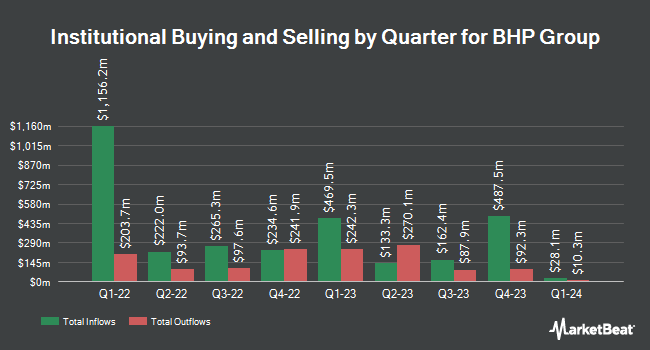

Sumitomo Mitsui Trust Group Inc. lessened its stake in shares of BHP Group Limited (NYSE:BHP - Free Report) by 13.0% during the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 88,734 shares of the mining company's stock after selling 13,272 shares during the period. Sumitomo Mitsui Trust Group Inc.'s holdings in BHP Group were worth $4,333,000 as of its most recent filing with the SEC.

Other institutional investors and hedge funds have also bought and sold shares of the company. Eastern Bank bought a new stake in BHP Group during the third quarter worth about $26,000. Versant Capital Management Inc bought a new stake in BHP Group in the fourth quarter valued at approximately $40,000. Union Bancaire Privee UBP SA bought a new stake in BHP Group in the fourth quarter valued at approximately $46,000. Farmers & Merchants Investments Inc. bought a new stake in BHP Group in the third quarter valued at approximately $50,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank raised its stake in BHP Group by 42.9% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,169 shares of the mining company's stock valued at $73,000 after buying an additional 351 shares during the period. Institutional investors own 3.79% of the company's stock.

Analysts Set New Price Targets

Several research firms have issued reports on BHP. Jefferies Financial Group dropped their price objective on BHP Group from $57.00 to $53.00 and set a "hold" rating on the stock in a research note on Monday, January 6th. StockNews.com lowered BHP Group from a "strong-buy" rating to a "buy" rating in a research note on Friday, January 31st. Three equities research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, BHP Group presently has an average rating of "Moderate Buy" and a consensus target price of $53.00.

Check Out Our Latest Analysis on BHP

BHP Group Stock Down 0.5 %

Shares of NYSE BHP traded down $0.26 during trading hours on Monday, reaching $51.57. 2,832,252 shares of the stock were exchanged, compared to its average volume of 2,318,036. The company has a debt-to-equity ratio of 0.38, a current ratio of 1.70 and a quick ratio of 1.29. BHP Group Limited has a 52 week low of $48.06 and a 52 week high of $63.21. The stock's fifty day simple moving average is $49.94 and its 200 day simple moving average is $53.21.

BHP Group Company Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

Further Reading

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.