Summit Global Investments acquired a new position in NetScout Systems, Inc. (NASDAQ:NTCT - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 33,149 shares of the technology company's stock, valued at approximately $718,000.

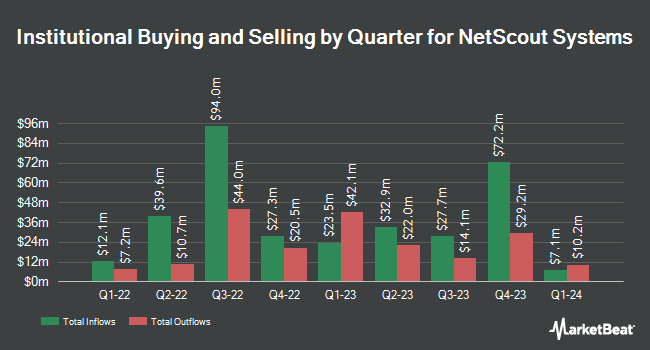

Other hedge funds have also recently bought and sold shares of the company. Quarry LP boosted its holdings in NetScout Systems by 316.8% in the third quarter. Quarry LP now owns 1,513 shares of the technology company's stock valued at $33,000 after acquiring an additional 1,150 shares during the last quarter. FMR LLC boosted its stake in shares of NetScout Systems by 32.1% in the 3rd quarter. FMR LLC now owns 1,964 shares of the technology company's stock valued at $43,000 after purchasing an additional 477 shares during the last quarter. KBC Group NV boosted its stake in shares of NetScout Systems by 52.4% in the 3rd quarter. KBC Group NV now owns 3,100 shares of the technology company's stock valued at $67,000 after purchasing an additional 1,066 shares during the last quarter. PNC Financial Services Group Inc. grew its position in shares of NetScout Systems by 17.0% during the 4th quarter. PNC Financial Services Group Inc. now owns 3,495 shares of the technology company's stock worth $76,000 after buying an additional 508 shares during the period. Finally, Quest Partners LLC raised its stake in shares of NetScout Systems by 91.0% during the third quarter. Quest Partners LLC now owns 7,613 shares of the technology company's stock worth $166,000 after buying an additional 3,627 shares during the last quarter. 91.64% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts have recently issued reports on the company. StockNews.com upgraded NetScout Systems from a "buy" rating to a "strong-buy" rating in a research report on Tuesday, December 10th. Royal Bank of Canada boosted their target price on NetScout Systems from $22.00 to $25.00 and gave the stock a "sector perform" rating in a research report on Friday, January 31st.

Check Out Our Latest Report on NTCT

Insider Transactions at NetScout Systems

In other NetScout Systems news, insider Jean A. Bua sold 11,999 shares of NetScout Systems stock in a transaction dated Thursday, February 13th. The stock was sold at an average price of $23.92, for a total transaction of $287,016.08. Following the completion of the transaction, the insider now owns 71,361 shares in the company, valued at approximately $1,706,955.12. The trade was a 14.39 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP John Downing sold 3,000 shares of the stock in a transaction that occurred on Tuesday, February 18th. The shares were sold at an average price of $24.25, for a total value of $72,750.00. Following the sale, the executive vice president now directly owns 130,352 shares of the company's stock, valued at $3,161,036. The trade was a 2.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 21,499 shares of company stock valued at $512,321. Corporate insiders own 3.71% of the company's stock.

NetScout Systems Trading Down 0.1 %

Shares of NTCT stock traded down $0.03 on Thursday, hitting $21.74. The stock had a trading volume of 320,552 shares, compared to its average volume of 502,645. NetScout Systems, Inc. has a twelve month low of $17.10 and a twelve month high of $27.89. The company has a current ratio of 1.81, a quick ratio of 1.78 and a debt-to-equity ratio of 0.05. The firm has a market cap of $1.56 billion, a P/E ratio of -3.71 and a beta of 0.64. The company has a fifty day moving average price of $22.72 and a two-hundred day moving average price of $21.91.

NetScout Systems (NASDAQ:NTCT - Get Free Report) last issued its quarterly earnings results on Thursday, January 30th. The technology company reported $0.78 EPS for the quarter, beating the consensus estimate of $0.74 by $0.04. NetScout Systems had a positive return on equity of 6.76% and a negative net margin of 50.90%. As a group, analysts forecast that NetScout Systems, Inc. will post 1.5 earnings per share for the current fiscal year.

NetScout Systems Profile

(

Free Report)

NetScout Systems, Inc provides service assurance and cybersecurity solutions for protect digital business services against disruptions in the United States, Europe, Asia, and internationally. The company offers nGeniusONE management software that enables customers to predict, preempt, and resolve network and service delivery problems, as well as facilitate the optimization and capacity planning of their network infrastructures; and specialized platforms and analytic modules that enable its customers to analyze and troubleshoot traffic in radio access and Wi-Fi networks.

Recommended Stories

Before you consider NetScout Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetScout Systems wasn't on the list.

While NetScout Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.