gave the company a "neutral" rating in a report on Tuesday, October 22nd. Finally, Mizuho raised their price target on shares of Williams Companies from $47.00 to $56.00 and gave the stock an "outperform" rating in a report on Monday, November 4th. One analyst has rated the stock with a sell rating, seven have issued a hold rating and nine have issued a buy rating to the stock. According to MarketBeat.com, Williams Companies presently has a consensus rating of "Hold" and a consensus target price of $50.38.

Get Our Latest Research Report on Williams Companies

Insider Buying and Selling

In related news, SVP Terrance Lane Wilson sold 2,000 shares of the stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $45.29, for a total value of $90,580.00. Following the transaction, the senior vice president now owns 304,200 shares in the company, valued at approximately $13,777,218. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In related news, SVP Terrance Lane Wilson sold 2,000 shares of the firm's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $45.29, for a total transaction of $90,580.00. Following the sale, the senior vice president now owns 304,200 shares in the company, valued at approximately $13,777,218. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CAO Mary A. Hausman sold 7,951 shares of the company's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $56.30, for a total transaction of $447,641.30. Following the completion of the transaction, the chief accounting officer now owns 25,858 shares of the company's stock, valued at approximately $1,455,805.40. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.44% of the stock is currently owned by company insiders.

Williams Companies Trading Down 0.0 %

NYSE:WMB traded down $0.02 during midday trading on Thursday, hitting $55.58. The stock had a trading volume of 2,536,145 shares, compared to its average volume of 6,231,066. The Williams Companies, Inc. has a one year low of $32.65 and a one year high of $57.33. The company has a market capitalization of $67.75 billion, a price-to-earnings ratio of 23.59, a PEG ratio of 5.56 and a beta of 1.03. The stock has a 50-day moving average of $49.48 and a 200 day moving average of $44.74. The company has a quick ratio of 0.51, a current ratio of 0.57 and a debt-to-equity ratio of 1.67.

Williams Companies (NYSE:WMB - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The pipeline company reported $0.43 earnings per share for the quarter, topping the consensus estimate of $0.42 by $0.01. Williams Companies had a net margin of 27.36% and a return on equity of 15.89%. The firm had revenue of $2.65 billion during the quarter, compared to analysts' expectations of $2.52 billion. During the same quarter in the prior year, the company earned $0.45 EPS. The company's revenue was up 3.7% compared to the same quarter last year. As a group, sell-side analysts forecast that The Williams Companies, Inc. will post 2.01 EPS for the current year.

Williams Companies Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 30th. Investors of record on Friday, December 13th will be given a $0.475 dividend. This represents a $1.90 annualized dividend and a dividend yield of 3.42%. The ex-dividend date is Friday, December 13th. Williams Companies's payout ratio is currently 80.17%.

About Williams Companies

(

Free Report)

The Williams Companies, Inc, together with its subsidiaries, operates as an energy infrastructure company primarily in the United States. It operates through Transmission & Gulf of Mexico, Northeast G&P, West, and Gas & NGL Marketing Services segments. The Transmission & Gulf of Mexico segment comprises natural gas pipelines; Transco, Northwest pipeline, MountainWest, and related natural gas storage facilities; and natural gas gathering and processing, and crude oil production handling and transportation assets in the Gulf Coast region.

Read More

Before you consider Williams Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Williams Companies wasn't on the list.

While Williams Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report