Summit Global Investments increased its stake in Ross Stores, Inc. (NASDAQ:ROST - Free Report) by 62.8% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 17,202 shares of the apparel retailer's stock after acquiring an additional 6,633 shares during the period. Summit Global Investments' holdings in Ross Stores were worth $2,589,000 as of its most recent SEC filing.

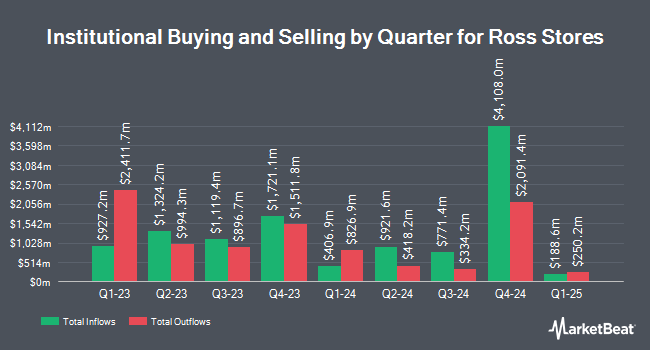

Several other hedge funds have also modified their holdings of ROST. Vanguard Group Inc. lifted its holdings in Ross Stores by 1.2% in the 1st quarter. Vanguard Group Inc. now owns 28,916,192 shares of the apparel retailer's stock worth $4,243,740,000 after buying an additional 346,474 shares in the last quarter. Victory Capital Management Inc. increased its holdings in Ross Stores by 11.7% during the 2nd quarter. Victory Capital Management Inc. now owns 3,310,364 shares of the apparel retailer's stock worth $481,062,000 after purchasing an additional 347,006 shares during the last quarter. Legal & General Group Plc raised its position in shares of Ross Stores by 10.3% in the 2nd quarter. Legal & General Group Plc now owns 2,737,042 shares of the apparel retailer's stock valued at $397,747,000 after purchasing an additional 254,720 shares in the last quarter. Dimensional Fund Advisors LP grew its position in shares of Ross Stores by 15.5% during the second quarter. Dimensional Fund Advisors LP now owns 2,477,142 shares of the apparel retailer's stock worth $359,991,000 after buying an additional 331,996 shares in the last quarter. Finally, Los Angeles Capital Management LLC increased its stake in shares of Ross Stores by 68.8% in the second quarter. Los Angeles Capital Management LLC now owns 2,391,856 shares of the apparel retailer's stock worth $347,585,000 after buying an additional 975,190 shares during the last quarter. 86.86% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Ross Stores

In other Ross Stores news, CEO Barbara Rentler sold 48,885 shares of the business's stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $153.93, for a total value of $7,524,868.05. Following the completion of the sale, the chief executive officer now owns 311,853 shares of the company's stock, valued at $48,003,532.29. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In other news, Chairman Michael Balmuth sold 14,887 shares of Ross Stores stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $152.22, for a total transaction of $2,266,099.14. Following the sale, the chairman now directly owns 11,133 shares in the company, valued at approximately $1,694,665.26. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Barbara Rentler sold 48,885 shares of the stock in a transaction on Tuesday, August 27th. The stock was sold at an average price of $153.93, for a total value of $7,524,868.05. Following the transaction, the chief executive officer now owns 311,853 shares of the company's stock, valued at $48,003,532.29. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 72,138 shares of company stock valued at $11,093,051. 2.10% of the stock is currently owned by corporate insiders.

Ross Stores Trading Up 1.6 %

ROST stock traded up $2.34 during mid-day trading on Friday, reaching $144.38. 1,553,295 shares of the stock traded hands, compared to its average volume of 2,245,284. The stock's fifty day moving average is $147.55 and its 200-day moving average is $143.75. The company has a market cap of $47.90 billion, a P/E ratio of 23.05, a P/E/G ratio of 2.25 and a beta of 1.09. The company has a current ratio of 1.56, a quick ratio of 1.05 and a debt-to-equity ratio of 0.30. Ross Stores, Inc. has a 52-week low of $119.73 and a 52-week high of $163.60.

Ross Stores (NASDAQ:ROST - Get Free Report) last posted its quarterly earnings results on Thursday, August 22nd. The apparel retailer reported $1.59 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.50 by $0.09. The business had revenue of $5.29 billion during the quarter, compared to analyst estimates of $5.25 billion. Ross Stores had a net margin of 9.82% and a return on equity of 42.43%. The firm's revenue was up 7.1% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.32 earnings per share. As a group, sell-side analysts expect that Ross Stores, Inc. will post 6.2 earnings per share for the current year.

Ross Stores Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Tuesday, September 10th were issued a $0.3675 dividend. The ex-dividend date of this dividend was Tuesday, September 10th. This represents a $1.47 dividend on an annualized basis and a yield of 1.02%. Ross Stores's dividend payout ratio is currently 23.71%.

Wall Street Analysts Forecast Growth

Several analysts have issued reports on ROST shares. Bank of America upped their price objective on Ross Stores from $170.00 to $180.00 and gave the company a "buy" rating in a research note on Friday, August 23rd. Wells Fargo & Company lifted their price objective on shares of Ross Stores from $160.00 to $175.00 and gave the stock an "overweight" rating in a report on Friday, August 23rd. Barclays increased their target price on shares of Ross Stores from $165.00 to $175.00 and gave the stock an "overweight" rating in a report on Friday, August 23rd. Morgan Stanley boosted their price objective on shares of Ross Stores from $163.00 to $178.00 and gave the company an "overweight" rating in a research report on Friday, August 23rd. Finally, Gordon Haskett upgraded Ross Stores to a "strong-buy" rating in a research note on Friday, August 23rd. Three research analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Ross Stores currently has a consensus rating of "Moderate Buy" and a consensus price target of $171.88.

Read Our Latest Stock Analysis on Ross Stores

Ross Stores Profile

(

Free Report)

Ross Stores, Inc, together with its subsidiaries, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names in the United States. Its stores primarily offer apparel, accessories, footwear, and home fashions. The company's Ross Dress for Less stores sell its products at department and specialty stores to middle income households; and dd's DISCOUNTS stores sell its products at department and discount stores for households with moderate income.

Read More

Before you consider Ross Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ross Stores wasn't on the list.

While Ross Stores currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report