Oppenheimer Asset Management Inc. cut its position in Sun Communities, Inc. (NYSE:SUI - Free Report) by 11.9% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 47,671 shares of the real estate investment trust's stock after selling 6,429 shares during the period. Oppenheimer Asset Management Inc.'s holdings in Sun Communities were worth $6,443,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

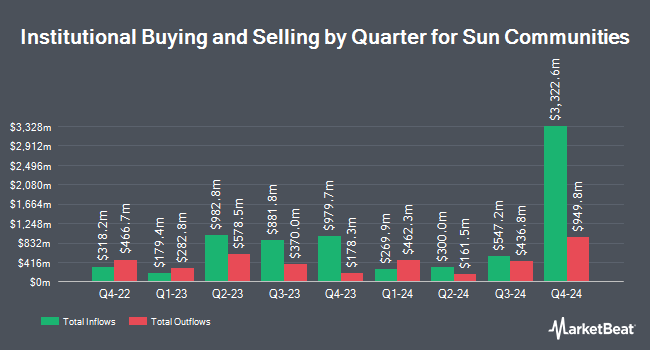

Several other institutional investors have also bought and sold shares of SUI. Empowered Funds LLC purchased a new position in shares of Sun Communities in the first quarter valued at approximately $237,000. State Board of Administration of Florida Retirement System raised its position in shares of Sun Communities by 4.7% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 151,233 shares of the real estate investment trust's stock valued at $21,306,000 after acquiring an additional 6,746 shares in the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. increased its position in Sun Communities by 8.5% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 143,209 shares of the real estate investment trust's stock worth $18,414,000 after buying an additional 11,195 shares during the period. Centersquare Investment Management LLC increased its holdings in shares of Sun Communities by 4.7% during the first quarter. Centersquare Investment Management LLC now owns 2,171,868 shares of the real estate investment trust's stock valued at $279,259,000 after purchasing an additional 96,529 shares during the period. Finally, Mitsubishi UFJ Trust & Banking Corp boosted its position in shares of Sun Communities by 175.9% in the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 183,895 shares of the real estate investment trust's stock valued at $23,264,000 after purchasing an additional 117,251 shares during the period. Institutional investors own 99.59% of the company's stock.

Analyst Ratings Changes

SUI has been the topic of a number of research reports. Wells Fargo & Company boosted their price objective on Sun Communities from $123.00 to $154.00 and gave the company an "equal weight" rating in a research report on Thursday, September 19th. StockNews.com upgraded Sun Communities from a "sell" rating to a "hold" rating in a research report on Tuesday. Bank of America lowered Sun Communities from a "neutral" rating to an "underperform" rating and decreased their price objective for the stock from $147.00 to $114.00 in a report on Tuesday. Jefferies Financial Group began coverage on Sun Communities in a research report on Thursday, October 17th. They set a "buy" rating and a $160.00 target price on the stock. Finally, Evercore ISI raised their target price on Sun Communities from $149.00 to $150.00 and gave the stock an "in-line" rating in a research note on Monday, October 21st. One equities research analyst has rated the stock with a sell rating, nine have assigned a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $139.08.

Check Out Our Latest Report on Sun Communities

Sun Communities Trading Up 1.1 %

SUI traded up $1.34 on Friday, hitting $125.43. 236,580 shares of the company were exchanged, compared to its average volume of 829,899. The stock has a market capitalization of $15.98 billion, a PE ratio of 66.41, a price-to-earnings-growth ratio of 0.53 and a beta of 0.91. Sun Communities, Inc. has a 12 month low of $110.98 and a 12 month high of $147.83. The firm has a fifty day simple moving average of $134.46 and a two-hundred day simple moving average of $126.96. The company has a debt-to-equity ratio of 0.93, a quick ratio of 1.61 and a current ratio of 1.61.

Sun Communities (NYSE:SUI - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The real estate investment trust reported $2.31 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.51 by ($0.20). The company had revenue of $939.90 million for the quarter, compared to the consensus estimate of $980.41 million. Sun Communities had a net margin of 7.46% and a return on equity of 3.21%. The business's revenue for the quarter was down 4.4% on a year-over-year basis. During the same period in the prior year, the firm posted $2.57 EPS. Sell-side analysts expect that Sun Communities, Inc. will post 6.75 earnings per share for the current year.

Sun Communities Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Monday, September 30th were issued a $0.94 dividend. The ex-dividend date was Monday, September 30th. This represents a $3.76 dividend on an annualized basis and a dividend yield of 3.00%. Sun Communities's dividend payout ratio is presently 202.15%.

About Sun Communities

(

Free Report)

Established in 1975, Sun Communities, Inc became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of December 31, 2023, the Company owned, operated, or had an interest in a portfolio of 667 developed MH, RV and Marina properties comprising 179,310 developed sites and approximately 48,030 wet slips and dry storage spaces in the U.S., the UK and Canada.

Read More

Before you consider Sun Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Communities wasn't on the list.

While Sun Communities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.