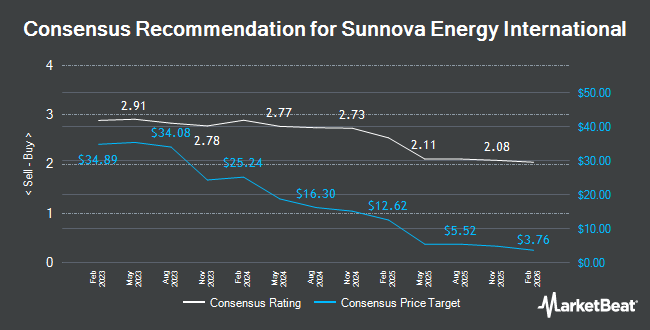

Sunnova Energy International (NYSE:NOVA - Get Free Report) was downgraded by analysts at Guggenheim from a "buy" rating to a "neutral" rating in a report released on Thursday, Marketbeat.com reports.

A number of other research analysts have also issued reports on NOVA. Royal Bank of Canada boosted their price target on shares of Sunnova Energy International from $9.00 to $10.00 and gave the stock an "outperform" rating in a research note on Monday, August 5th. Piper Sandler increased their target price on Sunnova Energy International from $7.00 to $8.00 and gave the stock a "neutral" rating in a research note on Monday, August 12th. Jefferies Financial Group assumed coverage on Sunnova Energy International in a research note on Thursday, October 10th. They issued a "buy" rating and a $15.00 price target on the stock. The Goldman Sachs Group increased their price objective on Sunnova Energy International from $10.00 to $13.00 and gave the stock a "buy" rating in a research report on Friday, August 2nd. Finally, Deutsche Bank Aktiengesellschaft decreased their target price on shares of Sunnova Energy International from $9.00 to $6.25 and set a "hold" rating on the stock in a research report on Friday, November 1st. Nine analysts have rated the stock with a hold rating and thirteen have given a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $11.61.

View Our Latest Stock Analysis on NOVA

Sunnova Energy International Stock Performance

NYSE NOVA traded up $0.23 during trading on Thursday, reaching $3.65. The company's stock had a trading volume of 22,448,014 shares, compared to its average volume of 8,074,228. Sunnova Energy International has a twelve month low of $3.25 and a twelve month high of $16.35. The firm has a market cap of $455.44 million, a price-to-earnings ratio of -1.08 and a beta of 2.26. The business's fifty day moving average price is $8.37 and its 200-day moving average price is $6.92. The company has a debt-to-equity ratio of 3.26, a quick ratio of 0.86 and a current ratio of 0.86.

Sunnova Energy International (NYSE:NOVA - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported ($0.98) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.53) by ($0.45). Sunnova Energy International had a negative net margin of 51.02% and a negative return on equity of 11.15%. The company had revenue of $235.30 million during the quarter, compared to analyst estimates of $238.23 million. During the same period in the previous year, the firm posted ($0.53) EPS. The company's revenue for the quarter was up 18.6% on a year-over-year basis. As a group, analysts anticipate that Sunnova Energy International will post -2.27 EPS for the current fiscal year.

Insider Transactions at Sunnova Energy International

In other Sunnova Energy International news, insider William J. Berger sold 77,000 shares of the stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $11.31, for a total transaction of $870,870.00. Following the transaction, the insider now owns 409,045 shares of the company's stock, valued at $4,626,298.95. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this link. Insiders own 4.50% of the company's stock.

Institutional Investors Weigh In On Sunnova Energy International

Several hedge funds have recently modified their holdings of the stock. Quest Partners LLC increased its stake in Sunnova Energy International by 101,695.5% during the third quarter. Quest Partners LLC now owns 67,185 shares of the company's stock worth $654,000 after acquiring an additional 67,119 shares during the last quarter. Mizuho Markets Americas LLC lifted its stake in shares of Sunnova Energy International by 53.7% during the third quarter. Mizuho Markets Americas LLC now owns 282,805 shares of the company's stock worth $2,755,000 after purchasing an additional 98,800 shares in the last quarter. GSA Capital Partners LLP boosted its position in shares of Sunnova Energy International by 28.4% in the third quarter. GSA Capital Partners LLP now owns 130,741 shares of the company's stock worth $1,273,000 after buying an additional 28,931 shares during the period. First Trust Direct Indexing L.P. grew its stake in shares of Sunnova Energy International by 11.6% in the third quarter. First Trust Direct Indexing L.P. now owns 19,373 shares of the company's stock valued at $189,000 after buying an additional 2,016 shares in the last quarter. Finally, PFG Investments LLC purchased a new stake in shares of Sunnova Energy International during the third quarter valued at approximately $130,000.

About Sunnova Energy International

(

Get Free Report)

Sunnova Energy International Inc engages in the provision of energy as a service in the United States. The company offers electricity, as well as offers operations and maintenance, monitoring, repairs and replacements, equipment upgrades, on-site power optimization, and solar energy system and energy storage system diagnostics services.

See Also

Before you consider Sunnova Energy International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunnova Energy International wasn't on the list.

While Sunnova Energy International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.