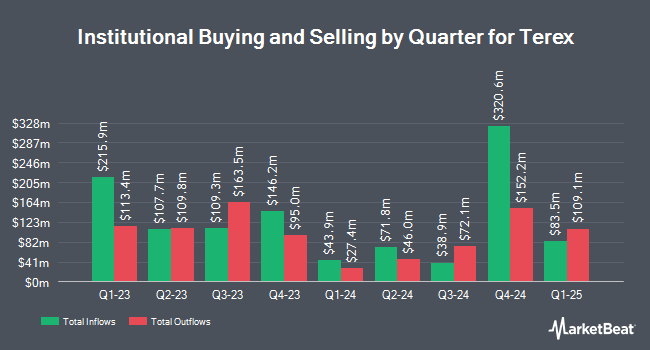

Summit Global Investments raised its position in shares of Terex Co. (NYSE:TEX - Free Report) by 302.4% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 22,141 shares of the industrial products company's stock after buying an additional 16,639 shares during the quarter. Summit Global Investments' holdings in Terex were worth $1,171,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also added to or reduced their stakes in TEX. Greenwich Wealth Management LLC raised its position in Terex by 0.3% in the 3rd quarter. Greenwich Wealth Management LLC now owns 62,371 shares of the industrial products company's stock worth $3,300,000 after buying an additional 181 shares during the last quarter. Dorsey Wright & Associates increased its position in shares of Terex by 0.3% during the 2nd quarter. Dorsey Wright & Associates now owns 61,309 shares of the industrial products company's stock valued at $3,362,000 after purchasing an additional 186 shares during the last quarter. Blue Trust Inc. increased its position in shares of Terex by 57.5% during the 2nd quarter. Blue Trust Inc. now owns 512 shares of the industrial products company's stock valued at $28,000 after purchasing an additional 187 shares during the last quarter. FCG Investment Co increased its position in shares of Terex by 3.5% during the 2nd quarter. FCG Investment Co now owns 6,534 shares of the industrial products company's stock valued at $358,000 after purchasing an additional 220 shares during the last quarter. Finally, US Bancorp DE increased its position in shares of Terex by 4.0% during the 3rd quarter. US Bancorp DE now owns 5,837 shares of the industrial products company's stock valued at $309,000 after purchasing an additional 227 shares during the last quarter. Hedge funds and other institutional investors own 92.88% of the company's stock.

Terex Trading Down 0.8 %

TEX traded down $0.44 during trading on Friday, reaching $55.73. The company had a trading volume of 939,972 shares, compared to its average volume of 825,084. The stock has a market cap of $3.72 billion, a P/E ratio of 8.14, a PEG ratio of 4.73 and a beta of 1.53. The business has a 50 day simple moving average of $53.18 and a 200-day simple moving average of $55.89. Terex Co. has a 52 week low of $47.30 and a 52 week high of $68.08. The company has a quick ratio of 1.16, a current ratio of 2.39 and a debt-to-equity ratio of 0.32.

Terex (NYSE:TEX - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The industrial products company reported $1.46 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.31 by $0.15. Terex had a return on equity of 24.92% and a net margin of 9.08%. The company had revenue of $1.21 billion during the quarter, compared to the consensus estimate of $1.16 billion. During the same period last year, the company earned $1.75 earnings per share. Terex's revenue was down 6.0% on a year-over-year basis. On average, equities analysts anticipate that Terex Co. will post 6.07 EPS for the current fiscal year.

Terex Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Friday, November 8th will be paid a $0.17 dividend. The ex-dividend date of this dividend is Friday, November 8th. This represents a $0.68 dividend on an annualized basis and a yield of 1.22%. Terex's payout ratio is 9.93%.

Analyst Ratings Changes

TEX has been the subject of several research reports. Evercore ISI reduced their price target on shares of Terex from $67.00 to $59.00 and set an "outperform" rating for the company in a research report on Monday, August 19th. Truist Financial increased their target price on shares of Terex from $62.00 to $65.00 and gave the stock a "buy" rating in a report on Monday, November 4th. The Goldman Sachs Group reduced their target price on shares of Terex from $72.00 to $62.00 and set a "neutral" rating for the company in a report on Friday, September 20th. Citigroup reduced their target price on shares of Terex from $60.00 to $57.00 and set a "neutral" rating for the company in a report on Monday, September 23rd. Finally, Robert W. Baird reduced their target price on shares of Terex from $65.00 to $55.00 and set a "neutral" rating for the company in a report on Thursday, October 31st. One research analyst has rated the stock with a sell rating, seven have given a hold rating and two have assigned a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $59.56.

Read Our Latest Stock Report on Terex

About Terex

(

Free Report)

Terex Corporation manufactures and sells aerial work platforms and materials processing machinery worldwide. It operates in two segments, Materials Processing (MP) and Aerial Work Platforms (AWP). The MP segment designs, manufactures, services, and markets materials processing and specialty equipment, includes crushers, washing systems, screens, trommels, apron feeders, material handlers, pick and carry cranes, rough terrain cranes, tower cranes, wood processing, biomass and recycling equipment, concrete mixer trucks and concrete pavers, conveyors, and related components and replacement parts under the Terex, Powerscreen, Fuchs, EvoQuip, Canica, Cedarapids, CBI, Simplicity, Franna, Terex Ecotec, Finlay, ProAll, ZenRobotics, Terex Washing Systems, Terex MPS, Terex Jaques, Terex Advance, ProStack, Terex Bid-Well, MDS, and Terex Recycling Systems brands.

Further Reading

Before you consider Terex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terex wasn't on the list.

While Terex currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.