Bank of America lowered shares of Sun Communities (NYSE:SUI - Free Report) from a neutral rating to an underperform rating in a research note released on Tuesday, Marketbeat reports. They currently have $114.00 price target on the real estate investment trust's stock, down from their prior price target of $147.00.

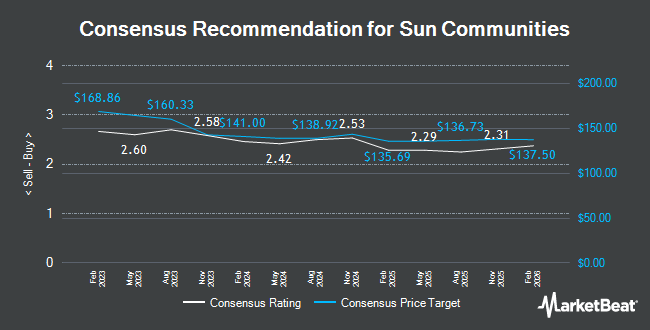

SUI has been the subject of several other reports. Jefferies Financial Group began coverage on Sun Communities in a research note on Thursday, October 17th. They set a "buy" rating and a $160.00 price objective for the company. Truist Financial upped their price objective on Sun Communities from $127.00 to $138.00 and gave the company a "hold" rating in a research note on Tuesday, August 13th. Baird R W downgraded Sun Communities from a "strong-buy" rating to a "hold" rating in a research note on Thursday, November 7th. Wells Fargo & Company upped their price objective on Sun Communities from $123.00 to $154.00 and gave the company an "equal weight" rating in a research note on Thursday, September 19th. Finally, Robert W. Baird downgraded Sun Communities from an "outperform" rating to a "neutral" rating and reduced their price objective for the company from $145.00 to $126.00 in a research note on Thursday, November 7th. Two investment analysts have rated the stock with a sell rating, seven have assigned a hold rating, five have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Sun Communities presently has an average rating of "Hold" and an average price target of $139.50.

View Our Latest Report on SUI

Sun Communities Stock Performance

Shares of Sun Communities stock traded down $2.42 on Tuesday, hitting $124.70. The stock had a trading volume of 760,893 shares, compared to its average volume of 828,872. Sun Communities has a 52-week low of $110.98 and a 52-week high of $147.83. The company has a current ratio of 1.42, a quick ratio of 1.42 and a debt-to-equity ratio of 1.09. The stock has a market cap of $15.55 billion, a price-to-earnings ratio of 68.34, a P/E/G ratio of 0.96 and a beta of 0.91. The company's 50 day moving average price is $135.16 and its 200 day moving average price is $126.95.

Sun Communities (NYSE:SUI - Get Free Report) last posted its earnings results on Wednesday, November 6th. The real estate investment trust reported $2.31 earnings per share for the quarter, missing the consensus estimate of $2.51 by ($0.20). Sun Communities had a net margin of 7.46% and a return on equity of 3.26%. The firm had revenue of $939.90 million during the quarter, compared to analysts' expectations of $980.41 million. During the same period in the previous year, the firm posted $2.57 earnings per share. The firm's revenue for the quarter was down 4.4% on a year-over-year basis. On average, research analysts anticipate that Sun Communities will post 6.76 EPS for the current year.

Sun Communities Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were issued a $0.94 dividend. This represents a $3.76 dividend on an annualized basis and a dividend yield of 3.02%. The ex-dividend date of this dividend was Monday, September 30th. Sun Communities's dividend payout ratio is currently 202.15%.

Institutional Investors Weigh In On Sun Communities

Institutional investors and hedge funds have recently modified their holdings of the company. Centersquare Investment Management LLC lifted its stake in Sun Communities by 4.7% in the 1st quarter. Centersquare Investment Management LLC now owns 2,171,868 shares of the real estate investment trust's stock valued at $279,259,000 after buying an additional 96,529 shares in the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. lifted its stake in shares of Sun Communities by 8.5% during the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 143,209 shares of the real estate investment trust's stock worth $18,414,000 after purchasing an additional 11,195 shares during the period. Manning & Napier Advisors LLC purchased a new position in shares of Sun Communities in the 2nd quarter worth $13,164,000. SG Americas Securities LLC raised its position in shares of Sun Communities by 145.0% in the 1st quarter. SG Americas Securities LLC now owns 20,576 shares of the real estate investment trust's stock worth $2,646,000 after buying an additional 12,177 shares during the period. Finally, Virtu Financial LLC purchased a new position in shares of Sun Communities in the 1st quarter worth $1,106,000. Institutional investors and hedge funds own 99.59% of the company's stock.

About Sun Communities

(

Get Free Report)

Established in 1975, Sun Communities, Inc became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of December 31, 2023, the Company owned, operated, or had an interest in a portfolio of 667 developed MH, RV and Marina properties comprising 179,310 developed sites and approximately 48,030 wet slips and dry storage spaces in the U.S., the UK and Canada.

Further Reading

Before you consider Sun Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Communities wasn't on the list.

While Sun Communities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.