Summit Global Investments lifted its stake in Motorola Solutions, Inc. (NYSE:MSI - Free Report) by 115.5% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 22,715 shares of the communications equipment provider's stock after acquiring an additional 12,173 shares during the period. Summit Global Investments' holdings in Motorola Solutions were worth $10,213,000 at the end of the most recent reporting period.

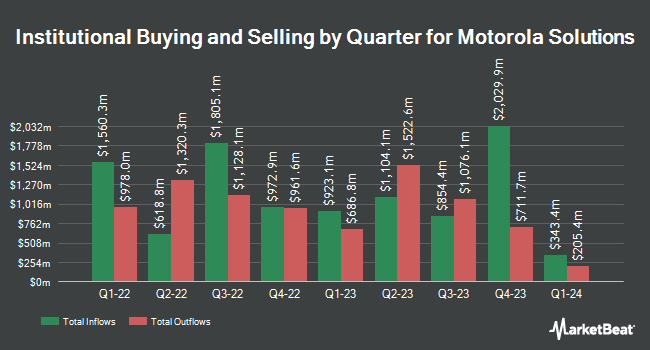

Several other hedge funds also recently made changes to their positions in the stock. Consolidated Planning Corp grew its holdings in Motorola Solutions by 10.9% during the 3rd quarter. Consolidated Planning Corp now owns 20,974 shares of the communications equipment provider's stock valued at $9,431,000 after buying an additional 2,057 shares in the last quarter. Washington Trust Bank grew its stake in Motorola Solutions by 9.9% during the third quarter. Washington Trust Bank now owns 712 shares of the communications equipment provider's stock valued at $320,000 after acquiring an additional 64 shares in the last quarter. Principal Financial Group Inc. lifted its stake in Motorola Solutions by 4.8% in the 3rd quarter. Principal Financial Group Inc. now owns 219,717 shares of the communications equipment provider's stock worth $98,791,000 after purchasing an additional 10,096 shares in the last quarter. Advisor Resource Council bought a new position in Motorola Solutions in the 3rd quarter valued at $207,000. Finally, Graypoint LLC grew its position in shares of Motorola Solutions by 13.5% during the 3rd quarter. Graypoint LLC now owns 1,048 shares of the communications equipment provider's stock valued at $471,000 after purchasing an additional 125 shares in the last quarter. 84.17% of the stock is currently owned by hedge funds and other institutional investors.

Motorola Solutions Trading Up 6.7 %

Shares of NYSE:MSI traded up $31.41 on Friday, reaching $501.36. 623,612 shares of the company traded hands, compared to its average volume of 666,263. Motorola Solutions, Inc. has a 52 week low of $305.73 and a 52 week high of $503.05. The company has a current ratio of 1.20, a quick ratio of 1.03 and a debt-to-equity ratio of 7.03. The business's 50-day simple moving average is $452.76 and its 200 day simple moving average is $407.52. The stock has a market capitalization of $83.65 billion, a P/E ratio of 54.89, a price-to-earnings-growth ratio of 3.86 and a beta of 0.97.

Motorola Solutions (NYSE:MSI - Get Free Report) last issued its earnings results on Thursday, November 7th. The communications equipment provider reported $3.46 EPS for the quarter, topping the consensus estimate of $3.10 by $0.36. The company had revenue of $2.79 billion for the quarter, compared to the consensus estimate of $2.76 billion. Motorola Solutions had a net margin of 14.04% and a return on equity of 337.36%. As a group, equities analysts anticipate that Motorola Solutions, Inc. will post 12.22 EPS for the current fiscal year.

Motorola Solutions Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Shareholders of record on Friday, September 13th were issued a $0.98 dividend. The ex-dividend date was Friday, September 13th. This represents a $3.92 annualized dividend and a yield of 0.78%. Motorola Solutions's dividend payout ratio (DPR) is presently 42.94%.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on MSI. Raymond James increased their price objective on Motorola Solutions from $425.00 to $515.00 and gave the stock an "outperform" rating in a research report on Friday. Evercore ISI raised their price target on Motorola Solutions from $450.00 to $500.00 and gave the company an "outperform" rating in a report on Friday, August 30th. JPMorgan Chase & Co. boosted their price objective on Motorola Solutions from $436.00 to $440.00 and gave the stock an "overweight" rating in a report on Friday, August 2nd. Barclays raised their target price on shares of Motorola Solutions from $467.00 to $529.00 and gave the company an "overweight" rating in a research note on Friday. Finally, Deutsche Bank Aktiengesellschaft raised their price target on Motorola Solutions from $385.00 to $440.00 and gave the company a "buy" rating in a research report on Tuesday, August 6th. Nine analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, Motorola Solutions presently has a consensus rating of "Buy" and a consensus price target of $493.43.

Get Our Latest Report on MSI

Motorola Solutions Company Profile

(

Free Report)

Motorola Solutions, Inc provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally. The company operates in two segments, Products and Systems Integration, and Software and Services. The Products and Systems Integration segment offers a portfolio of infrastructure, devices, accessories, and video security devices and infrastructure, as well as the implementation and integration of systems, devices, software, and applications for government, public safety, and commercial customers who operate private communications networks and video security solutions, as well as manage a mobile workforce.

Further Reading

Before you consider Motorola Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Motorola Solutions wasn't on the list.

While Motorola Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.