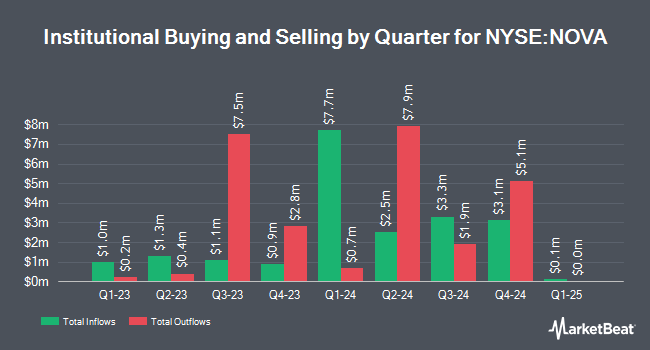

Connor Clark & Lunn Investment Management Ltd. boosted its holdings in Sunnova Energy International Inc. (NYSE:NOVA - Free Report) by 190.8% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 744,686 shares of the company's stock after buying an additional 488,623 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.60% of Sunnova Energy International worth $7,253,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. State Board of Administration of Florida Retirement System raised its holdings in Sunnova Energy International by 14.6% during the first quarter. State Board of Administration of Florida Retirement System now owns 33,033 shares of the company's stock worth $202,000 after purchasing an additional 4,200 shares in the last quarter. Vanguard Group Inc. raised its stake in Sunnova Energy International by 0.8% during the 1st quarter. Vanguard Group Inc. now owns 10,568,045 shares of the company's stock worth $64,782,000 after acquiring an additional 81,653 shares in the last quarter. Quadrature Capital Ltd raised its stake in Sunnova Energy International by 461.6% during the 1st quarter. Quadrature Capital Ltd now owns 227,873 shares of the company's stock worth $1,397,000 after acquiring an additional 187,299 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its position in Sunnova Energy International by 18.0% in the first quarter. Price T Rowe Associates Inc. MD now owns 74,332 shares of the company's stock valued at $456,000 after acquiring an additional 11,361 shares during the last quarter. Finally, Caxton Associates LP acquired a new position in Sunnova Energy International in the first quarter valued at $62,000.

Analyst Ratings Changes

A number of analysts have recently commented on the company. Citigroup cut their target price on Sunnova Energy International from $12.00 to $10.00 and set a "buy" rating on the stock in a research report on Tuesday, October 22nd. Scotiabank boosted their price objective on Sunnova Energy International from $10.00 to $14.00 and gave the company a "sector outperform" rating in a research note on Tuesday, August 6th. Susquehanna increased their price objective on Sunnova Energy International from $12.00 to $14.00 and gave the company a "positive" rating in a report on Friday, August 2nd. Jefferies Financial Group began coverage on shares of Sunnova Energy International in a report on Thursday, October 10th. They issued a "buy" rating and a $15.00 target price on the stock. Finally, The Goldman Sachs Group increased their price target on shares of Sunnova Energy International from $10.00 to $13.00 and gave the stock a "buy" rating in a research note on Friday, August 2nd. One analyst has rated the stock with a sell rating, nine have given a hold rating and thirteen have issued a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $10.73.

Get Our Latest Analysis on Sunnova Energy International

Insider Activity

In other news, CFO Eric Michael Williams purchased 13,800 shares of the company's stock in a transaction dated Monday, November 18th. The stock was acquired at an average price of $3.60 per share, for a total transaction of $49,680.00. Following the completion of the transaction, the chief financial officer now directly owns 13,800 shares in the company, valued at $49,680. This represents a ∞ increase in their position. The acquisition was disclosed in a filing with the SEC, which is available through this link. Also, Director Akbar Mohamed acquired 50,000 shares of the firm's stock in a transaction that occurred on Monday, November 18th. The stock was acquired at an average price of $3.64 per share, for a total transaction of $182,000.00. Following the completion of the transaction, the director now directly owns 352,654 shares in the company, valued at approximately $1,283,660.56. This represents a 16.52 % increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last three months, insiders purchased 118,517 shares of company stock worth $439,605. Company insiders own 4.50% of the company's stock.

Sunnova Energy International Price Performance

NYSE:NOVA traded up $0.53 during trading hours on Friday, hitting $4.90. The company's stock had a trading volume of 14,448,467 shares, compared to its average volume of 15,533,536. Sunnova Energy International Inc. has a 52-week low of $2.99 and a 52-week high of $16.35. The company has a debt-to-equity ratio of 3.26, a quick ratio of 0.86 and a current ratio of 0.86. The business's 50-day moving average is $6.66 and its two-hundred day moving average is $6.89. The company has a market capitalization of $612.27 million, a PE ratio of -1.46 and a beta of 2.26.

Sunnova Energy International (NYSE:NOVA - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The company reported ($0.98) EPS for the quarter, missing the consensus estimate of ($0.53) by ($0.45). Sunnova Energy International had a negative net margin of 51.02% and a negative return on equity of 11.15%. The company had revenue of $235.30 million during the quarter, compared to analyst estimates of $238.23 million. During the same quarter last year, the business earned ($0.53) EPS. The firm's revenue for the quarter was up 18.6% on a year-over-year basis. As a group, research analysts anticipate that Sunnova Energy International Inc. will post -2.29 EPS for the current fiscal year.

About Sunnova Energy International

(

Free Report)

Sunnova Energy International Inc engages in the provision of energy as a service in the United States. The company offers electricity, as well as offers operations and maintenance, monitoring, repairs and replacements, equipment upgrades, on-site power optimization, and solar energy system and energy storage system diagnostics services.

Featured Articles

Before you consider Sunnova Energy International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunnova Energy International wasn't on the list.

While Sunnova Energy International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.